Telus 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 159

FINANCIAL STATEMENTS & NOTES: 19

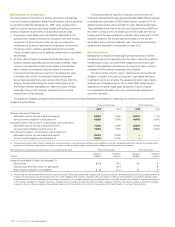

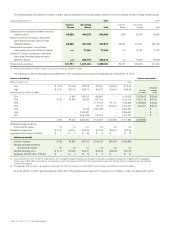

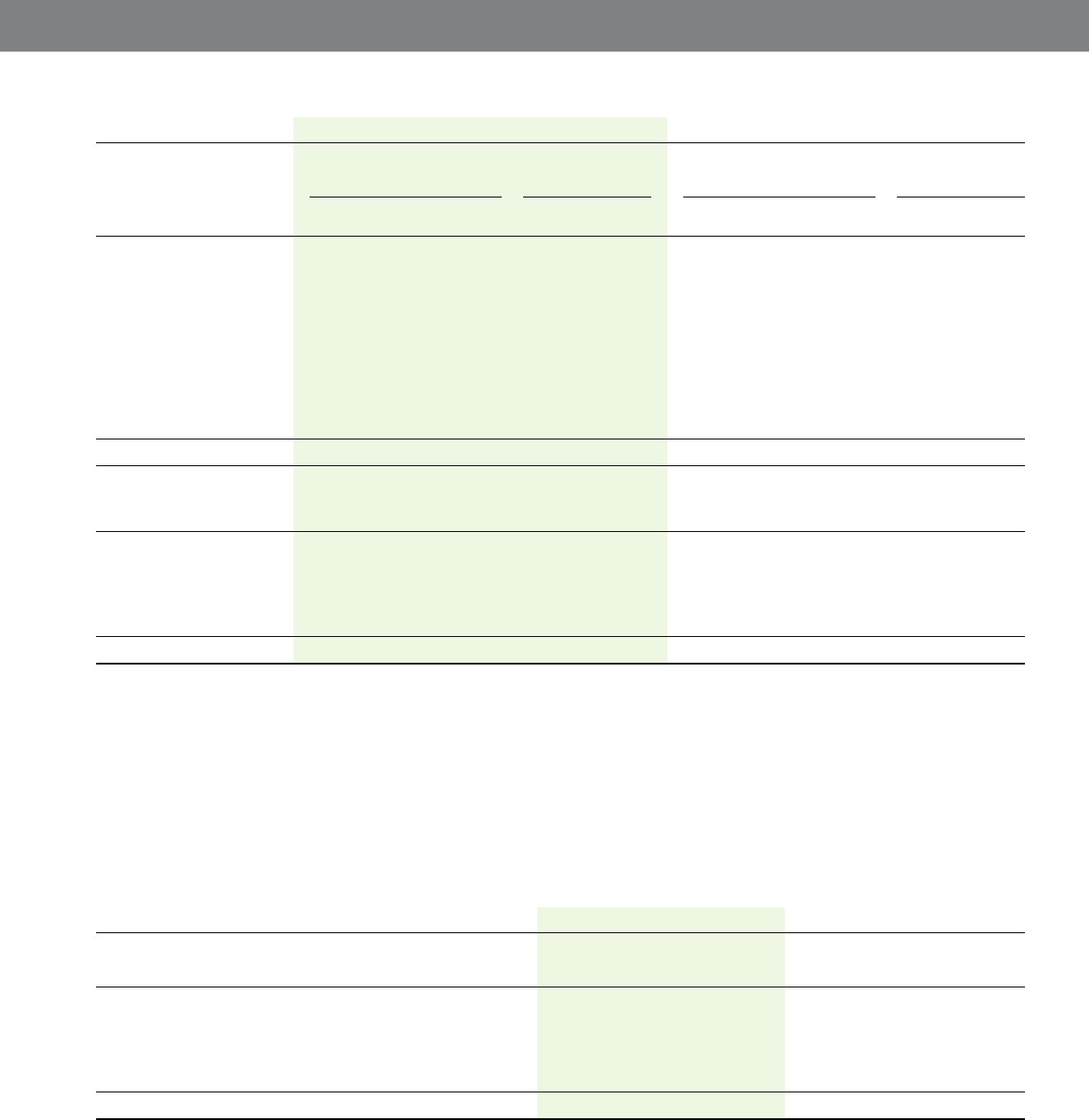

(b) Accumulated other comprehensive income (loss)

Years ended December 31 2010 2009

Accumulated Accumulated

Other comprehensive

other comprehensive

Other comprehensive other comprehensive

income (loss) income (loss) income (loss) income (loss)

Amount Income

Beginning End of

Amount Income Beginning End of

(millions) arising taxes Net of period period arising taxes Net of period period

Change in unrealized fair

value of derivatives

designated as cash

flow hedges

(Note 5(i))

Gains (losses) arising in

current period $ß15 $ß11 $ß 4 $ß(264) $ß(26) $ß(238)

(Gains) losses arising in prior

periods and transferred

to net income in the

current period 59 9 50 362 55 307

74 20 54 $ß(53) $ 1 98 29 69 $ß(122) $ß(53)

Cumulative foreign

currency translation

adjustment – – – (19) (19) (12) – (12) (7) (19)

Change in unrealized fair

value of available-for-

sale financial assets

and recognition of

amounts realized – – – – – 1 – 1 (1) –

$ß74 $ß20 $ß54 $ß(72) $ß(18) $ 87 $ 29 $ 58 $ß(130) $ß(72)

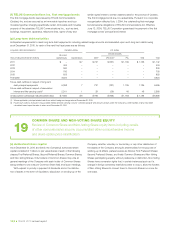

Shares at a price equal to the fair market value at the time of grant; prior

to 2001, options were also similarly awarded in respect of Common

Shares. Prior to 2002, directors were also awarded options to purchase

Non-Voting Shares and Common Shares at a price equal to the fair

market value at the time of grant. Option awards currently granted under

the plans may be exercised over specific periods not to exceed seven

years from the time of grant; prior to 2003, share option awards were

granted with exercise periods not to exceed ten years.

The following table presents a summary of the activity related to the

Company’s share option plans.

As at December 31, 2010, the Company’s estimate of the net

amount of existing gains (losses) arising from the unrealized fair value

of derivatives designated as cash flow hedges which are reported

in accumulated other comprehensive income and are expected to be

reclassified to net income in the next twelve months, excluding tax

effects, is $3 million.

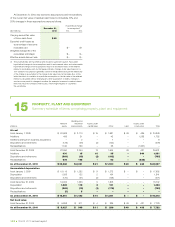

(c) Share option plans

The Company has a number of share option plans under which officers

and other employees may receive options to purchase Non-Voting

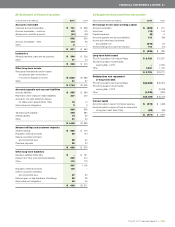

Years ended December 31 2010 2009

Weighted Weighted

Number of average share Number of average share

share options option price share options option price

Outstanding, beginning of period 11,057,916 $ß38.08 10,153,316 $ß39.23

Granted 2,787,876 33.00 2,572,556 30.61

Exercised(1) (1,329,351) 29.23 (619,760) 20.71

Forfeited (614,941) 39.55 (958,122) 42.18

Expired (159,834) 35.80 (90,074) 30.21

Outstanding, end of period 11,741,666 $ß37.83 11,057,916 $ß38.08

(1) The total intrinsic value of share option awards exercised for the year ended December 31, 2010, was $17 million (2009 – $7 million) (reflecting a weighted average price at the

dates of exercise of $41.88 per share (2009 – $32.41 per share)). The tax benefit realized for the tax deductions from share option exercises for the year ended December 31, 2010,

was $NIL (2009 – $NIL).

of the share option award is settled as a share option or using the net-

equity settlement feature. In 2007, certain outstanding grants of share

option awards had a net-cash settlement feature applied to them, as

further discussed in Note 12(b); the optionee has the choice of exercising

the net-cash settlement feature.

In 2006, certain outstanding grants of share option awards, which

were made after 2001, had a net-equity settlement feature applied

to them. This event did not result in the optionees receiving incremental

value and therefore modification accounting was not required for it.

The optionee does not have the choice of exercising the net-equity

settlement feature. It is at the Company’s discretion whether an exercise