Telus 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 59

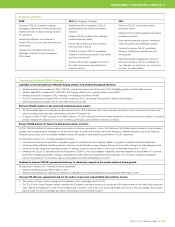

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

the redeemed Notes and $36 million for termination of the associated

cross currency interest rate swaps.

Interest income on tax refunds decreased by $44 million in 2010

when compared to 2009, as larger amounts were recognized in 2009

for settlement of prior years’ tax matters.

Income taxes

Years ended December 31

($ millions, except tax rates) 2010 2009 Change

Basic blended federal and provincial

tax at statutory income tax rates 396 366 8.2%

Revaluation of future income tax

liability to reflect future statutory

income tax rates (43) (99) –

Tax rate differential on, and

consequential adjustments from,

reassessments of prior years’

tax issues (36) (68) –

Share option award compensation 10 4 –

Other 1 – –

328 203 61.6%

Blended federal and provincial

statutory tax rates (%) 29.0 30.3 (1.3) pts.

Effective tax rates (%) 24.0 16.8 7.2 pts.

Basic blended statutory income taxes increased by $30 million in 2010

when compared to 2009, due to higher Income before income taxes,

partly offset by lower blended statutory income tax rates. The effective

tax rates were lower than the statutory tax rates due to revaluations of

future income tax liabilities and the tax rate differential and consequential

adjustments from reassessments of prior years’ tax issues. Changes to

B.C. income tax rates were enacted in the first quarter of 2009, reducing

rates beginning January 1, 2010. Changes to Ontario income tax rates

from 2010 to 2013 were enacted in the fourth quarter of 2009 for provin-

cial income taxes effective July 1, 2010 and thereafter. In addition,

enacted federal income tax rates decreased in 2010.

In 2010, the Rulings Division of Canada Revenue Agency (CRA)

advised the Company that, as a result of a detailed review of the

facts and regulatory issues concerning the acquisition of auctioned

spectrum in 2001 and 2008, CRA agreed with the Company’s filed

tax position that the spectrum acquired in both circumstances repre-

sented an amortizable asset for income tax purposes, which would

be amortized on a straight-line basis over the 10-year life of the licences.

This is expected to result in lower cash income taxes in each year

from 2011 to 2019, and does not include the impact of any future

spectrum purchases.

Share option award compensation in 2010 includes a $7 million

write-off of a future income tax asset due to the enactment of new

legislation in December 2010 that changes the tax treatment of certain

share-based compensation. Where stock option rights are acquired

by the Company in exchange for a cash payment, either the employee

must forgo his or her personal income tax deduction, which emulates

capital gains treatment, or the Company must forgo its tax deduction,

thereby eliminating the double benefit afforded to employees and

corporations. To the extent that the Company acquires the stock option

rights from employees, the Company has elected to forgo its tax

deduction for such payments.

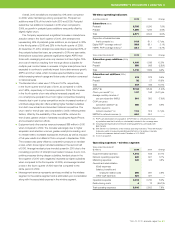

Other income statement items

Other expense, net

Years ended December 31

($ millions) 2010 2009 Change

32 32 –

Other expense, net, includes accounts receivable securitization expense,

income (losses) or impairments in equity or portfolio investments, gains

and losses on disposal of real estate, and charitable donations.

Accounts receivable securitization expenses were $8 million in 2010,

down $2 million from 2009 primarily due to lower rates. See Section 7.6

Accounts receivable sale for additional information. Charitable donations

increased by $10 million in 2010, and were largely offset by net gains

on the sale of minor investments and real estate in 2010 as compared

to net losses on minor investments in 2009.

Financing costs

Years ended December 31

($ millions) 2010 2009 Change

Interest on long-term debt,

short-term obligations and other 463 483 (4.1)%

Loss on redemption of long-term debt 52 99 (47.5)%

Interest income and foreign exchange (5) (50) –

510 532 (4.1)%

Interest on long-term debt, short-term obligations and other decreased

by $20 million in 2010 when compared to 2009 mainly due to lower

effective interest rates on long-term debt as well as a lower average debt

balance, partly offset by a $15 million financing charge in the third quarter

of 2010 that arose from the CRTC’s determinations on the regulatory

deferral account.

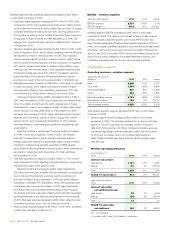

On September 2, 2010, the Company completed an early partial

redemption of U.S.$607 million of publicly traded U.S. dollar 8% Notes

due June 1, 2011, and terminated associated cross currency interest rate

swaps. The partial redemption was funded with $1 billion of new 5.05%

10-year Notes issued on July 23, 2010. The Company recorded a loss

on redemption comprised of $36 million in respect of the redeemed

Notes and $16 million for termination of the associated cross currency

interest rate swaps.

In December 2009, the Company completed an early partial

redemption of U.S.$577 million of publicly traded U.S. dollar 8% Notes

due June 1, 2011, and terminated associated cross currency interest

rate swaps. The partial redemption was funded with $1 billion of new

5.05% 10-year Notes issued on December 1, 2009. The Company

recorded a loss on redemption comprised of $63 million in respect of

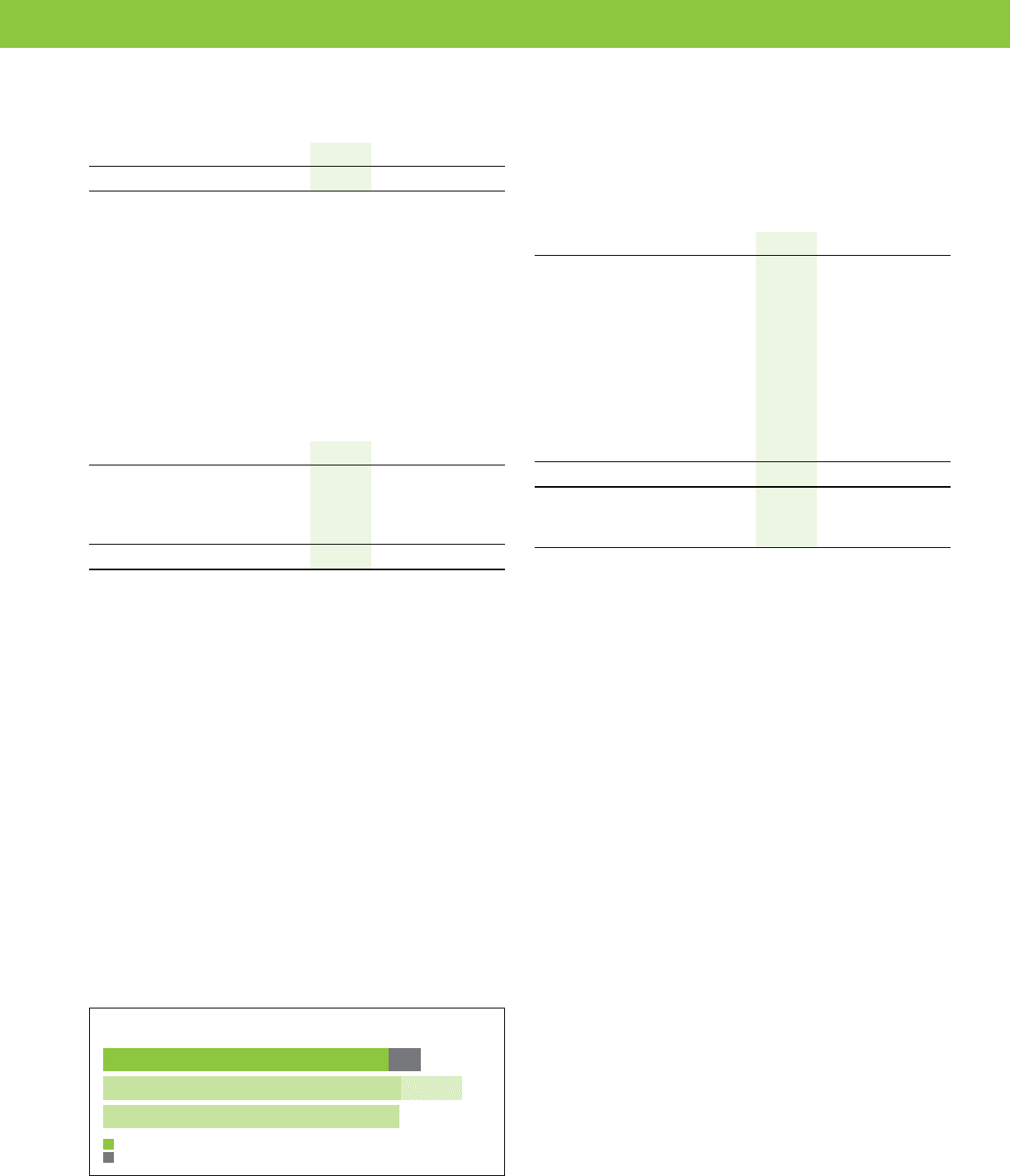

10

09

08

07

INTEREST EXPENSE ($ millions)

10 515

582

52

99

463

483

481

09

08

08

Interest expense before losses on long-term debt redemption

Losses on long-term debt redemption