Telus 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 123

Decisions’ initial four-year periods. Other than for the interest accrued

on the balance of the deferral account, which would be included in

financing costs, substantially all statement of income and other com-

prehensive income effects of the deferral account are recorded through

operating revenues.

(d) Cost of acquisition and advertising costs

Costs of acquiring customers, which include the total cost of hardware

subsidies, commissions, advertising and promotion related to the initial

customer acquisition, are expensed as incurred and are included in the

Consolidated Statements of Income and Other Comprehensive Income

as a component of Operations expense. Costs of advertising production,

airtime and space are expensed as incurred.

(e) Research and development

Research and development costs are expensed except in cases

where development costs meet certain identifiable criteria for capitaliza-

tion. Capitalized development costs are amortized over the life of the

commercial production, or in the case of serviceable property, plant

and equipment, are included in the appropriate property group and are

depreciated over its estimated useful life.

(f) Depreciation and amortization

Assets are depreciated on a straight-line basis over their estimated

useful life as determined by a continuing program of studies. Depreciation

includes amortization of assets under capital leases and amortization

of leasehold improvements. Leasehold improvements are normally amor-

tized over the lesser of their expected average service life or the term

of the lease. Intangible assets with finite lives (intangible assets subject to

amortization) are amortized on a straight-line basis over their estimated

lives; estimated lives are reviewed at least annually and are adjusted as

appropriate. The continuing program of asset life studies considers such

items as timing of technological obsolescence, competitive pressures

and future infrastructure utilization plans; such considerations could also

indicate that carrying values of assets may not be recoverable. If the

carrying values of assets were not considered recoverable, an impairment

provision (measured at the amount by which the carrying values of the

assets exceed their fair values) would be recorded.

Estimated useful lives for the majority of the Company’s property,

plant and equipment subject to depreciation are as follows:

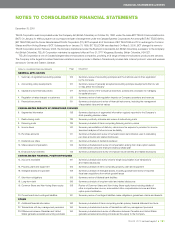

Estimated useful lives(1)

Network assets

Outside plant 17 to 40 years

Inside plant 5 to 15 years

Wireless site equipment 6.5 to 8 years

Balance of depreciable property, plant and equipment 4 to 20 years

(1) The composite depreciation rate for the year ended December 31, 2010, was 5.1%

(2009 – 5.4%). The rate is calculated by dividing depreciation expense by an average

gross book value of depreciable assets for the reporting period. A result of this

methodology is that the composite depreciation rate will be lower in a period that

has a higher proportion of fully depreciated assets remaining in use.

Estimated useful lives for the majority of the Company’s intangible

assets subject to amortization are as follows:

Estimated useful lives

Wireline subscriber base 40 years

Software 3 to 5 years

Access to rights-of-way and other 8 to 30 years

Voice local, voice long distance, data and wireless network:

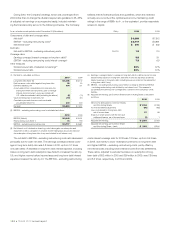

The Company recognizes revenues on the accrual basis and includes

an estimate of revenues earned but unbilled. Wireline and wireless

service revenues are recognized based upon usage of the Company’s

network and facilities and upon contract fees.

Advance billings are recorded when billing occurs prior to rendering

the associated service; such advance billings are recognized as revenue

in the period in which the services are provided. Similarly, and as appro-

priate, upfront customer activation and connection fees are deferred and

recognized over the average expected term of the customer relationship.

The Company follows the liability method of accounting for its quality

of service rate rebate amounts that arise from the jurisdiction of the CRTC.

The CRTC has established a portable subsidy mechanism to

subsidize Local Exchange Carriers, such as the Company, that provide

residential service to high cost serving areas. The CRTC has deter-

mined the per line/per band portable subsidy rate for all Local Exchange

Carriers. The Company recognizes the portable subsidy on an accrual

basis by applying the subsidy rate to the number of residential network

access lines it has in high cost serving areas, as further discussed in

Note 4(c). Differences, if any, between interim and final subsidy rates set

by the CRTC are accounted for as a change in estimate in the period

in which the CRTC finalizes the subsidy rate.

Other and wireless equipment: The Company recognizes product

revenues, including wireless handsets sold to re-sellers and customer

premises equipment, when the products are delivered and accepted by

the end-user customers. Revenues from operating leases of equipment

are recognized on a systematic and rational basis (normally a straight-line

basis) over the term of the lease.

Non-high cost serving area deferral account: On May 30, 2002,

and on July 31, 2002, the CRTC issued Decision 2002-34 and Decision

2002-43, respectively, pronouncements that affected the Company’s

wireline revenues initially for the four-year periods beginning June 1, 2002,

and August 1, 2002, respectively; subsequently the pronouncements

were extended by one year. In an effort to foster competition for residen-

tial basic service in non-high cost serving areas, the concept of a deferral

account mechanism was introduced by the CRTC, as an alternative

to mandating price reductions.

The deferral account arises from the CRTC requiring the Company

to defer the statement of income recognition of a portion of the monies

received in respect of residential basic services provided to non-high

cost serving areas. The revenue deferral was based on the rate of infla-

tion (as measured by a chain-weighted Gross Domestic Product Price

Index), less a productivity offset, and other exogenous factors that were

associated with allowed recoveries in previous price cap regimes that

have now expired. The Company may recognize the deferred amounts

upon the undertaking of qualifying actions, such as Service Improvement

Programs in qualifying non-high cost serving areas, rate reductions

(including those provided to competitors as required in Decision 2002-34

and Decision 2002-43), enhancement of accessibility to telecommunica-

tions services for individuals with disabilities and/or rebates to customers.

The deferral account balance also reflects an interest expense component

based on the Company’s applicable short-term cost of borrowing.

The Company has adopted the liability method of accounting for

the deferral account. This results in the Company recording a liability to

the extent that activities it has undertaken, realized rate reductions for

Competitor Services and other future qualifying events do not extinguish

the balance of the deferral account, as quantified in Note 21(b). This

also resulted in the Company continuing to record incremental liability

amounts, subject to reductions for the mitigating activities, during the

FINANCIAL STATEMENTS & NOTES: 1