Telus 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160 . TELUS 2010 annual report

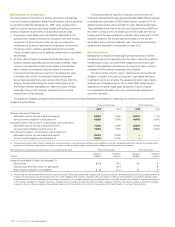

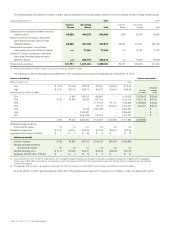

The following table reconciles the number of share options exercised and the associated number of Common Shares and Non-Voting Shares issued.

Years ended December 31 2010 2009

Common Non-Voting Common Non-Voting

Shares Shares Total Shares Shares To t a l

Shares issued or issuable pursuant to exercise

of share options 96,526 440,073 536,599 1,506 23,984 25,490

Impact of optionee choosing to settle share

option award exercises using net-cash

settlement feature 25,225 451,652 476,877 88,221 474,941 563,162

Shares issued pursuant to use of share

option award net-equity settlement feature n.a.(1) 77,061 77,061 n.a.(1) 15,162 15,162

Impact of Company choosing to settle share

option

award exercises using net-equity

settlement feature

n.a.(1) 238,814 238,814 n.a.(1) 15,946 15,946

Share options exercised 121,751 1,207,600 1,329,351 89,727 530,033 619,760

(1) Share option awards for Common Shares do not have a net-equity settlement feature.

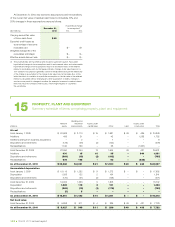

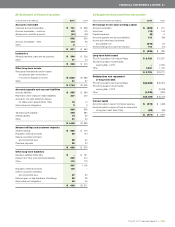

The following is a life and exercise price stratification of the Company’s share options outstanding as at December 31, 2010.

Options outstanding(1) Options exercisable

Range of option prices To t a l

Low $ß 8.43 $ß14.93 $ß23.08 $ß34.81 $ß53.09 $ß 8.43 Weighted

High $ß10.75 $ß22.06 $ß33.14 $ß50.47 $ß64.64 $ß64.64 Number average

Year of expiry and number of shares of shares price

2 011 – 3,650 559,312 450,650 – 1,013,612 1,013,612 $ß29.08

2012 4,733 84,600 65,000 1,057,785 – 1,212,118 1,212,118 $ß37.00

2013 – – – 1,112,797 51,741 1,164,538 1,039,855 $ß43.52

2014 – – – 30,120 973,921 1,004,041 994,301 $ß56.45

2015 – – 19,475 2,321,328 – 2,340,803 – $ –

2016 – – 2,305,527 – – 2,305,527 – $ –

2017 – – 2,551,226 149,801 – 2,701,027 – $ –

4,733 88,250 5,500,540 5,122,481 1,025,662 11,741,666 4,259,886

Weighted average remaining

contractual life (years) 1.8 1.9 5.1 2.9 3.2 4.0

Weighted average price $ß10.10 $ß16.34 $ß30.85 $ß41.95 $ß56.70 $ß37.83

Aggregate intrinsic value(2) (millions) $ – $ 2 $ 68 $ 9 $ – $ 79

Options exercisable

Number of shares 4,733 88,250 624,312 2,544,159 998,432 4,259,886

Weighted average remaining

contractual life (years) 1.8 1.9 0.7 1.6 3.2 1.8

Weighted average price $ß10.10 $ß16.34 $ß24.41 $ß40.25 $ß56.66 $ß41.25

Aggregate intrinsic value(2) (millions) $ – $ 2 $ 12 $ 8 $ – $ 22

(1) As at December 31, 2010, 10,764,911 share options, with a weighted average remaining contractual life of 3.8 years, a weighted average price of $38.03 and an aggregate

intrinsic value of $72 million, are vested or were expected to vest; these amounts differ from the corresponding amounts for all share options outstanding due to an estimate

for expected forfeitures.

(2) The aggregate intrinsic value is calculated upon December 31, 2010, per share prices of $45.48 for Common Shares and $43.25 for Non-Voting Shares.

As at December 31, 2010, approximately 29 million Non-Voting Shares were reserved for issuance, from Treasury, under the share option plans.