Telus 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 . TELUS 2010 annual report

of industry and Company-specific facts is used in determining the

fair value of the Company’s reporting units.

(g) Translation of foreign currencies

Trade transactions completed in foreign currencies are translated into

Canadian dollars at the rates prevailing at the time of the transactions.

Monetary assets and liabilities denominated in foreign currencies are

translated into Canadian dollars at the rate of exchange in effect at

the statement of financial position date with any resulting gain or loss

being included in the Consolidated Statements of Income and Other

Comprehensive Income as Financing costs, as set out in Note 8.

Hedge

accounting is applied in specific instances as further discussed in Note 1(i).

The Company has minor foreign subsidiaries that are considered to

be self-sustaining. Accordingly, foreign exchange gains and losses arising

from the translation of the minor foreign subsidiaries’ accounts into

Canadian dollars are reported as a component of other comprehensive

income, as set out in Note 19(b).

The carrying value of intangible assets with indefinite lives, and

goodwill, is periodically tested for impairment using a two-step

impairment test. The frequency of the impairment test generally is the

reciprocal of the stability of the relevant events and circumstances,

but intangible assets with indefinite lives and goodwill must, at a

minimum, be tested annually; the Company has selected December

as its annual test time. No impairment amounts arose from the

December 2010 and December 2009 annual tests. The test is

applied to each of the Company’s two reporting units (the reporting

units being identified in accordance with the criteria in the CICA

Handbook section for intangible assets and goodwill): Wireless

and Wireline.

The Company assesses its goodwill by applying the prescribed

method of comparing the fair value of its reporting units to the

carrying amounts of its reporting units. Consistent with current industry-

specific valuation methods, a combination of the discounted cash

flow approach, the market comparable approach and analytical review

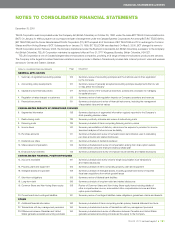

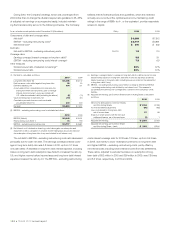

(h) Financial instruments – recognition and measurement

In respect of the recognition and measurement of financial instruments, the Company has adopted the following policies:

Classified as

available-for-sale

or held as part

of a cash flow Classified as

Financial instrument hedging relationship(1) held for trading(1)(2) Company’s reason for classification selection

Short-term marketable security investments(3)

X The Company has selected this method as it better reflects

management’s investment intentions

Long-term investments not subject to X The Company has selected classification as available-for-sale

significant influence of the Company(3) as it better reflects management’s investment intentions

Stand-alone derivatives which are a part of The Company believes that classification as held for hedging

an established and documented cash flow X results in a better matching of the change in the fair value

hedging relationship with the risk exposure being hedged

(1) The distinction between classification as available-for-sale (or held as part of a cash flow hedging relationship) or held for trading is that unrealized changes in the fair values of

financial instruments classified as available-for-sale, or the effective portion of unrealized changes in the fair values of financial instruments held for hedging, are included in other

comprehensive income and unrealized changes in the fair values of financial instruments classified as held for trading are included in net income.

(2) Certain financial instruments that are not required to be classified as held for trading may be classified as held for trading if the Company so chooses.

(3) In respect of investments in securities for which the fair values can be reliably measured, the Company determines the classification on an instrument-by-instrument basis at time

of initial recognition.

.In respect of hedges of anticipated transactions, which in the

Company’s specific instance currently relates to inventory purchase

commitments, hedge gains/losses will be included in the cost of

the inventory and will be expensed when the inventory is sold.

The Company has selected this method as it believes that a better

matching with the risk exposure being hedged is achieved.

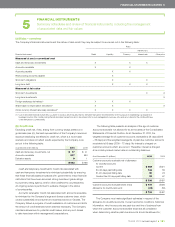

(i) Hedge accounting

General: The Company applies hedge accounting to the financial

instruments used to:

.establish designated currency hedging relationships for its U.S.

dollar denominated long-term debt future cash outflows (semi-annual

interest payments and principal payments at maturity), as set out in

Note 5 and further discussed in Note 18(b);

.establish designated currency hedging relationships for certain

U.S. dollar denominated future purchase commitments, as set out

in Note 5; and

.fix the compensation cost arising from specific grants of restricted

stock units, as set out in Note 5 and further discussed in Note 12(c).

.Accounts receivable that are available-for-sale to an arm’s-length

securitization trust are accounted for as loans and receivables.

The Company has selected this method as the benefits that would

have been expected to arise from using the available-for-sale

method were not expected to exceed the costs of selecting and

implementing that method.

.Regular-way purchases or sales (those which require actual delivery

of financial assets or financial liabilities) are recognized on the trade

date. The Company has selected this method as it is consistent

with the mandatory trade-date accounting required for derivative

instruments.

.Transaction costs, other than in respect of held for trading items,

are added to the initial fair value of the acquired financial asset

or financial liability. The Company has selected this method as it

believes that this results in a better matching of the transaction

costs with the periods benefiting from the transaction costs.