Telus 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

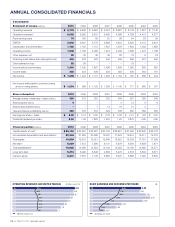

28 . TELUS 2010 annual report

$2 billion of debt refinancing completed in the past two years

and a lower overall level of debt.

Free cash flow increased by 95 per cent to $947 million

in 2010, reflecting both growth in earnings and a significant

$380 million decline in capital expenditures. Notably, our strong

cash flow position enabled us to make a voluntary $200 million

contribution in January 2011 to our defined benefit pension

plans, with positive impacts to our expected earnings and our

already strong pension funding position. The benefits from

the contribution include reductions in our pension expense

in 2011 and our cash taxes in 2010 and 2011.

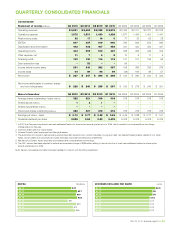

Indicative of the Company’s momentum are the 2011 ranges

and growth rates for consolidated and segmented targets

shown in the illustration above. I had more comfort setting these

targets in December 2010 than a year earlier, due to the fourth

quarter exit rate on wireless ARPU – a 1.9 per cent increase

compared to a 7.7 per cent decline in 2009. However, one can

never get too comfortable in our industry, with key uncertainties

in 2011 that include the magnitude of the impact from new

wireless entrants and regulatory developments. These targets

should be read in conjunction with the important assumptions

and caution regarding forward-looking statements contained

in Management’s discussion and analysis (MD&A).

Based on targeted EBITDA growth, as well as lower

financing costs and much lower cash taxes, free cash flow

is also expected to increase notably in 2011.

Strong financial management

TELUS has considerable financial strength and a demonstrated

commitment to transparency and adherence to prudent finan-

cial policies and guidelines. These have guided our actions

successfully over the past decade as we executed our

operational strategy while building financial strength and thereby

earned the confidence of investors.

Our track record is also

reflected in the strong investment

grade credit ratings we

maintain, BBB+ to A– with a stable trend, which have enabled

us to have ready access to capital markets.

We continued in 2010 to refinance and early redeem U.S.

debt due in June 2011 carrying an effective interest rate

of 8.5 per cent. In July, we successfully raised $1 billion of

10-year debt with a 5.05 per cent coupon. This mirrored

the same amount and coupon of a December 2009 debt issue.

The combined impact of these two bond issues would be to

lower annual interest costs by more than $65 million, which

will positively impact future earnings and cash flow. Importantly,

these debt issues also reduced our refinancing risk and

extended our debt maturity profile by almost two-thirds of

a year to 5.7 years.

Our good standing and ready access to capital markets

provide a competitive advantage in our ever-changing, technology-

driven and capital-intensive industry. This is increasingly

important as we continue to invest in new network infrastructure

and innovative solutions.

Considering interests of equity

and debt holders

TELUS continues its long-standing orientation to manage

capital in a manner that considers the interests of equity and

debt holders, and optimizes the cost and availability of capital

at an acceptable level of risk. We have acted to maintain our

strong credit ratings and 2010 represents the sixth consecutive

year that we have achieved our long-term financial policy

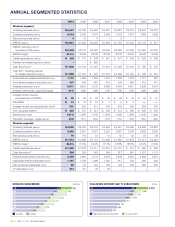

CONSOLIDATED AND SEGMENTED 2011 TARGETS

Earnings per share

(EPS) – basic

$3.50 to $3.90

7 to 19%

Revenues

$9.925 to

$10.225 billion

1 to 4%

Wireless EBITDA

$2.15 to

$2.25 billion

6 to 11%

Wireline EBITDA

$1.525 to

$1.625 billion

(6) to 0%

Wireline revenues

$4.725 to

$4.875 billion

(1) to 2%

Capital

expenditures

approximately

$1.7 billion

EBITDA

$3.675 to

$3.875 billion

1 to 6%

Wireless revenues

$5.2 to

$5.35 billion

4 to 7%