Telus 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 . TELUS 2010 annual report

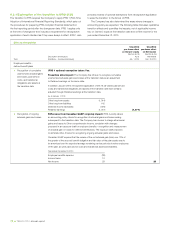

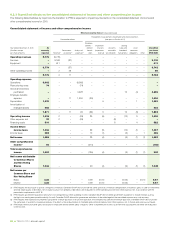

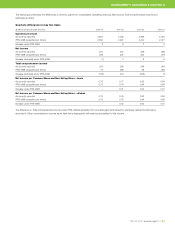

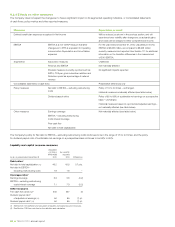

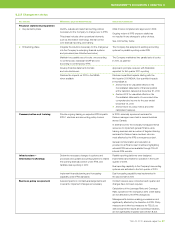

8.2.3 Quantified effects on the consolidated statement of income and other comprehensive income

The following table illustrates by topic how the transition to IFRS is expected to impact key line items on the consolidated statement of income and

other comprehensive income for 2010.

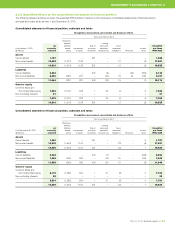

Consolidated statement of income and other comprehensive income

Effects on key line items (Increase (decrease))

Recognition, measurement, presentation and disclosure effects

Presentation effects (see topics in Section 8.2.1)

Employee

benefits – Impairment Leasing

Year ended December 31, 2010 As defined of assets Accounts (sales and Asset Unaudited

($ millions except currently Government Analysis of benefit (impairment receivable leaseback retirement pro forma

per share amounts) reported Revenue(1) assistance(2) expenses(3) plans reversal) securitization transactions) obligations Other IFRS-IASB

Operating revenues 9,779 (9,779) – – – – – – – – –

Services – 9,168 (37) – – – – – – – 9,131

Equipment – 611 – – – – – – – – 611

9,779 – (37) – – – – – – – 9,742

Other operating income – 2 48 – – – – – – – 50

9,779 2 11 – – – – – – – 9,792

Operating expenses

Operations 6,062 – – (6,062) – – – – – – –

Restructuring costs 74 – – (74) – – – – – – –

Goods and services

purchased – – – 4,228 – – – 12 (4) – 4,236

Employee benefits

expense – – 11 1,934 (39) – – – – – 1,906

Depreciation 1,333 – – – – 5 – – 1 – 1,339

Amortization of

intangible assets 402 – – – – – – – – – 402

7,871 – 11 26 (39) 5 – 12 (3) – 7,883

Operating income 1,908 2 – (26) 39 (5) – (12) 3 – 1,909

Other expense, net 32 2 – (26) – – (8) – – – –

Financing costs 510 – – – – – 8 – 4 – 522

Income before

income taxes 1,366 – – – 39 (5) – (12) (1) – 1,387

Income taxes 328 – – – 10 (1) – (3) – 1 335

Net income 1,038 – – – 29 (4) – (9) (1) (1) 1,052

Other comprehensive

income(4) 54 – – – (214) – – – – – (160)

Total comprehensive

income 1,092 – – – (185) (4) – (9) (1) (1) 892

Net income attributable

to Common Shares

and Non-Voting

Shares 1,034 – – – 29 (4) – (9) (1) (1) 1,048

Net income per

Common Share and

Non-Voting Share

Basic 3.23 – – – 0.09 (0.01) – (0.03) – (0.01) 3.27

Diluted 3.22 – – – 0.09 (0.01) – (0.03) – – 3.27

(1) IFRS requires the disclosure of specific categories of revenue. Canadian GAAP did not provide the same specificity of revenue categorization. In addition, gains on sale of investments

and real estate assets of $4 million, net of equity losses in non-affiliates of $2 million, are reclassified to Other operating income from Other expense, net, in accordance with the

presentation requirements of IAS 18.

(2) IFRS requires government assistance amounts to be categorized as Other operating income. Canadian GAAP did not define government assistance to include receipts such as

the high-cost serving area portable subsidy. As well, Canadian GAAP allowed for government assistance to be netted against the associated expense as a cost recovery.

(3) IFRS requires that expenses be presented using either a nature approach or a function approach; the Company has selected the nature approach. Canadian GAAP did not provide

the same level of specificity of expense analysis. One effect is the reclassification of charitable and political donations from Other expense, net, to Goods and services purchased.

(4) IFRS impact reflects actuarial gains and losses for employee defined benefit plans charged to Other comprehensive income, as an item that subsequently will never be reclassified

to Net income.