Telus 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 139

FINANCIAL STATEMENTS & NOTES: 6–8

In 2010 ongoing efficiency initiatives include:

.simplifying or automating processes to achieve operating

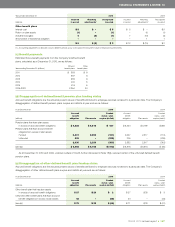

efficiencies, which includes workforce reductions;

.simplifying organizational structures through consolidation

of functions and reducing organizational layers;

.consolidating administrative real estate to create a smaller

environmental footprint through mobile working, encouraging

less inter-city travel, reduced daily commutes, and lower use

of real estate space, which includes vacating premises;

.decommissioning uneconomic products and services; and

.leveraging business process outsourcing and off-shoring

to the Company’s own international call centres.

These initiatives were aimed to improve the Company’s long-term

operating productivity and competitiveness. The Company’s estimate

of restructuring costs for 2011 is approximately $50 million.

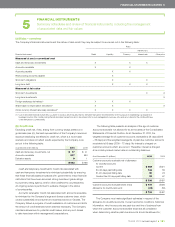

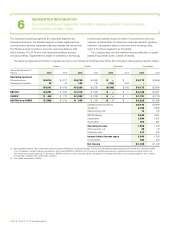

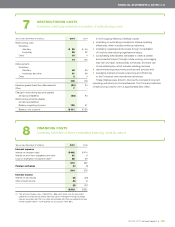

Years ended December 31 (millions) 2010 2009

Restructuring costs

Workforce

Voluntary $ß 39 $ß 94

Involuntary 25 92

Other 10 4

74 190

Disbursements

Workforce

Voluntary 42 36

Involuntary and other 61 66

Other 2 4

105 106

Expenses greater (less) than disbursements (31) 84

Other 7 –

Change in restructuring accounts payable

and accrued liabilities (24) 84

Restructuring accounts payable

and accrued liabilities

Balance, beginning of period 135 51

Balance, end of period $ß111 $ß135

7RESTRUCTURING COSTS

Summary continuity schedule and review of restructuring costs

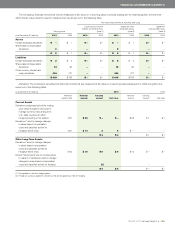

8FINANCING COSTS

Summary schedule of items comprising financing costs by nature

Years ended December 31 (millions) 2010 2009

Interest expense

Interest on long-term debt $ß442 $ß474

Interest on short-term obligations and other 21 9

Loss on redemption of long-term debt(1) 52 99

515 582

Foreign exchange (1) (3)

514 579

Interest income

Interest on tax refunds (2) (46)

Other interest income (2) (1)

(4) (47)

$ß510 $ß532

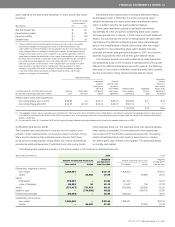

(1) This amount includes a loss of $16 (2009 – $36) which arose from the associated

settlement of financial instruments that were used to manage the foreign exchange

rate risk associated with the U.S. dollar denominated debt that was redeemed during

the third quarter (2009 – fourth quarter), as discussed in Note 18(b).