Telus 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 41

MANAGEMENT’S DISCUSSION & ANALYSIS: 1

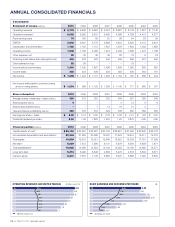

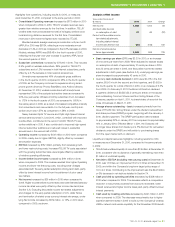

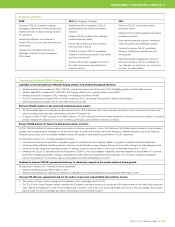

Analysis of Net income

Years ended December 31

($ millions) 2010 2009 Change

Net income 1,038 1,002 36

Add back after-tax loss

on redemption of debt 37 69 (32)

Deduct net favourable income

tax-related adjustments,

including related interest

income (see Section 5.2) (30) (165) 135

Net income before above

items (approximate) 1,045 906 139

.Basic earnings per share (EPS) was $3.23 in 2010, or an increase

of nine cents per share from 2009. When adjusted to exclude losses

on redemption of debt of approximately 12 cents per share in 2010

and 22 cents per share in 2009, and favourable income tax-related

adjustments in both years (see Section 5.2), underlying earnings per

share increased by approximately 42 cents in 2010.

.Quarterly cash dividends declared in 2010 were $0.475 in the first

quarter, $0.50 in both the second and third quarters, and $0.525 in

the fourth quarter for a total of $2.00 in 2010, or an increase of 5.3%

from 2009. On February 8, 2011, the Board of Directors declared

a quarterly dividend of $0.525 (52.5 cents per share) on the issued

and outstanding Common Shares and Non-Voting Shares of the

Company, payable on April 1, 2011, to shareholders of record at the

close of business on March 11, 2011.

.Average shares outstanding – basic increased primarily from the

issue of TELUS Non-Voting Shares under the dividend reinvestment

and share purchase (DRISP) program, beginning with the January 4,

2010, dividend payment. The DRISP participation rate increased

to approximately 32% in January 2011 as compared to approximately

14% in January 2010. Effective March 1, 2011, the Company will

no longer issue shares from treasury at a 3% discount for reinvested

dividends under the DRISP, and will switch to purchasing shares

from the open market with no discount.

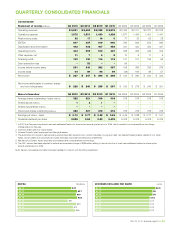

Liquidity and capital resources highlights, including results for 2010,

or measures as at December 31, 2010, compared to the same periods

in 2009:

.TELUS had unutilized liquidity of more than $1.9 billion at December 31,

2010, consistent with its objective of generally maintaining more than

$1 billion of unutilized liquidity.

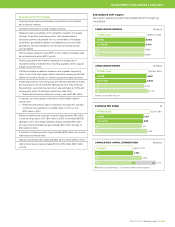

.Net debt to EBITDA (excluding restructuring costs) at December 31,

2010, was 1.8 times, an improvement from 2.0 times at December 31,

2009, and within the Company’s long-term target policy range of

1.5 to 2.0 times. Contributing to the improvement was the $443 million

or 6% decrease in net debt as detailed in Section 7.4.

.Cash provided by operating activities decreased by $358 million in

2010 when compared to 2009. The decrease reflects a comparative

reduction in securitized proceeds from accounts receivable, lower

interest received and higher income taxes paid, partly offset by lower

interest payments.

.Cash used by investing activities decreased by $421 million in 2010

when compared to 2009. The decrease was primarily due to higher

capital investment levels in 2009 to build out the Company’s wireless

HSPA+ network and service capability for the November 2009 launch.

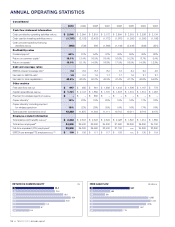

Highlights from operations, including results for 2010, or measures

as at December 31, 2010, compared to the same periods in 2009:

.Consolidated Operating revenues increased by $173 million in 2010

when compared to 2009. In 2010, TELUS’ wireless revenues were

greater than wireline revenues for the first time. In addition, TELUS’

wireline data revenue exceeded the total of its legacy wireline voice

local and long distance revenues for the first time. Consolidated

revenues in 2010 were the highest ever recorded by TELUS.

Blended wireless average revenue per subscriber unit per month

(ARPU) for 2010 was $57.64, reflecting a more moderate annual

decrease of 1.4% in 2010 as compared to the 6.8% decrease in 2009.

Notably, wireless ARPU was $58.48 in the fourth quarter of 2010,

reflecting the first year-over-year increase in quarterly ARPU since

the second quarter of 2007.

.Subscriber connections increased by 378,000 in 2010. This includes

6.9% growth in wireless subscribers, 85% growth in TELUS TV

subscribers and a 1.2% increase in total Internet subscribers, partly

offset by a 5.7% decrease in total network access lines.

Smartphones represented 46% of postpaid gross additions

in the fourth quarter of 2010, compared to 25% in the fourth quarter

of 2009, as the Company continued to experience strong smart-

phone growth driven by iPhone, BlackBerry and Android devices.

At December 31, 2010, wireless subscribers with smartphones

represented 33% of the postpaid subscriber base as compared to

20% one year earlier. Wireless monthly subscriber churn increased

to 1.72% in the fourth quarter of 2010, as compared to 1.60% in

the same period in 2009, as a result of increased competitive intensity

from incumbents and new entrants. For the full year, monthly sub-

scriber churn was 1.57% as compared to 1.58% in 2009.

Newly branded Optik TV service and Optik High Speed Internet

service were launched in June 2010, which, combined with improved

bundle offers, contributed to the record 144,000 TELUS TV sub-

scriber additions in 2010. It also contributed to improved high-speed

Internet subscriber additions and reduced losses in residential

access lines in the second half of 2010.

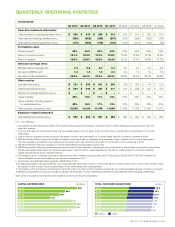

.Operating income increased by $139 million in 2010 when compared

to 2009, mainly due to higher EBITDA, slightly offset by increased

amortization expenses.

.EBITDA increased by $152 million primarily from wireless growth

and lower restructuring costs. Increased TELUS TV costs associated

with the growing subscriber base were largely offset by realization

of wireline operating efficiencies.

.Income before income taxes increased by $161 million in 2010

when compared to 2009. The increase resulted from higher Operating

income and lower net financing costs, including lower charges

associated with the early partial redemption of long-term debt, partly

offset by lower interest income from the settlement of prior years’

tax matters.

.Net income increased by $36 million in 2010 when compared to

2009. Higher income before income taxes and lower blended statutory

income tax rates were partly offset by other income tax items (see

Section 5.3). Excluding favourable income tax-related adjustments

and charges for the early partial redemption of U.S. dollar Notes

and termination of related cross currency interest rate swaps, under-

lying Net income increased by $139 million, or 15%, in 2010 when

compared to 2009, as shown.