Telus 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 . TELUS 2010 annual report

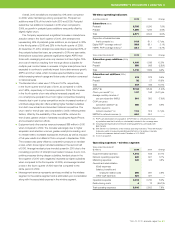

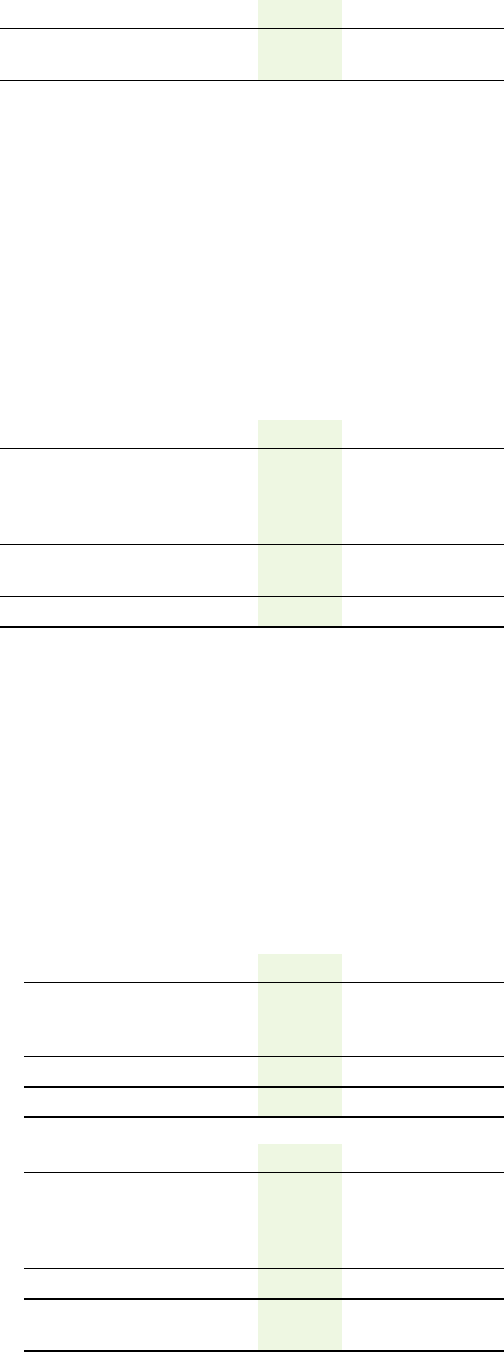

EBITDA – wireless segment

Years ended December 31 2010 2009 Change

EBITDA ($ millions) 2,031 1,933 5.1%

EBITDA margin (%) 40.2 40.8 (0.6) pts.

Wireless segment EBITDA increased by $98 million in 2010 when

compared to 2009. This reflects improvement in terms of data revenue

growth, postpaid subscriber growth, lower voice ARPU erosion and

lower bad debt expenses. Wireless margins were pressured in 2010 pri-

marily due to higher combined acquisition and retention costs associated

with higher volumes and continued smartphone adoption following the

launch in late 2009 of the new HSPA+ network and related devices such

as the iPhone, earlier availability of the latest BlackBerry devices, and

increased competitive intensity driving higher handset subsidies.

5.5 Wireline segment

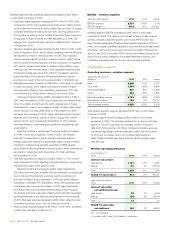

Operating revenues – wireline segment

Years ended December 31

($ millions) 2010 2009 Change

Data 2,268 2,146 5.7%

Voice local 1,684 1,856 (9.3)%

Voice long distance 530 619 (14.4)%

Other 283 278 1.8%

External operating revenue 4,765 4,899 (2.7)%

Intersegment revenue 155 134 15.7%

Total operating revenue 4,920 5,033 (2.2)%

Total wireline segment revenue decreased $113 million in 2010 when

compared to 2009.

.Wireline data revenues increased by $122 million in 2010 when

compared to 2009. The increase resulted from: (i) strong subscriber

growth in TELUS TV services; (ii) increased Internet, enhanced

data and hosting services; (iii) higher managed workplace revenues

including a high margin software application sale in the first quarter

of 2010; and to a lesser extent, (iv) increased data equipment

sales. These increases were partly offset by declining legacy basic

data services.

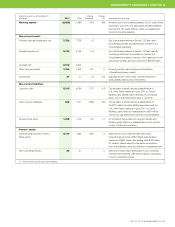

Wireline operating indicators

As at December 31

(000s) 2010 2009 Change

Internet subscribers

High-speed 1,167 1,128 3.5%

Dial-up 62 87 (28.7)%

To t a l 1,229 1,215 1.2%

TELUS TV subscribers(1) 314 170 84.7%

Years ended December 31

(000s) 2010 2009 Change

Internet subscriber

net additions (losses)

High-speed 39 37 5.4%

Dial-up (25) (37) 32.4%

To t a l 14 – n/m

TELUS TV subscriber

net additions(1) 144 92 56.5%

n/m – not meaningful.

(1) Includes Optik TV and TELUS Satellite TV subscribers.

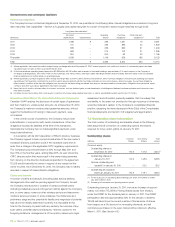

Wireless segment total operating expenses increased by $214 million

in 2010 when compared to 2009.

.Equipment sales expenses increased by $170 million in 2010 when

compared to 2009. The increase was primarily due to higher acquisi-

tion and retention volumes, as well as higher per-unit costs to support

increased smartphone loading for both new client acquisitions and

the migration of existing clients, notably including a higher proportion

of upgrades to Apple iPhones and RIM BlackBerrys. In 2010, this

category also includes full-year results from Black’s Photo, acquired

in September 2009.

.Network operating expenses increased by $19 million or 3.1% in 2010

when compared to 2009, which reflects increasing network efficiency

as indicated by network revenue growth of 5.0%. The increase in

network expense reflects growth in roaming volumes, slightly higher

revenue-share and licensing costs, and the introduction of regulated

e911 fees for wireless subscribers in Quebec, partly offset by lower

roaming costs from reduced rates. Lower negotiated revenue-share

and licensing rates were more than offset by increases in revenue-

share volumes to third parties and licensing volumes to service

providers as a result of the continued penetration of smartphones.

.Marketing expenses increased by $18 million in 2010 when compared

to 2009, principally due to higher commissions related to higher

volumes, partly offset by lower advertising expenses in 2010 due

to the initial launch of the HSPA+ network in November 2009.

COA per gross subscriber addition increased by $13 or 3.9% in

2010, when compared to 2009, due to higher per-unit subsidy costs

driven by a higher smartphone mix, and to a lesser extent higher

commissions to support an increasing number of higher-value smart-

phone devices. This was partly offset by a favourable U.S. dollar

exchange rate compared to 2009, higher advertising and promotion

expenditures in the fourth quarter of 2009 to support the HSPA+

network launch, and increased gross additions in 2010 creating

improved efficiency of advertising and promotion expenditures per

gross addition.

Retention costs as a percentage of network revenue increased

to 11.6% in 2010, as compared to 10.9% in 2009. The retention

cost ratio increased due to higher retention volumes related to

a larger subscriber base and a significantly larger volume of clients

migrating to smartphones, typically upgrades to HSPA devices,

partly offset by improving network revenue growth, lower commissions

per retention subscriber and a favourable U.S. dollar exchange

rate compared to 2009.

.Total G&A expenses increased by only $15 million, or 1.7%, in 2010

when compared to 2009, reflecting improved efficiency in supporting

the subscriber base, which grew by 6.9%.

Salaries, benefits and employee-related costs increased by

$15 million year-over-year, as higher 2010 performance bonus accruals

due to improved financial and operating results and inclusion of

a full year of Black’s Photo expenses in 2010 were partly offset by

reductions in domestic FTE employees. Other G&A expenses were

unchanged year-over-year, as inclusion of a full year of expenses

from Black’s Photo and increased external labour costs to support

the growing subscriber base were offset by lower bad debt expenses

and supplemented by one-time operating savings in the first quarter

of 2010. Bad debt expense decreased by $25 million, reflecting lower

involuntary subscriber churn from an improved economy.

.Restructuring costs decreased by $8 million in 2010 when compared

to 2009. See discussion in Section 5.3.