Telus 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 . TELUS 2010 annual report

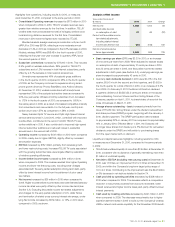

Assumptions for 2010 original targets Result or expectation for 2010

A blended statutory tax rate of approximately 28.5 to 29.5%

(30.3% in 2009). The expected decrease is based on enacted

changes in federal and provincial income tax rates

The blended statutory income tax rate was 29% and the effective

income tax rate was 24%.

Cash income taxes peaking at approximately $385 to $425 million

(net $266 million in 2009) due to the timing of instalment payments

Cash income tax payments net of refunds received were $311 million

in 2010, comprised of instalments for 2010 and final payments for the

2009 tax year made in the first quarter, net of $41 million of refunds for the

settlement of prior years’ matters. The expectation for the full year was

revised to a range of $300 to $350 million on November 5, 2010, and was

previously revised to a range of $330 to $370 million on August 6, 2010.

A pension accounting discount rate was estimated at 5.75% and

subsequently set at 5.85% (140 basis points lower than 2009).

The expected long-term return of 7.25% is unchanged from 2009

and consistent with the Company’s long-run returns and its

future expectations.

.Defined benefit pension plans net expenses were estimated

to be $28 million in 2010 (compared to $18 million in 2009), based

on projected pension fund returns

.Defined benefit pension plans contributions were estimated to be

approximately $143 million in 2010, down from $179 million in 2009,

largely due to the stock market recovery in 2009 and proposed

federal pension reforms.

Defined benefit pension plan expenses were $28 million in 2010 and

are set at the beginning of the year. The Company’s contributions to

defined benefit pension plans in 2010 were $137 million. A $200 million

voluntary contribution was announced in mid-December 2010 and

made in January 2011. See Assumptions for 2011 targets in Section 1.5.

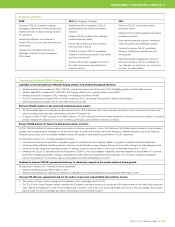

Wireline revenue growth is expected to vary between negative 1%

to positive 2% in 2011, reflecting data growth in business services and

residential entertainment services, offset by continued decreases in

traditional local and long distance service revenues. Wireline EBITDA

is expected to decline between zero and 6% as a result of revenue

declines in higher margin legacy services and continued short-term

dilutive costs associated with Optik TV subscriber growth. This is being

partially offset by growth from lower margin data services, incremental

savings from efficiency activities and a reduction in restructuring costs.

Capital expenditures in 2011 are expected to be similar year-over-year

at approximately $1.7 billion. TELUS expects to continue its broadband

infrastructure expansion and upgrades supporting Optik TV and Internet

services in the top 48 communities in Alberta and B.C., which includes

completing the overlay of VDSL2 technology. In addition, TELUS expects

to continue to enhance wireless network capacity and deploy HSPA+

dual-cell technology to increase the manufacturer-rated data download

speed to up to 42 megabits per second (Mbps).

TELUS will continue to focus on cost reduction in 2011, with a planned

investment of approximately $50 million in restructuring costs ($74 mil-

lion in 2010). TELUS expects to generate approximately $50 million in

incremental operating efficiency savings in 2011 related to restructuring

investments, capital efficiency initiatives and operating efficiency initia-

tives made in 2011 or prior periods (approximately $134 million in 2010).

TELUS made a $200 million voluntary special contribution to

its defined benefit pension plans in January 2011, which is expected to

be accretive to 2011 EBITDA and EPS. Pension contributions are tax

deductible and are expected to reduce cash taxes in 2010 and 2011 by

a total of approximately $57 million.

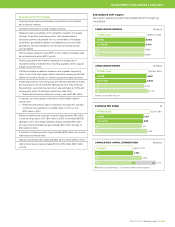

1.5 Financial and operating targets for 2011

As a result of the convergence of Canadian GAAP with IFRS and TELUS’

changeover to IFRS on January 1, 2011, targets for 2011 are according

to IFRS. Further discussion of the expected effects of the changeover to

IFRS is provided in Section 8.2 Accounting policy developments.

The following assumptions apply to TELUS’ 2011 targets presented

in Scorecards in the previous section. The 2011 targets and assump-

tions were originally announced on December 14, 2010, in the Company’s

annual financial targets news release and accompanying investor

conference call.

For 2011, TELUS is targeting a consolidated revenue increase over

2010 of 1 to 4% and an EBITDA increase of 1 to 6%. Revenue and

EBITDA are expected to benefit from TELUS’ continued execution in its

data and wireless operations. The growth rate in EBITDA is potentially

higher than the growth rate in revenues due to efficiency activities and

lower expected restructuring costs. Earnings per share (EPS) are targeted

to grow in a range of 7 to 19%, due to operating earnings growth and

lower financing costs.

TELUS wireless revenue is forecast to increase 4 to 7% in 2011 as

a result of continued subscriber growth. Growth in loading is expected

to benefit from a wireless industry penetration gain of approximately

4.5 to five percentage points. TELUS expects to continue to benefit from

its HSPA+ network investments resulting in increased data and roaming

revenues helping to offset continued declines in voice ARPU. Wireless

EBITDA is expected to be 6 to 11% higher in 2011, despite the impact on

margins of increased investments in customer acquisition and retention.