Telus 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 151

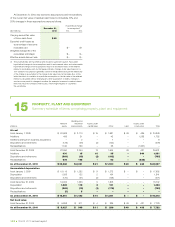

FINANCIAL STATEMENTS & NOTES: 14

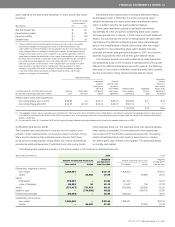

(l) Defined contribution plans

The Company’s total defined contribution pension plan costs recognized

were as follows:

Years ended December 31 (millions) 2010 2009

Union pension plan and public service

pension plan contributions $ß27 $ß30

Other defined contribution pension plans 34 31

$ß61 $ß61

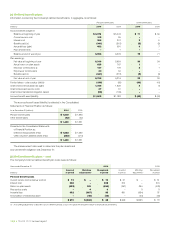

14 ACCOUNTS RECEIVABLE

Summary schedule and review of arm’s-length securitization trust transactions

and related disclosures

Cash flows from the securitization were as follows:

Years ended December 31 (millions) 2010 2009

Cumulative proceeds from securitization,

beginning of period $ 500 $ 300

Proceeds from new securitizations – 200

Securitization reduction payments (100) –

Cumulative proceeds from securitization,

end of period $ 400 $ 500

Proceeds from collections reinvested

in revolving-period securitizations $ß4,235 $ß4,060

Proceeds from collections pertaining

to retained interest $ 720 $ 780

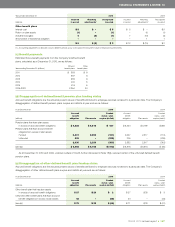

The key economic assumptions used to determine the loss on sale

of receivables, the future cash flows and fair values attributed to the

retained interest were as follows:

Years ended December 31 2010 2009

Expected credit losses as a percentage

of accounts receivable sold 1.0% 1.2%

Weighted average life of the receivables

sold (days) 34 32

Effective annual discount rate 1.2% 0.8%

Servicing 1.0% 1.0%

Generally, the sold trade receivables do not experience prepayments.

On July 26, 2002, TELUS Communications Inc., a wholly owned

subsidiary of TELUS, entered into an agreement with an arm’s-length

securitization trust associated with a major Schedule I bank under

which TELUS Communications Inc. is able to sell an interest in certain

of its trade receivables up to a maximum of $500 million (2009 –

$500 million). This revolving-period securitization agreement had an

initial term ending July 18, 2007; a November 30, 2006, amendment

resulted in the term being extended to July 18, 2008; a March 31, 2008,

amendment resulted in the term being extended to July 17, 2009;

and a May 6, 2009, amendment resulted in the term being extended

to May 6, 2012.

As a result of selling the interest in certain of the trade receivables on

a fully serviced basis, a servicing liability is recognized on the date of sale

and is, in turn, amortized to earnings over the expected life of the trade

receivables.

TELUS Communications Inc. is required to maintain at least a BBB

(low) credit rating by Dominion Bond Rating Service or the securitization

trust may require the sale program to be wound down prior to the end

of the term.

As at December 31 (millions) 2010 2009

Total managed portfolio $ß1,322 $ß1,201

Securitized receivables (465) (598)

Retained interest in receivables sold 60 91

Receivables held $ 917 $ 694

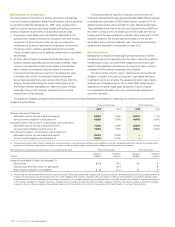

For the year ended December 31, 2010, the Company recognized

composite losses of $8 million (2009 – $11 million) on the sale of

receivables arising from the securitization.