Telus 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168 . TELUS 2010 annual report

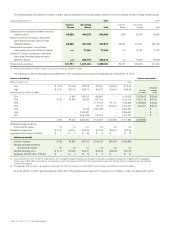

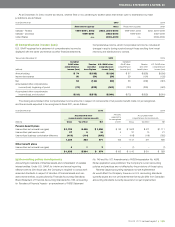

Years ended December 31 2010 2009

Unrecognized tax benefits Unrecognized tax benefits

Component Component

sheltered by Component sheltered by Component

losses carried comprised of losses carried comprised of

(millions) Gross forward capital losses Gross forward capital losses

Balance, beginning of period $ß800 $ß35 $ß156 $ß867 $ß310 $ß156

Tax positions related to prior years

Additions for tax returns filed during the year,

less prior year estimates 16 – – 11 – –

816 35 156 878 310 156

Tax positions related to prior years

Reduction for timing items

deductible in the year (40) – – (47) (47) –

Positions abandoned (156) – (156) – – –

Other changes in estimates 2 – – 7 – –

Tax positions related to current year

Estimated additions 31 – – 35 30 –

Reductions – – – – – –

Settlements (84) – – (67) – –

Current period reduction in losses (4) (7) – (2) (258) –

Lapses in statutes of limitations – – – (1) – –

Adjustments for tax rate changes (3) – – (3) – –

Balance, end of period $ß562 $ß28 $ß – $ß800 $ß 35 $ß156

As at December 31, 2010, it is reasonably possible that the Company’s

net unrecognized tax benefits will significantly increase and decrease in

the next twelve months for the following items:

.It is expected that Notices of Reassessment will be issued and/

or settlements will be reached with various government authorities

over the next twelve months that are expected to effectively settle a

number of uncertain tax positions and result in adjustments to the

effective tax rate and gross unrecognized tax benefits including the

abandonment of any remaining unrecognized tax benefits. Certain

presently unrecognized tax benefits pertain to a number of items

involving uncertainty as to the exact taxation period tax deductions

may be claimed among periods of changing statutory tax rates.

It is estimated the gross amount of the unrecognized tax benefits that

are expected to be resolved ranges from $65 million to $85 million

(2009 – $115 million to $135 million).

.It is anticipated that the Company will commence litigation pro-

ceedings in 2011 with respect to certain unrecognized tax benefits

with gross amounts expected to be resolved or abandoned

ultimately within a range of $60 million to $190 million.

.For those items that are timing in nature, it is reasonably possible

that the gross unrecognized tax benefits will decrease by $15 million

to $25 million (2009 – $15 million to $25 million) as temporary

differences are drawn down.

.During the next twelve months, the Company will file tax returns

covering the period ended December 31, 2010, as required by statute.

The returns are likely to contain unrecognized tax benefits that are

different than what has been quantified above. As the positions will

only be finalized at the time the tax returns are prepared, the amount

of such benefits cannot be estimated with certainty prior to that time.

Included in the balance at December 31, 2010 and 2009, excluding

net capital losses, are tax positions for which the ultimate deductibility is

highly certain but for which there is uncertainty about the timing of such

deductibility. In addition, the Company has losses carried forward that

are available to be applied against unrecognized tax benefits. As a result,

the impact on the annual effective tax rate is significantly less than the

gross amount of gross unrecognized tax benefits noted above.

The gross reserves are adjusted for tax rate changes applicable

to current and future taxation years based on the expected timing of

loss utilization.

In the application of both Canadian GAAP and U.S. GAAP, the

Company accrues for interest charges on current tax liabilities that have

not been funded, which would include interest and penalties arising

from uncertain tax positions. The Company includes such charges as a

component of Financing costs. During the year ended December 31, 2010,

the Company recorded interest income of $2 million (2009 – $46 million)

in respect of income taxes, recorded interest expense of $NIL (2009 –

$NIL) and collected $2 million (2009 – $54 million) of interest receivable.

As at December 31, 2010, the Company had a balance of $5 million

for accrued interest payable (2009 - $5 million) in respect of differences

between when tax-related exposures have been funded compared

to when tax-related exposures may have come into existence.