Telus 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76 . TELUS 2010 annual report

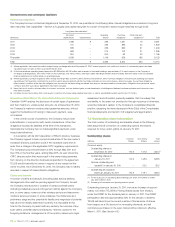

The Company is supporting Bell Canada’s request to the CRTC to

review and vary the determination of interest, since consumer group

court appeals and the extended Commission review process for

communities proposed by the ILECs for broadband expansion con-

tributed to the delay in the CRTC’s decision on the disposition of

the deferral account balance.

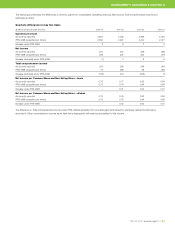

The CRTC directed TELUS to rebate approximately $54 million

to residential customers in non-high cost serving areas (urban areas),

allowing the Company flexibility in the method of rebate, including

promotional offerings for related or unrelated products or services

of greater value than a cash rebate – such promotions to be con-

cluded by the end of February 2011. The CRTC also approved that

the remaining deferral account balance of $111 million be used to:

(i) expand broadband services to 159 rural and remote communities

in Alberta, British Columbia and Eastern Quebec over a period

ending in 2014; and (ii) improve accessibility of telecommunications

services for individuals with disabilities.

.The balance of the deferral account was $162 million at December 31,

2010. The critical accounting estimates for extinguishing the balance

of the deferral account that are uncertain at the time of making the

estimate include determining over what period of time qualifying

deferred amounts will be recognized in the Company’s Consolidated

statements of income and comprehensive income. The balance of

the deferral account not rebated to customers will be used to build

and provide broadband services in remote and rural areas, as well as

for accessibility initiatives. Such amounts will be recognized in revenues

over a period extending beyond 2014, but will not be accompanied

by corresponding cash inflows. Rebates refunded to customers from

the deferral account were expected to be completed by the end of

the first quarter of 2011 and do not impact TELUS’ Net income.

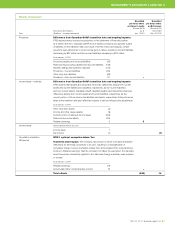

.This accounting estimate is in respect of an item within the Advance

billings and customer deposits and Other long-term liabilities line items

on TELUS’ Consolidated statements of financial position. The total

deferral account balance comprised less than 1% of Total liabilities and

owners’ equity at December 31, 2010 and 2009. Based on unaudited

pro forma IFRS-IASB financial information, this accounting estimate

resides within the Advance billings and customer deposits and non-

current Provisions line items and comprises less than 1% of Total

liabilities and owners’ equity at December 31 and January 1, 2010.

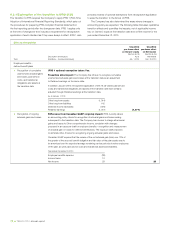

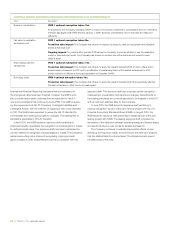

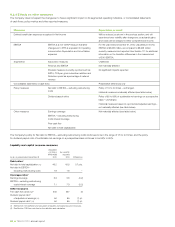

Employee defined benefit pension plans

Certain actuarial and economic assumptions used in

determining defined benefit pension costs, accrued pension

benefit obligations and pension plan assets

.The Company reviews industry practices, trends, economic

conditions and data provided by actuaries when developing

assumptions used in the determination of defined benefit pension

costs and accrued pension benefit obligations. Pension plan

assets are generally valued using market prices, however, some

assets are valued using market estimates when market prices

are not readily available. Defined benefit pension costs are also

affected by the quantitative methods used to determine estimated

returns on pension plan assets. Actuarial support is obtained

for interpolations of experience gains and losses that affect the

defined benefit pension costs and accrued benefit obligations.

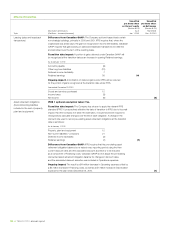

The timing of the reversal of the temporary differences is estimated

and the tax rate substantively enacted for the periods of reversal

is applied to the temporary differences. The carrying amounts of

assets and liabilities are based upon the amounts recorded in the

financial statements and are therefore subject to accounting esti-

mates that are inherent in those balances. The tax basis of assets

and liabilities, as well as the amount of undeducted tax losses,

are

based upon the assessment of tax positions and measurement

of tax

benefits as noted above. Assumptions as to the timing of

reversal of temporary differences include expectations about the

future results of operations and cash flows. The composition of

income tax liabilities is reasonably likely to change from period to

period because of changes in the estimation of these significant

uncertainties.

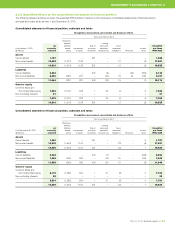

.This accounting estimate is in respect of material asset and

liability line items on the Company’s Consolidated statements of

financial position comprising less than 1% of Total assets and

approximately 9% of Total liabilities and owners’ equity at

December 31, 2010 and 2009. Based on unaudited pro forma

IFRS-IASB financial information, this accounting estimate is in

respect of material asset and liability line items comprising less than

1% of Total assets and approximately 9% of Total liabilities and

owners’ equity at December 31 and January 1, 2010. If the future

were to adversely differ from management’s best estimate of

the likelihood of tax positions being sustained, the amount of tax

benefit that is greater than 50% likely of being realized, the future

results of operations, the timing of reversal of deductible temporary

differences and taxable temporary differences, and the tax rates

applicable to future years, the Company could experience material

future income tax adjustments. Such future income tax adjustments

could result in an acceleration of cash outflows at an earlier time

than might otherwise be expected.

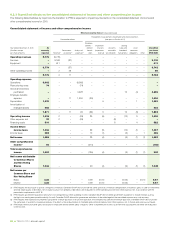

Advance billings and customer deposits /

Other long-term liabilities (Provisions under IFRS-IASB)

The accruals for CRTC deferral account liabilities

.The deferral account concept was introduced by the CRTC in 2002,

requiring the Company to maintain rates for residential basic services

provided in non-high cost serving areas, rather than lower the rates,

and defer the income statement recognition of a portion of the monies

received in a deferral account, from June 2002 to May 2006. The use

of deferral account funds was restricted and subject to a number of

court appeals including appeals to the Supreme Court of Canada by

consumer interest groups, Bell Canada and TELUS. The Supreme

Court dismissed all appeals in September 2009.

On August 31, 2010, in Telecom Decision 2010-639, the CRTC

finalized the deferral account balance for TELUS and issued its

determination on the use of the Company’s deferral account funds.

The CRTC also determined that the deferral accounts should have

continued to accrue interest in 2010, whereas TELUS had accrued

interest to May 31, 2006. This resulted in TELUS recording an addi-

tional $15 million charge in Financing costs in the third quarter of 2010.