Telus 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 . TELUS 2010 annual report

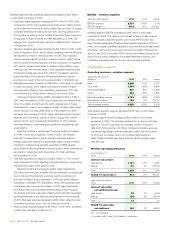

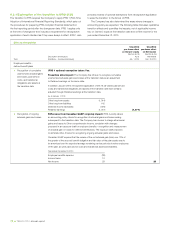

The EBITDA (excluding restructuring costs) interest coverage ratio

for 2010 was 7.3 times, up from 6.9 times in 2009, due mainly to lower

redemption premiums on long-term debt and higher EBITDA before

restructuring costs, partly offset by net interest costs including lower

interest income from tax settlements. The ratios, adjusted to exclude

losses on redemption of debt of $52 million in 2010 and $99 million

in 2009, were 7.8 times and 8.5 times, respectively, in 2010 and 2009.

Free cash flow (FCF) increased by $462 million in 2010 when

compared to 2009. The increase resulted mainly from lower capital

expenditures, higher EBITDA excluding restructuring costs and

lower interest paid, partly offset by higher income tax payments and

lower interest received on the settlement of prior years’ tax matters.

See FCF details in Section 11.2.

10

09

08

NET DEBT TO EBITDA

10 1.8

2.0

1. 9

09

08

08

EBITDA excludes restructuring costs.

10

09

08

07

EBITDA (EXCLUDING RESTRUCTURING COSTS)

INTEREST COVERAGE

10 7.3

6.9

8.3

09

08

08

Excluding losses on debt redemption of $99 million in 2009 and $52 million in 2010,

the ratio in 2009 was 8.5 times and the ratio in 2010 was 7.8 times.

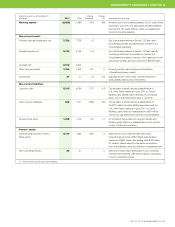

The Company’s strategy is to maintain the financial policies and

guidelines set out below. The Company believes that these measures

are currently at the optimal level and by maintaining credit ratings

in the range of BBB+ to A–, or the equivalent, are expected to provide

reasonable access to capital markets.

TELUS’ long-term financial policies and guidelines are:

.Net debt to EBITDA – excluding restructuring costs of 1.5 to 2.0 times

The ratio at December 31, 2010 was 1.8 times.

.Dividend payout ratio target guideline of 55 to 65% of sustainable

net earnings

The target guideline is on a prospective basis, rather than on a trailing

basis. The current guideline was approved by the Board on May 4,

2010, and signals management and Board confidence in the outlook

of the Company. The previous guideline was 45 to 55%.

7.4 Liquidity and capital resource measures

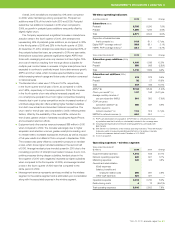

As at, or years ended,

December 31 2010 2009 Change

Components of debt and

coverage ratios(1) ($ millions)

Net debt 6,869 7,312 (443)

Total capitalization – book value 15,088 14,959 129

EBITDA – excluding

restructuring costs 3,717 3,681 36

Net interest cost 510 532 (22)

Debt ratios

Fixed-rate debt as a proportion

of total indebtedness (%) 93 87 6 pts.

Average term to maturity

of debt (years) 5.7 5.0 0.7

Net debt to total

capitalization (%)(1)(2) 45.5 48.9 (3.4) pts.

Net debt to EBITDA – excluding

restructuring costs(1)(2) 1.8 2.0 (0.2)

Coverage ratios (times)(1)(2)

Earnings coverage 3.8 3.1 0.7

EBITDA – excluding restructuring

costs interest coverage 7.3 6.9 0.4

Other measures(2)

Free cash flow ($ millions)(3) 947 485 462

Dividend payout ratio(1)

of adjusted net earnings (%) 65 67 (2) pts.

Dividend payout ratio(1) (%) 65 61 4 pts.

(1) See Section 11.4 Definition and calculation of liquidity and capital resource measures.

(2) See Section 8.2.4 for pro forma differences in measures under IFRS for fiscal 2010.

(3) See Section 11.2 Free cash flow for the definition and calculation.

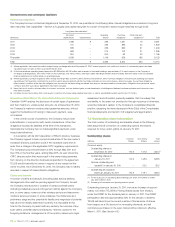

The decrease in Net debt at December 31, 2010, as compared to

one year earlier, includes maturity and repayment of $80 million of long-

term debt in 2010, a reduction in commercial paper, reduced proceeds

from securitized accounts receivable and partial redemption of U.S.

dollar Notes in September 2010, offset by a Note issue in July 2010.

The $129 million increase in total capitalization resulted from increased

retained earnings and Non-Voting Share capital, partly offset by

lower net debt.

The proportion of debt on a fixed-rate basis was 93% at December 31,

2010, up from 87% one year earlier primarily due to lower outstanding

commercial paper. The average term to maturity of debt was 5.7 years

at December 31, 2010, up from 5.0 years at December 31, 2009, primarily

due to the 10-year Note issue in July 2010 and the early partial redemp-

tion in September 2010 of U.S. dollar Notes due June 1, 2011.

The earnings coverage ratio was 3.8 times in 2010, up from 3.1 times

in 2009. A decrease in long-term interest expense, including losses on

long-term debt redemption, increased the ratio by 0.6, and higher income

before income taxes and long-term interest expense increased the

ratio by 0.1.