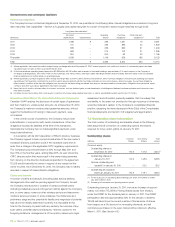

Telus 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 63

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

.Voice long distance revenue decreased by $89 million in 2010 when

compared to 2009. The decrease reflects ongoing industry-wide

price competition, losses of local subscribers, and technological

substitution to wireless and Internet-based services.

.Other revenue increased by $5 million in 2010 when compared to

2009. The increase included $8 million of revenue recognized from

CRTC Telecom Decision 2010-900 Review of the large incumbent

local exchange carriers’ support structure service rates partly offset

by lower voice equipment sales.

.Intersegment revenue represents services provided by the wireline

segment to the wireless segment and is eliminated upon consolidation

together with the associated expense in the wireless segment.

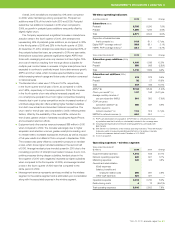

Operating expenses – wireline segment

Years ended December 31

($ millions) 2010 2009 Change

Salaries, benefits and

employee-related costs 1,715 1,811 (5.3)%

Other operations expenses 1,523 1,486 2.5%

Operations expenses 3,238 3,297 (1.8)%

Restructuring costs 70 178 (60.7)%

Total operating expenses 3,308 3,475 (4.8)%

Total wireline operating expenses decreased by $167 million in 2010

when compared to 2009.

.Salaries, benefits and employee-related expenses decreased by

$96 million in 2010 when compared to 2009. The decrease primarily

reflects lower base salaries from fewer domestic FTE employees

and continued reduction of discretionary employee-related expenses

such as travel, partly offset by labour rate inflation in 2010, increased

employee performance bonus compensation expenses due to

improved financial and operating results, and increased defined

benefit plan expenses.

.Other operations expenses increased by $37 million in 2010

when compared to 2009. The increase reflects higher TELUS TV

programming and material costs related to the 85% increase in

the subscriber base, and higher advertising and promotions costs,

partly offset by lower transit and termination costs due to lower

rates, supplier credits, lower cost of goods sold related to lower

overall equipment sales, and one-time operating savings in the

first quarter of 2010.

.Restructuring costs decreased by $108 million in 2010 when

compared to 2009. See discussion in Section 5.3.

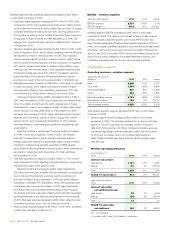

EBITDA – wireline segment

Years ended December 31 2010 2009 Change

EBITDA ($ millions) 1,612 1,558 3.5%

EBITDA margin (%) 32.8 31.0 1.8 pts.

Wireline segment EBITDA increased by $54 million in 2010 when

compared to 2009. Improvement in the EBITDA margin resulted from

lower restructuring costs and operating savings realized from efficiency

initiatives to mitigate declining voice revenues, supplemented by a high

margin software application sale in the first quarter of 2010, partially offset

by increased costs associated with the growth in TELUS TV services.

The Company launched its new Optik TV and Optik High Speed

Internet service brands in June 2010, as described in Section 2. This

launch, combined with enhanced bundling capabilities and retention

offers, positively impacted TV and high-speed subscriber additions

in the second half of 2010 relative to the second half of 2009 and

the first half of 2010. In addition, offers by the primary cable-TV com-

petitor in Western Canada were scaled back in the second half of

2010. TELUS upgraded a significant portion of its IP TV subscribers

to Microsoft Mediaroom technology in 2010, with a plan to fully

migrate the rest of the subscriber base in 2011.

.Voice local revenue decreased by $172 million in 2010 when

compared to 2009. The decrease continues to reflect lower basic

access and enhanced voice service revenues caused by com-

petition for residential subscribers, the consequent decline in local

residential access lines and matching of competitive offers, and

technological substitution by wireless and Internet-based services.

The decrease also reflects a decline in business voice lines

from technological substitution to data services, competitor activity

including price competition, and cautious business spending.

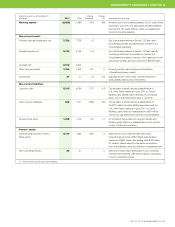

Wireline operating indicators

As at December 31

(000s) 2010 2009 Change

Network access lines (NALs)(1)

Residential 2,046 2,223 (8.0)%

Business 1,693 1,743 (2.9)%

To t a l 3,739 3,966 (5.7)%

Years ended December 31

(000s) 2010 2009 Change

Net (losses) additions in NALs

Residential (177) (175) (1.1)%

Business (50) (35) (42.9)%

To t a l (227) (210) (8.1)%

(1) As a result of a periodic subscriber measurement review and correction during

the first quarter of 2010, historical NALs were restated for the prior periods

commencing in 2007. Total NALs at December 31, 2009, reflect a reduction

of 15,000 residential NALs from the figure reported in the 2009 MD&A, in

respect of TELUS TV subscribers who did not subscribe to voice lines, but

were inadvertently included in NAL counts. Business NALs were reduced by

67,000 from the figure reported in the 2009 MD&A due to the cleanup and

removal of inaccurate subscriber records as part of the integration of billing

and subscriber reporting processes, as well as the consistent application

of industry measurement practices across TELUS.

Residential NALs continue to be affected by wireless and Internet-

based technological substitution for local services, as well as

promotional activity by primary cable-TV competitors in the Company’s

incumbent areas of B.C., Alberta and Eastern Quebec. Residential

NAL losses improved in the second half of 2010 relative to the loss

experience in the second half of 2009 and the first half of 2010 due

to the Company’s enhanced bundling capabilities resulting from its

expanded TV offering with Optik TV and the provision of competitive

retention offers.

Business NAL losses in 2010 reflect increased competition in

the small and medium business market, conversion of voice lines to

more efficient IP services, cautious business spending, and slower

growth in data lines due to the completion of some large enterprise

deals that also included large private IP networks. Growth in certain

data services such as private IP networks is not measured by business

NAL counts, and conversion of legacy voice services to IP services

results in an overall decrease in business NALs.