Telus 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 111

Earnings coverage is defined in the Canadian Securities

Administrators’ National Instrument (NI) 41-101 and related instruments.

Prior to the changeover to IFRS, the calculation prescribed the use

of gross interest expense on long-term debt; after the changeover to

IFRS, the calculation prescribes the use of total gross interest expense.

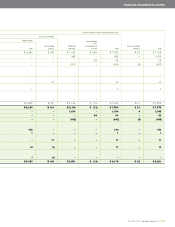

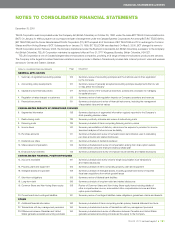

Calculation of earnings coverage

Unaudited

pro forma

Years ended December 31 IFRS-IASB As currently reported

($ millions, except ratio) 2010 2010 2009

Net income attributable

to Common Shares

and Non-Voting Shares 1,048 – –

Net income – 1,038 1,002

Income taxes 335 328 203

Gross interest expense

Interest on long-term debt 442 442 474

Interest on short-term

obligations and other 29 Excluded(1) Excluded(1)

Loss on redemption of debt 52 52 99

Interest accretion on asset

retirement obligations 4 n.a. n.a.

Numerator 1,916 1,860 1,778

Denominator –

Gross interest expense 527 494 573

Ratio (times) 3.6 3.8 3.1

(1) Interest on short-term obligations and other was $21 million in 2010 and $9 million

in 2009.

EBITDA – excluding restructuring costs is defined as EBITDA

(described in Section 11.1), adding back restructuring costs of $74 million

in 2010 and $190 million in 2009. This measure is used in the calculation

of Net debt to EBITDA – excluding restructuring costs and EBITDA –

excluding restructuring costs interest coverage, consistent with the

calculation of the Leverage Ratio and the Coverage Ratio in credit facility

covenants.

EBITDA – excluding restructuring costs interest coverage is

calculated on a 12-month trailing basis and defined as EBITDA excluding

restructuring costs, divided by Net interest cost. Historically, this measure

is substantially the same as the Coverage Ratio covenant in TELUS’

credit facilities.

Net debt is a non-GAAP measure whose nearest GAAP measure

is Long-term debt, including Current maturities of long-term debt, as

reconciled below. Net debt is one component of a ratio used to deter-

mine compliance with debt covenants (refer to the description of

Net debt to EBITDA below). The measurement of net debt is currently

unaffected by the changeover to IFRS.

Smartphones are advanced mobile devices or personal digital

assistants (PDAs) that provide text messaging, email, multimedia down-

loads and social networking (e.g. Facebook Mobile) functionalities in

addition to voice. TELUS reports smartphones as a percentage of gross

postpaid subscriber additions and as a percentage of the postpaid

subscriber base.

11.4 Definition and calculation of liquidity

and capital resource measures

Dividend payout ratio and dividend payout ratio of adjusted

net earnings: The basic measure is defined as the quarterly dividend

declared per Common Share and Non-Voting Share, as recorded

on the financial statements, multiplied by four and divided by the sum

of basic earnings per share for the most recent four quarters for interim

reporting periods (divided by annual basic earnings per share for fiscal

years). The target guideline for the annual dividend payout ratio is on

a prospective basis, rather than on a trailing basis, and is 55 to 65% of

sustainable net earnings. More representative of a sustainable calculation

is the historical ratio based on reported earnings per share adjusted to

exclude income tax-related adjustments, loss on redemption of debt,

and ongoing impacts of a net-cash settlement feature introduced in 2007.

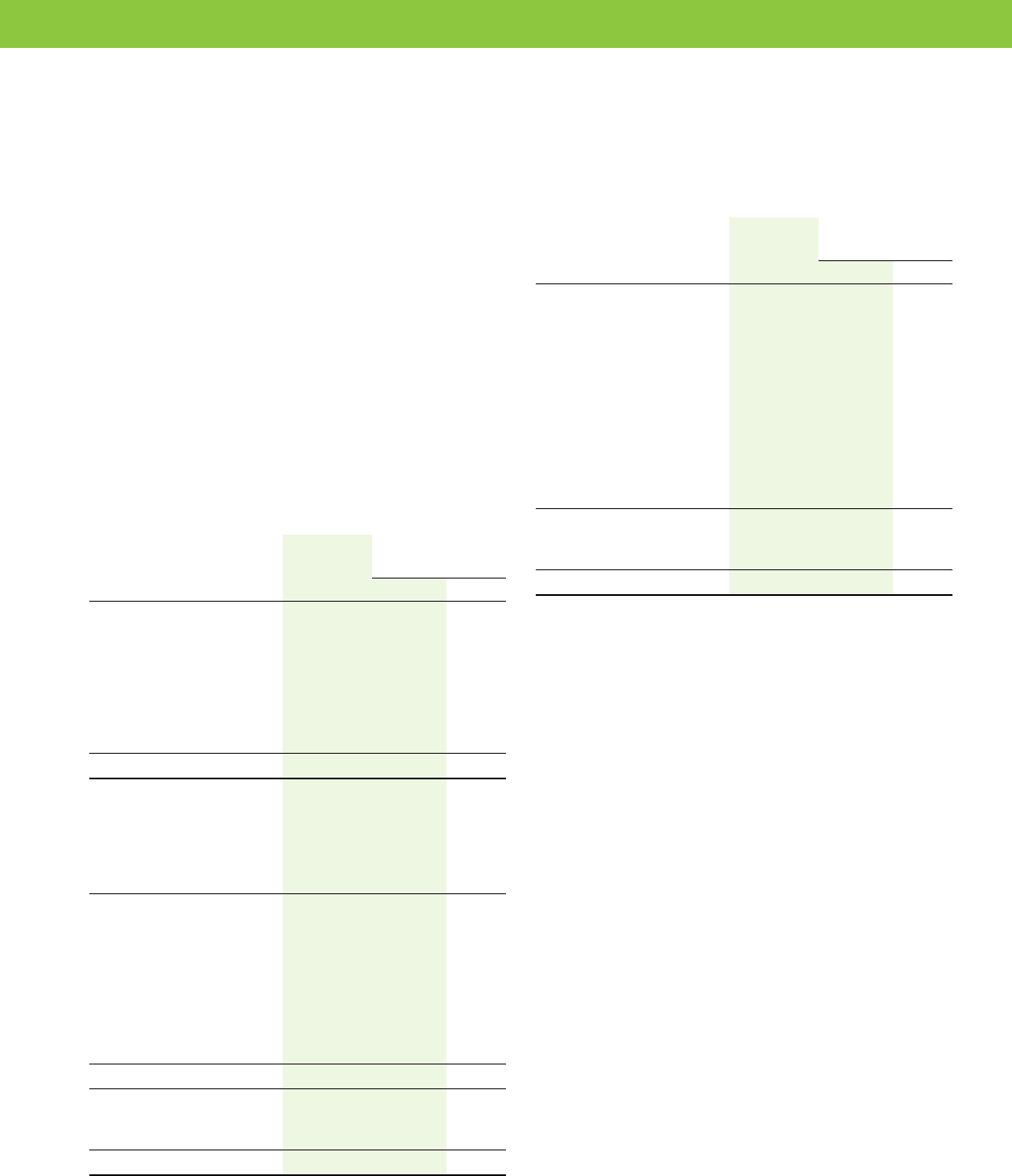

Calculation of dividend payout ratios

Unaudited

pro forma

Measure for December 31 IFRS-IASB As currently reported

($, except ratios) 2010 2010 2009

Dividend payout ratio

Numerator – Annualized fourth

quarter dividend declared

per Common Share and

Non-Voting Share 2.10 2.10 1.90

Denominator – Earnings

per Common Share and

Non-Voting Share 3.27 3.23 3.14

Ratio (%) 64 65 61

Dividend payout ratio

of adjusted net earnings

Numerator – Annualized fourth

quarter dividend declared

per Common Share and

Non-Voting Share 2.10 2.10 1.90

Adjusted net earnings ($ millions)

Net income attributable to

Common Shares and

Non-Voting Shares 1,048 1,034 998

Deduct favourable income

tax-related adjustments (30) (30) (165)

Add back loss on

redemption of debt 37 37 69

Net-cash settlement feature

(7) (7) 1

1,048 1,034 903

Denominator – Adjusted net

earnings per Common Share

and Non-Voting Share 3.27 3.23 2.84

Adjusted ratio (%) 64 65 67

MANAGEMENT’S DISCUSSION & ANALYSIS: 11