Telus 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 149

FINANCIAL STATEMENTS & NOTES: 13

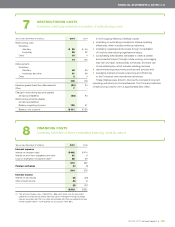

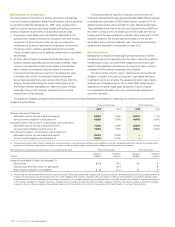

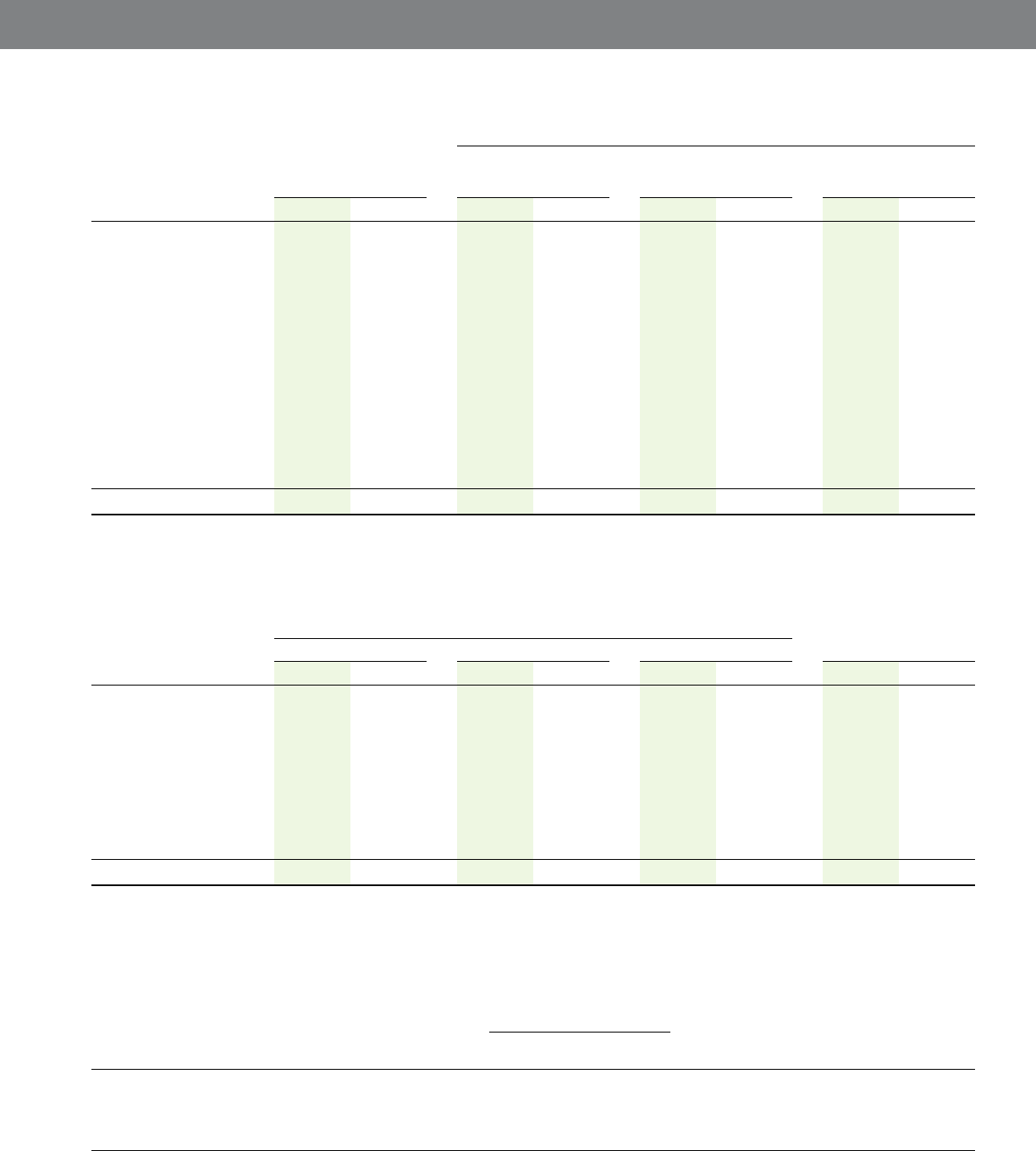

(h) Fair value measurements – pension benefit plans

Information about the fair value measurements of the Company’s defined benefit pension plans’ assets, in aggregate, is as follows:

Fair value measurements at reporting date using

Quoted prices in active Significant other Significant

markets for identical items observable inputs unobservable inputs

To t a l (Level 1) (Level 2) (Level 3)

As at December 31 (millions) 2010 2009 2010 2009 2010 2009 2010 2009

Asset class

Equity securities

Canadian $ß2,174 $ß1,921 $ß1,790 $ß1,743 $ 384 $ 178 $ß – $ß –

Foreign 1,589 1,415 1,122 969 412 380 55 66

Debt securities

Debt securities issued

by national, provincial

or local governments 1,357 1,207 1,071 1,014 286 193 – –

Corporate debt securities 558 620 – – 558 620 – –

Asset-backed securities 54 45 – – 54 45 – –

Commercial mortgages 218 312 – – – – 218 312

Cash and cash equivalents 386 389 17 25 369 364 – –

Real estate 429 393 51 45 – – 378 348

Other – 14 – – – 14 – –

$ß6,765 $ß6,316 $ß4,051 $ß3,796 $2,063 $ß1,794 $ß651 $ß726

At December 31, 2010, shares of TELUS Corporation accounted for less than 1% of the assets held in the pension and other benefit trusts

administered by the Company.

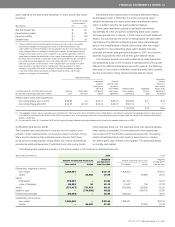

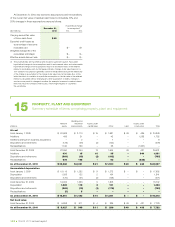

The changes in the years ended December 31, 2010 and 2009, of the fair value measurements of the Company’s defined benefit pension plans’

assets which use significant unobservable inputs, in aggregate, are as follows:

Asset class

Equity securities – foreign Commercial mortgages Real estate To t a l

Year ended December 31 (millions) 2010 2009 2010 2009 2010 2009 2010 2009

Balance, beginning of year $ß66 $ß80 $ß312 $ß285 $ß348 $ß320 $ß726 $ß685

Actual return on plan assets

relating to assets:

Still held at reporting date (19) (18) 1 17 (13) (13) (31) (14)

Sold during the period – – (3) 6 – – (3) 6

Purchases, sales and

settlements 8 4 (92) 4 43 41 (41) 49

Transfers in and/or out

of Level 3 – – – – – – – –

Balance, end of year $ß55 $ß66 $ß218 $ß312 $ß378 $ß348 $ß651 $ß726

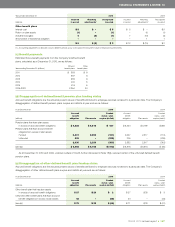

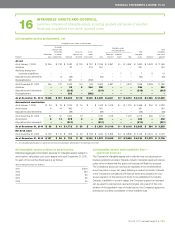

significant unobservable inputs (Level 3). The changes in the years

ended December 31, 2010 and 2009, of the fair value measurements of

the Company’s other defined benefit plan’s assets which use significant

unobservable inputs are as follows:

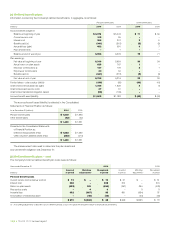

(i) Fair value measurements – other benefit plan

As at December 31, 2010 and 2009, the Company has only one other

defined benefit plan and it had only one asset, an experience related

underwriting agreement, the fair value of which was determined using

Actual return on plan assets

Balance, relating to assets Purchases, Transfers in

beginning Still held at the Sold during sales and and/or out Balance,

(millions) of year reporting date the period settlements of Level 3 end of year

Asset class

Experience rated underwriting agreement(1)

Year ended December 31, 2009 $ß34 $ß– $ß– $ß(4) $ß– $ß30

Year ended December 31, 2010 $ß30 $ß1 $ß– $ß(2) $ß– $ß29

(1) The effect of the experience rated underwriting agreement is that the Company’s contributions were transferred to an insurance company that in turn provides

the other defined benefits.