Telus 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164 . TELUS 2010 annual report

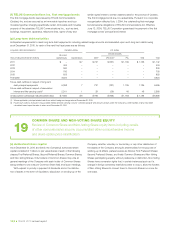

22 TRANSACTIONS WITH KEY MANAGEMENT PERSONNEL

Summary schedules and review of transactions with key management personnel

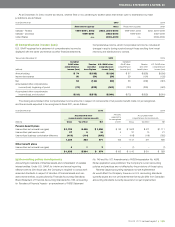

The liability amounts accrued for share-based compensation awards

to key management personnel are as follows:

As at December 31 (millions) 2010 2009

Restricted stock units $ß 7 $ß 5

Net-cash settlement feature for share options 3 2

Deferred share units(1) 18 12

$ß28 $ß19

(1) The Company’s Directors Share Option and Compensation Plan provides that, in

addition to their annual equity grant of deferred share units, a director may elect to

receive his or her annual retainer and meeting fees in deferred share units, Non-Voting

Shares or cash. Deferred share units entitle the directors to a specified number of,

or a cash payment based on the value of, TELUS’ Common Shares and Non-Voting

Shares. Deferred share units are paid out and expire when a director ceases to be

a director for any reason.

During the year ended December 31, 2010, key management per-

sonnel exercised 234,359 share options (2009 – 127,000 share options)

which had an intrinsic value of $3 million (2009 – $1 million) at the time

of exercise, reflecting a weighted average price at the date of exercise

of $42.85 (2009 – $32.57).

The Company’s key management personnel receive communications

services from the Company, which are immaterial and domestic in nature.

Employment agreements with members of the Executive Leadership

Team typically provide for severance payments if the executive’s employ-

ment is terminated without cause: 18 months (24 months for the Chief

Executive Officer and the Chief Financial Officer) of base salary, benefits

and accrual of pension service in lieu of notice and fifty per cent of base

salary in lieu of annual cash bonus (other than for the Chief Executive

Officer,

who would receive twice the average of the preceding three years’

annual cash bonus). In the event of a change in control (as defined),

the Executive Leadership Team members are not entitled to any differ-

ent treatment than other Company employees with respect to unvested

share-based compensation, other than for the Chief Executive Officer,

whose unvested share-based compensation would immediately vest.

The Company’s key management personnel have authority and

responsibility for overseeing, planning, directing and controlling the

activities of the Company and consist of the Company’s Board of

Directors and the Company’s Executive Leadership Team.

Total compensation expense for key management personnel, and

the composition thereof, for fiscal 2010 and fiscal 2009, is as follows:

For the years ended December 31 (millions) 2010 2009

Short-term benefits $ß11 $ß10

Post-employment pension and other benefits 3 3

Share-based compensation(1) 15 13

$ß29 $ß26

(1) For the year ended December 31, 2010, share-based compensation is net of $5

(2009 – inclusive of $3) of effects of derivatives used to manage share-based

compensation costs (Note 12(b)-(c)).

As disclosed in Note 12, the Company has made awards of share-

based compensation in fiscal 2010 and 2009. As most of these awards

are cliff-vesting the expense will be recognized ratably over a period of

years and thus only a portion of the fiscal 2010 and fiscal 2009 awards

are included in the amounts in the table above.

For the years ended December 31 (millions) 2010 2009

Share options awarded –

total fair value at date of grant $ß 3 $ß3

Restricted stock units awarded –

total fair value at date of grant 7 5

$ß10 $ß8

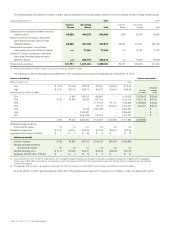

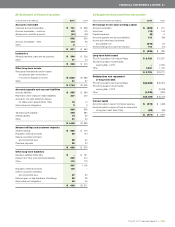

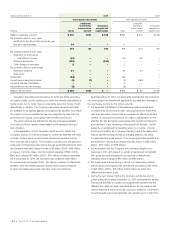

23 DIFFERENCES BETWEEN CANADIAN AND UNITED STATES

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

Summary schedules and review of differences between Canadian and United States

generally accepted accounting principles as they apply to the Company

in accordance with IFRS-IASB to U.S. GAAP. Upon the commencement

of presenting the Company’s financial statements in accordance with

IFRS-IASB in fiscal 2011, the Company currently expects that it will cease

reconciling its financial statements to U.S. GAAP.

The principles currently adopted in these financial statements

conform in all material respects to those generally accepted in the United

States except as summarized below.

The Consolidated financial statements have been prepared in

accordance with Canadian GAAP. As discussed further in Note 2,

Canadian GAAP is being converged with IFRS-IASB. The United

States Securities and Exchange Commission, effective March 4, 2008,

no longer requires certain reporting issuers, such as the Company,

to reconcile their financial statements included in their filings with the

United States Securities and Exchange Commission and prepared