Telus 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 127

FINANCIAL STATEMENTS & NOTES: 2–3

included in the Consolidated Statements of Income and Other Compre-

hensive Income as a component of other comprehensive income. When

there is an other than temporary decline in the value of the investment, the

carrying values of investments accounted for using the equity, available-

for-sale and cost methods are reduced to estimated fair values with such

reduction being included in the Consolidated Statements of Income and

Other Comprehensive Income as Other expense, net.

(s) Comparative amounts

Certain of the comparative amounts have been reclassified to conform to

the presentation adopted currently.

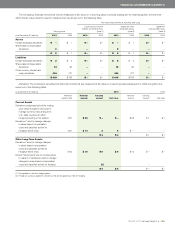

The Company accounts for its other investments as available-for-

sale at their fair values unless the investment securities do not have

quoted market prices in an active market, in which case the Company

uses the cost basis of accounting whereby investments are initially

recorded at cost and earnings from such investments are recognized

only to the extent received or receivable. The cost of investments sold

or amounts reclassified out of other comprehensive income into earnings

are determined on a specific identification basis.

Unless there is an other than temporary decline in the value of an

available-for-sale investment, carrying values for available-for-sale invest-

ments are adjusted to estimated fair values with such adjustment being

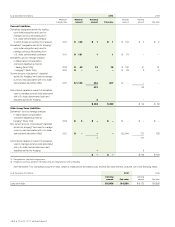

Standards as issued by the International Accounting Standards

Board (IFRS-IASB) over a transitional period to be complete by 2011.

The Company will be required to report using the converged standards

effective for interim and annual financial statements relating to fiscal

years beginning no later than on or after January 1, 2011, the date which

the Company has selected for adoption.

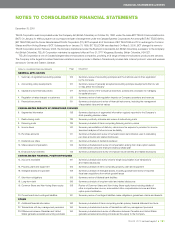

Convergence with International Financial

Reporting Standards as issued by the International

Accounting Standards Board

In 2006, Canada’s Accounting Standards Board ratified a strategic

plan that will result in Canadian GAAP, as used by publicly accountable

enterprises, being fully converged with International Financial Reporting

2ACCOUNTING POLICY DEVELOPMENTS

Summary review of generally accepted accounting principle developments

that do, will, or may, affect the Company

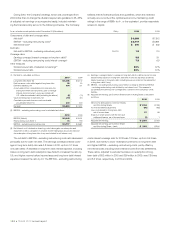

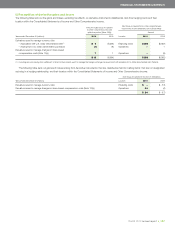

Net debt to EBITDA – excluding restructuring costs is calculated as

net debt at the end of the period divided by twelve-month trailing EBITDA

– excluding restructuring costs. Net debt is a measure that does not

have any standardized meaning prescribed by GAAP and is therefore

unlikely to be comparable to similar measures presented by other

issuers; the calculation of net debt is as set out in the following schedule.

Net debt is one component of a ratio used to determine compliance

with debt covenants. The calculation of EBITDA – excluding restructuring

costs is a measure that does not have any standardized meaning pre-

scribed by GAAP and is therefore unlikely to be comparable to similar

measures presented by other issuers; the calculation of EBITDA –

excluding restructuring costs is as set out in the following schedule.

This measure, historically, is substantially the same as the leverage

ratio covenant in the Company’s credit facilities.

The reported dividend payout ratio is calculated as the quarterly

dividend declared per Common Share and Non-Voting Share, as

recorded in the financial statements, multiplied by four and divided by

the sum of basic earnings per share for the most recent four quarters

for interim reporting periods (divided by annual basic earnings per

share for fiscal years); the reported dividend payout ratio of adjusted

net earnings differs in that it excludes: income tax-related adjustments;

the loss on redemption of long-term debt; and the ongoing impacts

of the share options with the net-cash settlement feature.

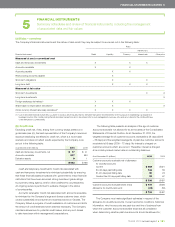

The Company’s objectives when managing capital are: (i) to maintain

a flexible capital structure that optimizes the cost of capital at acceptable

risk; and (ii) to manage capital in a manner that considers the interests

of equity and debt holders.

In the management of capital, the Company includes Common

Share and Non-Voting Share equity (excluding accumulated other com-

prehensive income), long-term debt (including any associated hedging

assets or liabilities, net of amounts recognized in accumulated other

comprehensive income), cash and temporary investments and securitized

accounts receivable in the definition of capital.

The Company manages the capital structure and makes adjustments

to it in the light of changes in economic conditions and the risk charac-

teristics of the underlying assets. In order to maintain or adjust the capital

structure, the Company may adjust the amount of dividends paid to

holders of Common Shares and Non-Voting Shares, purchase shares for

cancellation pursuant to permitted normal course issuer bids, issue new

shares, issue new debt, issue new debt to replace existing debt with

different characteristics and/or increase or decrease the amount of sales

of trade receivables to an arm’s-length securitization trust.

The Company monitors capital on a number of bases, including: net

debt to Earnings Before Interest, Taxes, Depreciation and Amortization –

excluding restructuring costs (EBITDA – excluding restructuring costs);

and dividend payout ratios.

3CAPITAL STRUCTURE FINANCIAL POLICIES

Summary review of the Company’s objectives, policies and processes

for managing its capital structure