Telus 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 . TELUS 2010 annual report

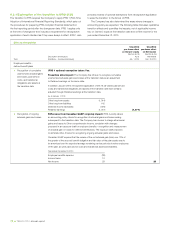

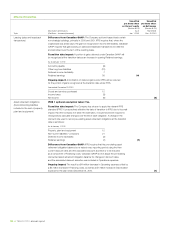

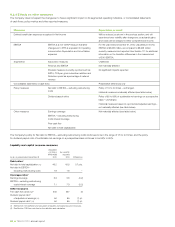

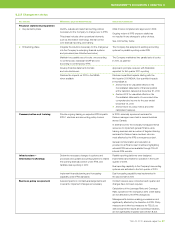

Key activity Milestones (expected timeframes) Status and comments

Control environment

.Internal control over financial

reporting

Approval of initial IFRS 1 optional exemption

and accounting policy choices

Senior management approval received for initial

elections and policy choices obtained in 2009.

Audit Committee review of management’s initial

elections and policy choices, and Board of Directors’

approval obtained in 2009.

Progress reviews by senior management

and Audit Committee

Review by senior management of implementation

progress, impacts of outstanding IFRS exposure

drafts, and quantification efforts in April, July and

October 2010, and January 2011.

Progress presented at Audit Committee meetings

in May, August and November 2010, and in

February 2011. Quantified results were reviewed

with the Audit Committee in July 2010.

Testing of controls for 2010 comparatives Activities commenced in the first quarter of 2010

and continued during the year

.Disclosure controls and procedures Review and sign-off conversion effects

on fiscal 2010

.Review and approval by senior management

.Review by Audit Committee and approval

by the Board of Directors

Approval of IFRS disclosures in third quarter

MD&A, including quantification of impacts on key

line items, received in October 2010.

First quarter of 2011:

.Approval of fiscal 2010 IFRS disclosures

in annual MD&A

.Senior management approval of supplementary

IFRS disclosures.

December 2010

.Board of Directors’ approval of the Company’s

2011 IFRS-based budget

.Senior management approval of 2011 public

annual targets under IFRS

.Publicly issue final guidance for fiscal 2010

according to Canadian GAAP together with

2011 annual targets according to IFRS.

The Company continued its long-standing practice

of releasing annual targets and key assumptions

for the upcoming year in December and providing

final guidance for the current year.

IFRS targets for 2011 and final Canadian GAAP

guidance for 2010 were released on December 14,

2010, followed by an investor call and webcast.

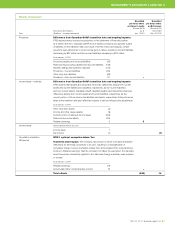

Revenues in the Canadian telecom industry grew by an estimated

2% in 2010, to approximately $42 billion, with wireless and data services

continuing to act as growth engines for the sector. Offsetting this growth

was continued wireline industry weakness in traditional voice service

revenue, as well as declining long distance revenues. Bell Canada and its

affiliated companies represented about 43% of the total industry revenue.

As the second largest telecommunications provider in Canada,

TELUS generated $9.8 billion in revenues in 2010, or approximately 23%

of the total industry revenue. TELUS’ revenue growth resumed in 2010,

increasing by 1.8%, with wireless revenues and wireline data revenue

representing approximately 74% of total revenues (71% in 2009).

The Company has targeted consolidated revenue growth between

1 and 4% in 2011.

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

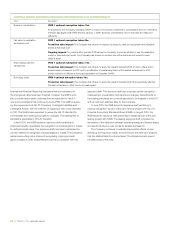

Outlook for the telecommunications industry

in 2011

During 2010, Canada’s economy showed signs of improvement, with

economic growth continuing through the fourth quarter of 2010 after

emerging from a recession in the third quarter of 2009. The Bank of

Canada reported in its January 2011 Monetary Report that it expects

Canada’s economic growth to be 2.4% in 2011 and 2.8% in 2012.

Western Canadian provinces are projected to grow at the fastest rates,

due to strong global demand for commodities.

9GENERAL OUTLOOK

Expectations for the telecommunications industry in 2011