Telus 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 131

FINANCIAL STATEMENTS & NOTES: 5

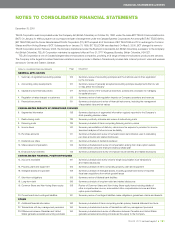

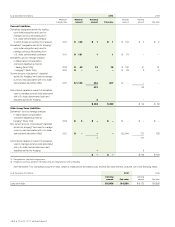

(a) Risks – overview

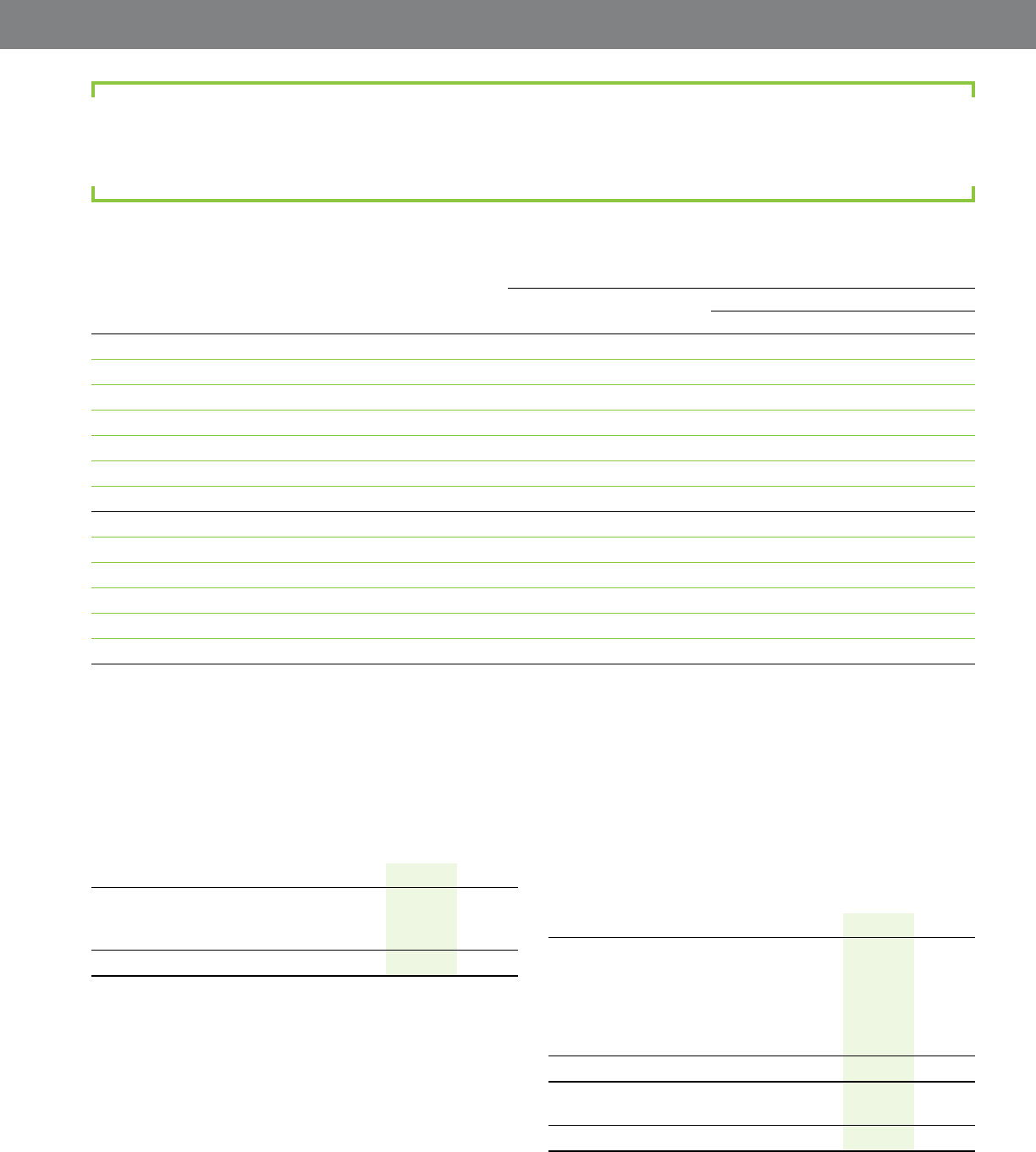

The Company’s financial instruments and the nature of risks which they may be subject to are as set out in the following table:

Risks

Market risks

Financial instrument Credit Liquidity Currency Interest rate Other price

Measured at cost or amortized cost

Cash and temporary investments X X X

Accounts receivable X X

Accounts payable X X

Restructuring accounts payable X

Short-term obligations X X

Long-term debt X X X

Measured at fair value

Short-term investments X X

Long-term investments X

Foreign exchange derivatives(1) X X X

Share-based compensation derivatives(1) X X X

Cross currency interest rate swap derivatives(1) X X X X

(1) Use of derivative financial instruments is subject to a policy which requires that no derivative transaction be entered into for the purpose of establishing a speculative or

leveraged position (the corollary being that all derivative transactions are to be entered into for risk management purposes only) and sets criteria for the creditworthiness

of the transaction counterparties.

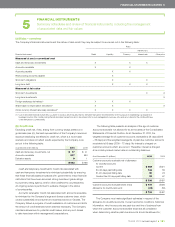

5FINANCIAL INSTRUMENTS

Summary schedules and review of financial instruments, including the management

of associated risks and fair values

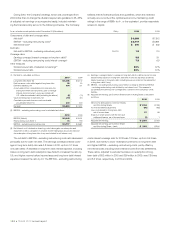

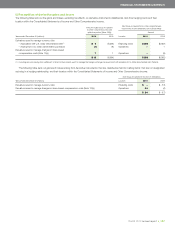

The following table presents an analysis of the age of customer

accounts receivable not allowed for as at the dates of the Consolidated

Statements of Financial Position. As at December 31, 2010, the

weighted average life of customer accounts receivable is 28 days (2009

– 35 days) and the weighted average life of past-due customer accounts

receivable is 59 days (2009 – 72 days). No interest is charged on

customer accounts which are current. Thereafter, interest is charged

at an industry-based market rate on outstanding balances.

As at December 31 (millions) 2010 2009

Customer accounts receivable net of allowance

for doubtful accounts

Current $ß489 $ß321

30–60 days past billing date 144 86

61–90 days past billing date 35 23

Greater than 90 days past billing date 32 67

$ß700 $ß497

Customer accounts receivable (Note 21(b)) $ß741 $ß556

Allowance for doubtful accounts (41) (59)

$ß700 $ß497

The Company must make significant estimates in respect of the

allowance for doubtful accounts. Current economic conditions, historical

information, why the accounts are past-due and line of business from

which the customer accounts receivable arose are all considered

when determining whether past-due accounts should be allowed for;

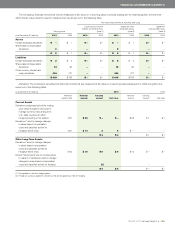

(b) Credit risk

Excluding credit risk, if any, arising from currency swaps settled on a

gross basis (see (c)), the best representation of the Company’s maximum

exposure (excluding tax effects) to credit risk, which is a worst-case

scenario and does not reflect results expected by the Company, is as

set out in the following table:

As at December 31 (millions) 2010 2009

Cash and temporary investments, net $ß 17 $ß 41

Accounts receivable 917 694

Derivative assets 9 1

$ß943 $ß736

Cash and temporary investments: Credit risk associated with

cash and temporary investments is minimized substantially by ensuring

that these financial assets are placed with: governments; major financial

institutions that have been accorded strong investment grade ratings

by a primary rating agency; and/or other creditworthy counterparties.

An ongoing review is performed to evaluate changes in the status

of counterparties.

Accounts receivable: Credit risk associated with accounts receivable

is minimized by the Company’s large and diverse customer base, which

covers substantially all consumer and business sectors in Canada. The

Company follows a program of credit evaluations of customers and limits

the amount of credit extended when deemed necessary. The Company

maintains allowances for potential credit losses, and any such losses

to date have been within management’s expectations.