Telus 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 . TELUS 2010 annual report

.the accruals for Canadian Radio-television and Telecommunications

Commission (CRTC) deferral account liabilities; and

.certain actuarial and economic assumptions used in determining

defined benefit pension costs, accrued pension benefit obligations

and pension plan assets.

Examples of significant judgements, apart from those involving

estimation, include:

.The Company’s view that substantially all the risks and rewards of

ownership of accounts receivable sold to an arm’s-length securitization

trust, as discussed further in Note 14, are transferred to the trust.

.The Company’s choice to depreciate and amortize its property,

plant, equipment and intangible assets subject to amortization on

a straight-line basis as it believes that this method better reflects the

consumption of resources related to the economic lifespan of those

assets than an accelerated method and is more representative of the

economic substance of the underlying use of those assets.

.The Company’s view that its spectrum licences granted by Industry

Canada will likely be renewed by Industry Canada; that the Company

intends to renew them; and that the Company believes it has the

financial and operational ability to renew them and, thus, they are

deemed to have an indefinite life, as discussed further in Note 16(c).

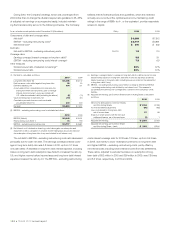

(c) Revenue recognition

The Company earns the majority of its revenue (voice local, voice

long distance, data (including data and information technology man

-

aged services) and wireless network) from access to, and usage of,

the Company’s telecommunications infrastructure. The majority of the

balance of the Company’s revenue (other and wireless equipment)

arises from providing products and services facilitating access to, and

usage of, the Company’s telecommunications infrastructure.

The Company offers complete and integrated solutions to meet its

customers’ needs. These solutions may involve the delivery of multiple

services and products occurring at different points in time and/or

over different periods of time. As appropriate, these multiple element

arrangements are separated into their component accounting units,

consideration is measured and allocated amongst the accounting units

based upon their relative fair values (derived using Company-specific

objective evidence) and then the Company’s relevant revenue recognition

policies are applied to the accounting units. Lease accounting is

applied to an accounting unit if it conveys the right to use a specific

asset to a customer.

Multiple contracts with a single customer are normally accounted

for as separate arrangements. In instances where multiple contracts are

entered into with a customer in a short period of time, they are reviewed

as a group to ensure that, similar to multiple element arrangements,

relative fair values are appropriate.

The Company’s revenues are recorded net of any value-added,

sales and/or use taxes billed to the customer concurrent with a revenue-

producing transaction.

When the Company receives no identifiable, separable benefit for

consideration given to a customer (e.g. discounts and rebates), the con-

sideration is recorded as a reduction of revenue rather than as an expense.

The accompanying consolidated financial statements have been

prepared in accordance with accounting principles generally accepted

in Canada and are expressed in Canadian dollars.

The terms TELUS or Company are used to mean TELUS Corporation

and, where the context of the narrative permits, or requires, its

subsidiaries.

(a) Consolidation

The consolidated financial statements include the accounts of the

Company and all of the Company’s subsidiaries, of which the princi-

pal one is TELUS Communications Inc. Currently, through the TELUS

Communications Company partnership and the TELE-MOBILE

COMPANY partnership, TELUS Communications Inc. includes substan-

tially all of the Company’s Wireline segment’s operations and all of the

Wireless segment’s operations.

Effective January 1, 2009, the Company early adopted the new

recommendations for business combinations (Canadian Institute of

Chartered Accountants (CICA) Handbook Section 1582), consolidations

(CICA Handbook Section 1601) and non-controlling interests (CICA

Handbook Section 1602) and did so in accordance with the transitional

provisions; the Company would otherwise have been required to

adopt the new recommendations effective January 1, 2011. During the

Company’s years ended December 31, 2010 and 2009, it was not signi-

ficantly affected by the early adoption of these recommendations.

The financing arrangements of the Company and all of its subsidiaries

do not impose restrictions on inter-corporate dividends.

On a continuing basis, TELUS Corporation reviews its corporate orga-

nization and effects changes as appropriate so as to enhance its value.

This process can, and does, affect which of the Company’s subsidiaries

are considered principal subsidiaries at any particular point in time.

(b) Use of estimates and judgements

The preparation of financial statements in conformity with generally

accepted accounting principles (GAAP) requires management to make

estimates, assumptions and judgements that affect: the reported

amounts of assets and liabilities at the date of the financial statements;

the disclosure of contingent assets and liabilities at the date of the

financial statements; and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from

those estimates.

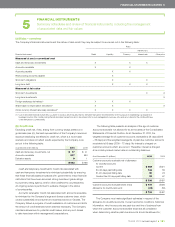

Examples of significant estimates and assumptions include:

.the key economic assumptions used to determine the fair value

of residual cash flows arising from accounts receivable securitization;

.the allowance for doubtful accounts;

.the allowance for inventory obsolescence;

.the estimated useful lives of assets;

.the recoverability of tangible assets;

.the recoverability of intangible assets with indefinite lives;

.the recoverability of goodwill;

.the recoverability of long-term investments;

.the amount and composition of income tax assets and income tax

liabilities, including the amount of unrecognized tax benefits;

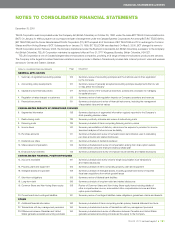

1SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Summary review of accounting principles and the methods used

in their application by the Company