Telus 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 . TELUS 2010 annual report

The CICA’s Canadian Performance Reporting Board defined

standardized free cash flow to foster comparability of the measure

between entities. Standardized free cash flow is an indication of

the entity’s capacity to generate discretionary cash from operations,

comprising cash flows from operating activities less net capital expen-

ditures and those dividends that are more representative of interest

costs. It does not necessarily represent the cash flow in the period

available for management to use at its discretion, which may be affected

by other sources and non-discretionary uses of cash. The following

reconciles management’s definition of free cash flow with standardized

free cash flow and Cash provided by operating activities.

Free cash flow reconciliation

Years ended December 31 As currently reported

($ millions) 2010 2009

Cash provided by operating activities 2,546 2,904

Deduct stipulated dividends n.a. n.a.

Deduct capital expenditures (1,721) (2,103)

Proceeds from disposition of capital assets 1 –

Standardized free cash flow

(CICA guideline) 826 801

Other (line item in cash provided

by operating activities) 41 (23)

Reduction (increase) in securitized

accounts receivable 100 (200)

Other net changes in non-cash operating

working capital (20) (93)

Proceeds from disposition of capital assets (1) –

Free cash flow (management’s definition) 947 485

11.3 Definitions of wireless operating indicators

These measures are industry metrics and are useful in assessing the

operating performance of a wireless company.

Average revenue per subscriber unit per month (ARPU)

is calculated as Network revenue divided by the average number of

subscriber units on the network during the period and expressed as a

rate per month. Data ARPU is a component of ARPU, calculated on the

same basis for revenue derived from services such as text messaging,

mobile computing, personal digital assistance devices, Internet browser

activity and pay-per-use downloads.

Churn per month is calculated as the number of subscriber units

disconnected during a given period divided by the average number of

subscriber units on the network during the period, and expressed as

a rate per month. A prepaid subscriber is disconnected when the sub-

scriber has no usage for 90 days following expiry of the prepaid card.

Cost of acquisition (COA) consists of the total of handset subsidies,

commissions, and advertising and promotion expenses related to the

initial subscriber acquisition during a given period. As defined, COA

excludes costs to retain existing subscribers (retention spend).

COA per gross subscriber addition is calculated as cost of

acquisition divided by gross subscriber activations during the period.

Retention spend to Network revenue represents direct costs

associated with marketing and promotional efforts aimed at the

retention of the existing subscriber base divided by Network revenue.

Calculation of EBITDA less capital expenditures

Unaudited

pro forma

Years ended December 31 IFRS-IASB As currently reported

($ millions) 2010 2010 2009

EBITDA 3,650 3,643 3,491

Capital expenditures (1,721) (1,721) (2,103)

1,929 1,922 1,388

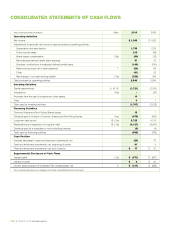

11.2 Free cash flow

Free cash flow is not a calculation based on Canadian GAAP, IFRS-IASB

or U.S. GAAP and should not be considered an alternative to the Con-

solidated statements of cash flows. TELUS reports free cash flow because

it is a key measure used by management to evaluate the Company’s

performance. Free cash flow excludes certain working capital changes

and other sources and uses of cash, as found in the Consolidated

statements of cash flows. Free cash flow can be used to gauge TELUS’

performance over time. Investors are cautioned that free cash flow as

reported by TELUS may not be comparable in all instances to free cash

flow as reported by other companies, and differs from standardized

free cash flow defined by the CICA. Management’s definition of free cash

flow provides an indication of how much cash generated by operations

is available after capital expenditures, but before dividends, acquisitions,

proceeds from divested assets and changes in certain working capital

items (such as trade receivables and trade payables).

Calculation of free cash flow

Unaudited

pro forma

Years ended December 31 IFRS-IASB As currently reported

($ millions) 2010 2010 2009

EBITDA (see Section 11.1) 3,650 3,643 3,491

Deduct donations and

securitization fees included

in Other expense, net,

as currently reported n.a. (33) (25)

Items from the consolidated

statements of cash flows:

Share-based compensation (30) (30) (23)

Net employee defined

benefit plans expense

(recovery) (8) 31 20

Employer contributions

to employee defined

benefit plans (140) (140) (180)

Restructuring costs net

of cash payments (24) (24) 84

Cash interest paid (includes

securitization fees

under IFRS) (479) (471) (567)

Cash interest received 3 3 54

Income taxes refunded

(paid), net (311) (311) (266)

Capital expenditures (1,721) (1,721) (2,103)

Free cash flow

(management’s definition)

940 947 485