Telus 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 . TELUS 2010 annual report

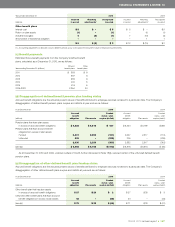

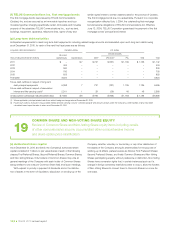

(f) Accumulated pension benefit obligations

Accumulated benefit obligations differ from accrued benefit obligations in that accumulated benefit obligations do not include assumptions about

future compensation levels. The Company’s disaggregation of defined pension benefit plans accumulated benefit obligations and plan assets at

year-end are as follows:

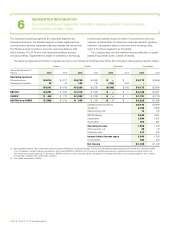

As at December 31 2010 2009

Accumulated Accumulated

benefit benefit

(millions) obligation Plan assets Difference obligation Plan assets Difference

Pension plans that have plan assets

in excess of accumulated benefit obligations $ß5,857 $ß6,209 $ß352 $ß5,353 $ß5,794 $ß441

Pension plans that have accumulated benefit

obligations in excess of plan assets

Funded 599 556 (43) 545 522 (23)

Unfunded 210 – (210) 189 – (189)

809 556 (253) 734 522 (212)

$ß6,666 $ß6,765 $ß 99 $ß6,087 $ß6,316 $ß229

of BC TELECOM Inc. and TELUS Corporation, the Company’s prede-

cessors. Externally managed funds are permitted to invest in securities

of the Company, provided that the investments are consistent with the

funds’ mandate and are in compliance with the relevant SIP&P.

Diversification: The Company’s strategy for equity security invest-

ments is to be broadly diversified across individual securities, industry

sectors and geographical regions. A meaningful portion (15–25%

of total plans’ assets) of the investment in equity securities is allocated

to foreign equity securities with the intent of further increasing the

diversification of the plans’ assets. Debt securities may include a mean-

ingful allocation to mortgages with the objective of enhancing cash

flow and providing greater scope for the management of the bond

component of the plans’ assets. Debt securities also may include real

return bonds to provide inflation protection, consistent with the indexed

nature of some defined benefit obligations. Real estate investments

are used to provide diversification of plans’ assets, potential long-term

inflation hedging and comparatively stable investment income.

Relationship between plan assets and benefit obligations: With the

objective of lowering its long-term costs of defined benefit plans, the

Company purposely mismatches plan assets and benefit obligations.

This mismatching is implemented by including equity investments in the

long-term asset mix as well as fixed income securities and mortgages

with durations that differ from the benefit obligations. Compensation

for liquidity issues that may have otherwise arisen from mismatching of

plan assets and benefit obligations comes from broadly diversified

investment holdings (including cash and short-term investment holdings)

and cash flows from dividends, interest and rents from diversified

investment holdings.

(g) Plan investment strategies and policies

The Company’s primary goal for the defined benefit plans is to ensure

the security of the retirement income and other benefits of the plan

members and their beneficiaries. A secondary goal of the Company is

to maximize the long-term rate of return of the defined benefit plans’

assets within a level of risk acceptable to the Company.

Risk management: The Company considers absolute risk (the risk

of contribution increases, inadequate plan surplus and unfunded obli-

gations) to be more important than relative return risk. Accordingly, the

defined benefit plans’ designs, the nature and maturity of defined benefit

obligations and characteristics of the plans’ memberships significantly

influence investment strategies and policies. The Company manages risk

through specifying allowable and prohibited investment types, setting

diversification strategies and determining target asset allocations.

Allowable and prohibited investment types: Allowable and prohibited

investment types, along with associated guidelines and limits, are

set out in each fund’s Pension Benefits Standards Act, 1985, required

Statement of Investment Policies and Procedures (SIP&P), which is

reviewed and approved annually by the designated governing fiduciary.

The SIP&P guidelines and limits are further governed by the Pension

Benefits Standards Regulations, 1985’s permitted investments and

lending limits. As well as conventional investments, each fund’s SIP&P

may provide for the use of derivative products to facilitate investment

operations and to manage risk provided that no short position is

taken, no use of leverage is made and there is no violation of guidelines

and limits established in the SIP&P. Internally managed funds are

pro-

hibited from increasing grandfathered investments in securities

of the

Company; grandfathered investments were made prior to the merger

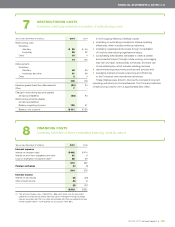

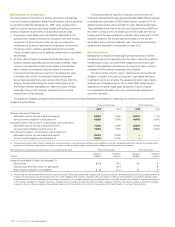

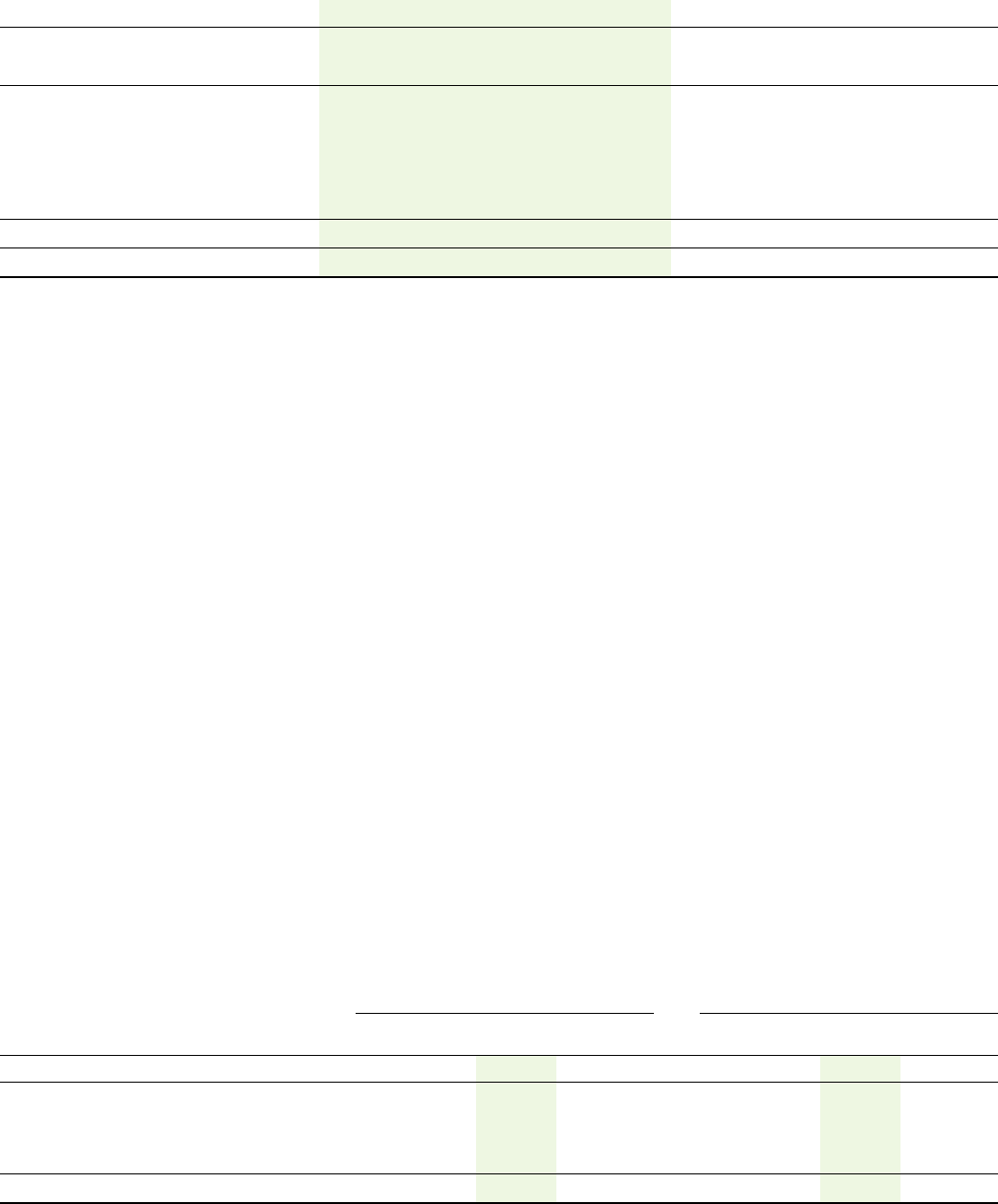

Asset allocations: Information concerning the Company’s defined benefit plans’ target asset allocation and actual asset allocation is as follows:

Pension benefit plans Other benefit plans

Target Percentage of plan assets Target Percentage of plan assets

allocation at end of year allocation at end of year

2 011 2010 2009 2 011 2010 2009

Equity securities 45–60% 56% 53% – – –

Debt securities 35–45% 38% 41% – – –

Real estate 4–8% 6% 6% – – –

Other 0–2% – – 100% 100% 100%

100% 100% 100% 100% 100%