Telus 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152 . TELUS 2010 annual report

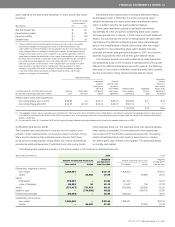

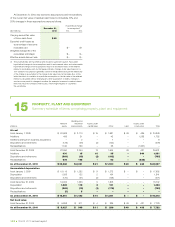

At December 31, 2010, key economic assumptions and the sensitivity

of the current fair value of residual cash flows to immediate 10% and

20% changes in those assumptions were as follows:

Hypothetical change

December 31, in assumptions(1)

($ in millions) 2010 10% 20%

Carrying amount/fair value

of future cash flows $ß60

Expected credit losses as

a percentage of accounts

receivable sold $ß– $ß1

Weighted average life of the

receivables sold (days) $ß– $ß–

Effective annual discount rate $ß– $ß–

(1) These sensitivities are hypothetical and should be used with caution. Favourable

hypothetical changes in the assumptions result in an increased value, and unfavourable

hypothetical changes in the assumptions result in a decreased value, of the retained

interest in receivables sold. As the figures indicate, changes in fair value based on a

10% variation in assumptions generally cannot be extrapolated because the relationship

of the change in assumption to the change in fair value may not be linear. Also, in this

table, the effect of a variation in a particular assumption on the fair value of the retained

interest is calculated without changing any other assumption; in reality, changes in

one factor may result in changes in another (for example, increases in market interest

rates may result in increased credit losses), which might magnify or counteract

the sensitivities.

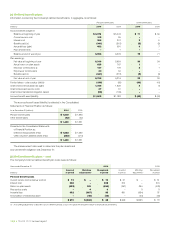

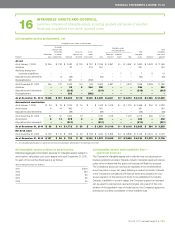

15 PROPERTY, PLANT AND EQUIPMENT

Summary schedule of items comprising property, plant and equipment

Buildings and

Network leasehold Assets under Assets under

(millions) assets improvements capital lease Other Land construction To t a l

At cost

As at January 1, 2009 $ 20,609 $ 2,110 $ 15 $ 1,681 $ 49 $ß 485 $ 24,949

Additions 406 21 – 42 – 1,283 1,752

Additions arising from business acquisitions – 2 – 7 – – 9

Dispositions and retirements (125) (28) (2) (124) – – (279)

Reclassifications 1,160 139 – 38 – (1,337) –

As at December 31, 2009 22,050 2,244 13 1,644 49 431 26,431

Additions 431 15 10 35 – 840 1,331

Dispositions and retirements (568) (13) (2) (182) – – (765)

Reclassifications 675 105 – 53 – (833) –

As at December 31, 2010 $ß22,588 $ß2,351 $ß21 $ß1,550 $ß49 $ 438 $ß26,997

Accumulated depreciation

As at January 1, 2009 $ 15,119 $ 1,232 $ 9 $ 1,272 $ – $ß – $ 17,632

Depreciation 1,053 122 2 164 – – 1,341

Dispositions and retirements (120) (21) (2) (128) – – (271)

As at December 31, 2009 16,052 1,333 9 1,308 – – 18,702

Depreciation 1,082 118 2 131 – – 1,333

Dispositions and retirements (568) (13) (1) (178) – – (760)

Reclassifications (5) 5 – – – – –

As at December 31, 2010 $ß16,561 $ß1,443 $ß10 $ß1,261 $ß – $ – $ß19,275

Net book value

As at December 31, 2009 $ 5,998 $ß 911 $ 4 $ß 336 $ 49 $ß 431 $ 7,729

As at December 31, 2010 $ß 6,027 $ 908 $ß11 $ 289 $ß49 $ 438 $ß 7,722