Telus 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 57

include a $52 million loss on early redemption of approximately 45%

of the principal amount of 8% U.S. dollar Notes (maturity June 2011)

and unwinding of related cross currency interest rate swaps. Similarly,

financing costs in the fourth quarter of 2009 include a $99 million

loss for a similar early partial redemption of these Notes. Each partial

redemption was financed with a new 10-year, $1 billion 5.05% Note

issue (see discussion in Section 7.3).

The trends in Net income and earnings per share (EPS) reflect the

items noted above, as well as adjustments arising from legislated income

tax changes, settlements and tax reassessments for prior years, includ-

ing any related interest on reassessments. The information presented

below for 2009 has been revised from that reported in fiscal 2009, and

now excludes investment tax credits.

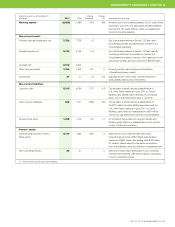

expense in the fourth quarter of 2009 resulted from growth in capital

assets in service, including the wireless HSPA+ network launched

in November 2009.

The increase in Amortization of intangible assets in 2010 resulted

from implementation of HSPA+ services in November 2009. Offsetting

this in the second quarter of 2010 was a reduction of approximately

$5 million for investment tax credits (ITCs) following determination

of eligibility by taxation authorities, for assets capitalized in prior years

that are now fully amortized. Similarly, ITCs reduced amortization

by approximately $10 million in the fourth quarter of 2009.

Financing costs for each period shown are also net of varying amounts

of interest income, including interest from the settlement of prior years’

income tax-related matters. Financing costs in the third quarter of 2010

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

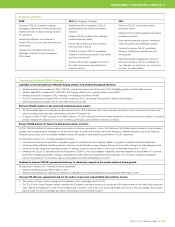

Income tax-related adjustments

($ in millions, except EPS amounts) 2010 Q4 2010 Q3 2010 Q2 2010 Q1 2009 Q4 2009 Q3 2009 Q2 2009 Q1

Approximate Net

income impact 10 9 10 1 71 14 18 62

Approximate EPS impact 0.03 0.03 0.03 – 0.23 0.04 0.06 0.19

Approximate basic EPS

excluding income

tax-related impacts 0.67 0.74 0.89 0.84 0.26 0.84 0.71 0.82

offset by changes in other income tax items. Excluding favourable

income tax-related adjustments, charges for the early partial redemption

of U.S. dollar Notes and termination of related cross currency interest

rate swaps, underlying Net income increased by $63 million in the fourth

quarter when compared to the same period in 2009, as shown below.

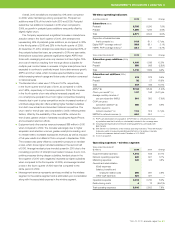

Analysis of Net income

Quarters ended December 31

($ millions) 2010 2009 Change

Net income 227 156 71

Add back after-tax loss

on redemption of debt – 69 (69)

Deduct net favourable income

tax-related adjustments,

including related interest income (10) (71) 61

Net income before above items

(approximate) 217 154 63

Cash provided by operating activities increased by $72 million in

the fourth quarter of 2010 when compared to the same period in 2009.

The increase reflects higher income tax recoveries and lower interest

payments, partly offset by a comparative reduction in cash flow received

from securitized accounts receivable.

Cash used by investing activities increased by $46 million in the

fourth quarter of 2010 when compared to the same period in 2009,

reflecting increased capital expenditures for efficiency initiatives.

Cash used by financing activities increased by $66 million in the

fourth quarter of 2010 when compared to the same period in 2009,

principally due to refinancing activities and debt reduction since

December 2009.

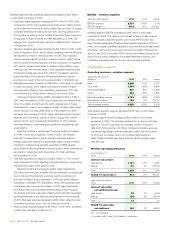

Fourth quarter

Management’s review of operations contained in TELUS’ fourth quarter

news release on February 11, 2011, discussed fourth quarter results in

detail. The following summarizes fourth quarter operating results in 2010,

as compared to 2009.

Consolidated Operating revenues increased by $108 million in the

fourth quarter of 2010 when compared to the same period in 2009.

Wireless network revenue increased year-over-year by $97 million due

to growth in data revenue driven by increasing smartphone adoption,

partly offset by declining voice ARPU. Wireless equipment and other

revenue increased year-over-year by $16 million due to increased acqui-

sition and retention volumes, and sales of accessories. Wireline segment

data revenue increased year-over-year by $37 million due to growth

in TELUS TV, enhanced data and Internet services and managed work-

place revenues. However, wireline data revenue growth was more than

offset by year-over-year declines in legacy voice and other revenues

totalling $42 million.

Operating income increased by $56 million in the fourth quarter

of 2010 when compared to the same period in 2009, mainly due to a

$58 million increase in EBITDA, slightly offset by increased amortiza-

tion expenses. Wireless EBITDA increased by $41 million while wireline

EBITDA increased by $17 million.

Income before income taxes increased by $183 million in the

fourth quarter of 2010 when compared to the same period in 2009.

The increase resulted primarily from higher Operating income and

lower net financing costs, including lower charges associated with the

early partial redemption of long-term debt.

Net income increased by $71 million in the fourth quarter of 2010

when compared to the same period in 2009. Higher income before

income taxes and lower blended statutory income tax rates were partly