Telus 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 157

FINANCIAL STATEMENTS & NOTES: 18

(2009 – $721 million), as set out in Note 5(h). The asset value of the

swap agreements increases (decreases) when the statement of financial

position date exchange rate increases (decreases) the Canadian dollar

equivalent of the U.S. Dollar notes.

The Company translates items such as the U.S. Dollar notes

into equivalent Canadian dollars at the rate of exchange in effect at

the statement of financial position date. The swap agreements at

December 31, 2010, comprised a net derivative liability of $404 million

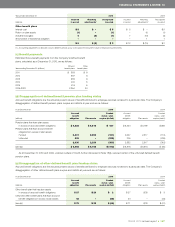

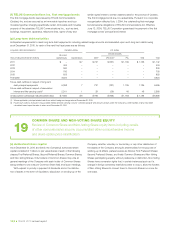

Principal face amount Redemption

Outstanding present

at financial value spread

Series Issued Issue price Originally issued statement date (basis points)(1)

8.00% (U.S. Dollar) Notes due 2011 May 2001 U.S.$994.78 U.S.$2.0 billion U.S.$0.7 billion 30

5.00% Notes, Series CB May 2006 $998.80 $300 million $300 million 16

4.50% Notes, Series CC March 2007 $999.91 $300 million $300 million 15

4.95% Notes, Series CD March 2007 $999.53 $700 million $700 million 24

5.95% Notes, Series CE(2) April 2008 $998.97 $500 million $500 million 66

4.95% Notes, Series CF(2) May 2009 $999.96 $700 million $700 million 71

5.05% Notes, Series CG(2) December 2009 $994.19 $1.0 billion $1.0 billion 45.5

5.05% Notes, Series CH(2) July 2010 $997.44 $1.0 billion $1.0 billion 47

(1) The notes are redeemable at the option of the Company, in whole at any time, or in part from time to time, on not fewer than 30 and not more than 60 days’ prior notice.

The redemption price is equal to the greater of (i) the present value of the notes discounted at the Adjusted Treasury Rate (in respect of the U.S. dollar denominated notes) or

the Government of Canada yield (in respect of the Canadian dollar denominated notes) plus the redemption present value spread, or (ii) 100% of the principal amount thereof.

In addition, accrued and unpaid interest, if any, will be paid to the date fixed for redemption.

(2) The Series CE Notes, Series CF Notes, Series CG Notes and Series CH Notes each require the Company to make an offer to repurchase the Series CE Notes, Series CF Notes,

Series CG Notes and Series CH Notes at a price equal to 101% of their principal plus accrued and unpaid interest to the date of repurchase upon the occurrence of a change

in control triggering event, as defined in the supplemental trust indenture.

TELUS Corporation’s credit facility expiring on May 1, 2012, is

unsecured and bears interest at prime rate, U.S. Dollar Base Rate, a

bankers’ acceptance rate or London interbank offered rate (LIBOR)

(all such terms as used or defined in the credit facility), plus applicable

margins. The credit facility contains customary representations, war-

ranties and covenants including two financial quarter-end financial ratio

tests. The financial ratio tests are that the Company may not permit its

net debt to operating cash flow ratio to exceed 4.0:1 and may not permit

its operating cash flow to interest expense ratio to be less than 2.0:1,

each as defined under the credit facility.

On June 19, 2009, TELUS Corporation entered into an amended

$300 million revolving credit facility with a syndicate of financial institutions,

expiring December 31, 2010; during the quarter ended September 30,

2010, the Company exercised its right to cancel the facility in its entirety.

The credit facility was unsecured and bore interest at prime rate or

bankers’ acceptance rate (all such terms as used or defined in the credit

facility), plus applicable margins.

Continued access to TELUS Corporation’s credit facility is not contin-

gent on the maintenance by TELUS Corporation of a specific credit rating.

(c) TELUS Corporation commercial paper

On May 15, 2007, TELUS Corporation entered into an unsecured

commercial paper program, which is backstopped by a portion of its

$2.0 billion syndicated credit facility, enabling it to issue commercial

paper up to a maximum aggregate of $800 million (or U.S. dollar

equivalent), to be used for general corporate purposes, including capi-

tal expenditures and investments; in August 2008, the program was

expanded to $1.2 billion. Commercial paper debt is due within one year

but is classified as long-term debt as the amounts are fully supported,

and the Company expects that they will continue to be supported,

by the revolving credit facility which has no repayment requirements

within the next year.

(d) TELUS Corporation credit facilities

On March 2, 2007, TELUS Corporation entered into a $2.0 billion bank

credit facility with a syndicate of financial institutions. The credit facility

consists of a $2.0 billion (or U.S. dollar equivalent) revolving credit facility

expiring on May 1, 2012, to be used for general corporate purposes

including the backstop of commercial paper.

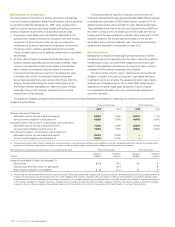

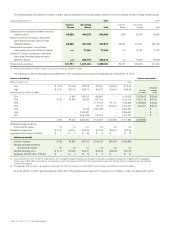

As at December 31 (millions) 2010 2009

Revolving credit facility expiring May 1, 2012 May 1, 2012 December 31, 2010 To t a l

Net available $ß1,779 $ß1,410 $ß300 $ 1,710

Outstanding, undrawn letters of credit 117 123 – 123

Backstop of commercial paper 104 467 – 467

Gross available $ß2,000 $ß2,000 $ß300 $ 2,300

than 30 days’ notice at the higher of par and the price calculated to

provide the Government of Canada Yield plus 15 basis points.

Pursuant to an amalgamation on January 1, 2001, the Debentures

became obligations of TELUS Communications Inc. The debentures

are not secured by any mortgage, pledge or other charge and are gov-

erned by certain covenants including a negative pledge and a limitation

on issues of additional debt, subject to a debt to capitalization ratio

and interest coverage test. Effective June 12, 2009, TELUS Corporation

guaranteed the payment of the debentures’ principal and interest.

(e) TELUS Communications Inc. debentures

The outstanding Series 1 through 5 debentures were issued by a pre-

decessor corporation of TELUS Communications Inc., BC TEL, under a

Trust Indenture dated May 31, 1990, and are non-redeemable.

The outstanding Series B Debentures were issued by a predecessor

corporation of TELUS Communications Inc., AGT Limited, under a Trust

Indenture dated August 24, 1994, and a supplemental trust indenture

dated September 22, 1995. They are redeemable at the option of the

Company, in whole at any time or in part from time to time, on not less