Telus 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 . TELUS 2010 annual report

expected, reflecting a shortfall from wireline sales growth and ongoing

erosion in legacy voice services. Achievement of the consolidated

EBITDA and earnings targets reflects strong wireless performance and

the realization of benefits from strategic investments in broadband

networks and operating efficiency initiatives.

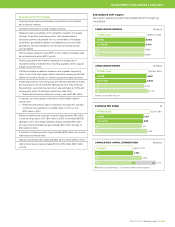

TELUS provided revised public guidance on August 6, 2010, to reflect

lower expected consolidated and wireline revenue. On November 5,

the Company further revised public guidance for an expected increase

in the lower end of the range for consolidated EBITDA and earnings

per share, as well as higher endpoints for the wireless EBITDA range.

The guidance revisions were achieved.

The following scorecard compares TELUS’ fiscal 2010 performance

to its original targets and presents targets for 2011. As a result of the

convergence of Canadian GAAP with IFRS-IASB (abbreviated as IFRS),

and TELUS’ changeover to IFRS on January 1, 2011, targets for 2011

are according to IFRS. Unaudited pro forma IFRS 2010 comparative

results are provided for reference. Further discussion of the expected

effects of the changeover to IFRS is provided in Section 8.2 Accounting

policy developments.

Targets for 2011 were announced on December 14, 2010. These

targets and pro forma comparative results for 2010 are fully qualified by

the Caution regarding forward-looking statements at the beginning of

the MD&A, as well as the discussion in Section 8.2. Additional information

on expectations and assumptions for 2011 are provided in Section 1.5

Financial and operating targets for 2011, Section 1.6 TELUS segment

targets, and Section 9: General outlook.

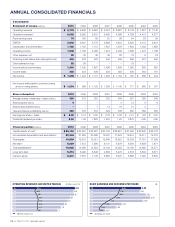

.Cash used by financing activities increased by $124 million in 2010

when compared to 2009, mainly due to refinancing activities and

debt reduction.

In 2010, the Company extended the average term to maturity on

its long-term debt to 5.7 years from five years at December 31, 2009,

through two key financing activities: (i) a $1 billion 10-year, 5.05%

Note issue in July; and (ii) use of the Note proceeds in September

to early redeem U.S.$607 million, or approximately 45%, of its then

outstanding U.S. dollar 8% Notes due June 1, 2011, and terminate

associated cross currency interest rate swaps. The U.S. dollar debt

has an effective yield of approximately 8.5%. This partial redemption

and a similar Note issue and early partial redemption in December

2009 have rebalanced the debt maturity profile out over several years

and reduced the risk of having a concentrated amount of debt

coming due in any one year.

.Free cash flow increased by $462 million in 2010 when compared

to 2009. The increase reflected lower interest payments due in part to

lower early debt redemption payments, as well as improved EBITDA

and lower capital expenditures, partly offset by higher income tax

payments and lower interest income.

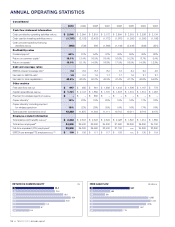

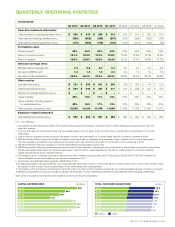

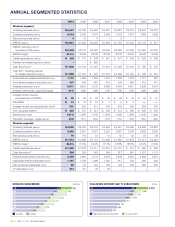

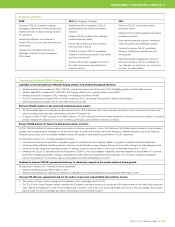

1.4 Performance scorecard

The Company announced its public targets for 2010 on December 15,

2009. Three of four original 2010 consolidated targets and three of four

original 2010 segment targets were achieved or exceeded, as shown

in the table below. Consolidated and wireline revenues were lower than

2010 performance 2011 targets (IFRS-IASB)

2010 unaudited

Actual results Original targets pro forma IFRS-based 2011 targets and estimated

Scorecards and growth and estimated growth Result comparative results growth over 2010 IFRS

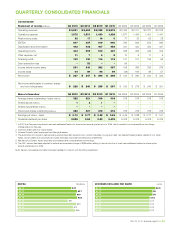

Consolidated

Revenues $9.779 billion $9.8 to $10.1 billion ✗ $9.792 billion $9.925 to $10.225 billion

2% 2 to 5% 1 to 4%

EBITDA(1) $3.643 billion $3.5 to $3.7 billion ✓ $3.650 billion $3.675 to $3.875 billion

4% flat to 6% 1 to 6%

EPS – basic(2) $3.23 $2.90 to $3.30 ✓ $3.27 $3.50 to $3.90

3% (8) to 5% 7 to 19%

Capital expenditures $1.721 billion Approx. $1.7 billion ✓ $1.721 billion Approx. $1.7 billion

(18)% (19)%

Wireless segment

Revenue (external) $5.014 billion $4.95 to $5.1 billion ✓ $5.014 billion $5.2 to $5.35 billion

6.5% 5 to 8% 4 to 7%

EBITDA $2.031 billion $1.925 to $2.025 billion ✓✓ $2.022 billion $2.15 to $2.25 billion

5% flat to 5% 6 to 11%

Wireline segment

Revenue (external) $4.765 billion $4.85 to $5.0 billion ✗ $4.778 billion $4.725 to $4.875 billion

(3)% (1) to 2% (1) to 2%

EBITDA $1.612 billion $1.575 to $1.675 billion ✓ $1.628 billion $1.525 to $1.625 billion

3.5% 1 to 8% (6) to 0%

(1) A non-GAAP measure. See Section 11.1 Earnings before interest, taxes, ✓✓ Exceeded target

depreciation and amortization (EBITDA) for the definition. ✓ Met target

(2) Actual EPS for 2010 includes approximately nine cents for favourable income ✗ Missed target

tax-related adjustments and a 12-cent charge for early partial redemption

of long-term debt that were not contemplated in the original target for EPS.