Telus 2010 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 155

FINANCIAL STATEMENTS & NOTES: 17

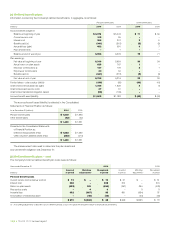

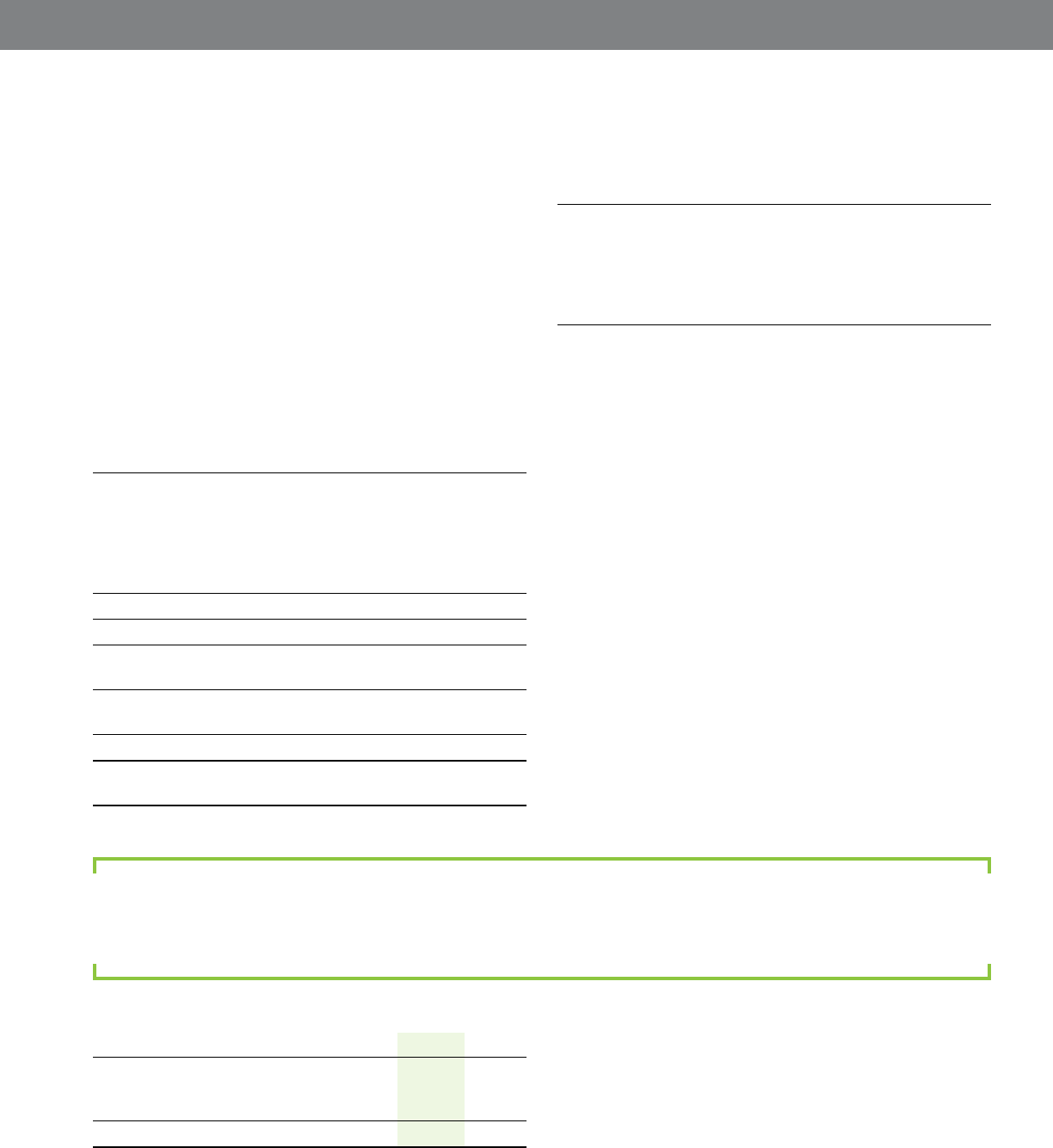

Pro forma disclosures: The following pro forma supplemental

information represents certain results of operations as if the business

acquisition noted above had been completed as at the beginning

of the fiscal year presented.

Year ended December 31, 2009

(millions except per share amounts) As reported(1) Pro forma(2)

Operating revenues $ß9,606 $ß9,668

Net income $ß1,002 $ 993

Net income per Common Share

and Non-Voting Share

Basic $ß 3.14 $ß 3.12

Diluted $ß 3.14 $ß 3.11

(1) Operating revenues and net income (loss) for the year ended December 31, 2009,

include $44 and $(1), respectively, in respect of the acquisition of Black’s Photo

Corporation.

(2) Pro forma amounts for the year ended December 31, 2009 reflect Black’s Photo

Corporation. Black’s Photo Corporation was acquired on September 3, 2009;

its results have been included in the Company’s Consolidated Statement of Income

and Other Comprehensive Income effective the same date.

The pro forma supplemental information is based on estimates

and assumptions which are believed to be reasonable. The pro forma

supplemental information is not necessarily indicative of the Company’s

consolidated financial results in future periods or the results that

actually would have been realized had the business acquisitions been

completed at the beginning of the periods presented. The pro forma

supplemental information includes incremental intangible asset amor-

tization, financing and other charges as a result of the acquisitions,

net of the related tax effects.

Black’s Photo Corporation: On September 3, 2009 (the acquisition

date), the Company acquired a 100% economic and voting interest in

Black’s Photo Corporation, a national imaging and digital retail company

for $28 million cash ($26 million net of cash acquired). There was no

con

tingent consideration in the transaction. This investment was made

with

a view to enhancing the Company’s distribution of wireless products

and services across Canada.

The primary factors that contributed to a purchase price that resulted

in the recognition of goodwill are: the existing Black’s Photo Corporation

business; the acquired workforce; and the time-to-market benefits

of acquiring an established multi-location retailer to distribute wireless

products. Black’s Photo Corporation’s results of operations are included

in the Company’s Wireless segment effective September 3, 2009.

The amount assigned to goodwill is not expected to be deductible

for tax purposes.

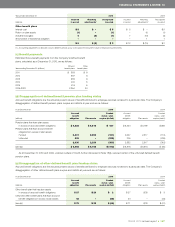

Purchase price: The purchase price amounts assigned to assets

acquired and liabilities assumed are as set out in the following table:

Black’s Photo

As at September 3, 2009 (millions) Corporation

Assets

Current assets $ß22

Non-current assets

Property, plant and equipment 9

Intangible assets with indefinite life (brand) 7

Other long-term assets 1

Total non-current assets 17

Total identifiable assets acquired 39

Liabilities

Current liabilities (19)

Net identifiable assets acquired 20

Goodwill 8

Net assets acquired $ß28

Acquisition effected by way of:

Cash consideration $ß28

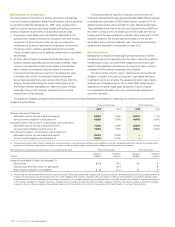

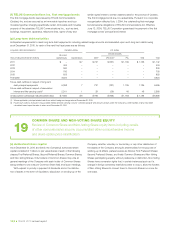

17 SHORT-TERM OBLIGATIONS

Summary review of bilateral bank facilities

The Company’s bilateral bank facilities are as follows:

As at December 31 (millions) 2010 2009

Net available $ß56 $ß53

Drawn 2 6

Outstanding, undrawn letters of credit 3 3

Gross available $ß61 $ß62