Telus 2010 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 165

FINANCIAL STATEMENTS & NOTES: 22–23

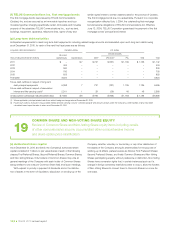

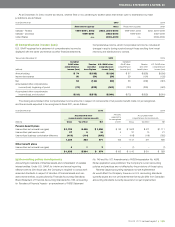

The following is an analysis of retained earnings reflecting the

application of U.S. GAAP:

Years ended December 31 (millions) 2010 2009

Balance at beginning of period $ 553 $ 227

Net income in accordance with U.S. GAAP

attributable to Common Shares

and Non-Voting Shares 958 927

1,511 1,154

Dividends (642) (601)

Balance at end of period $ 869 $ 553

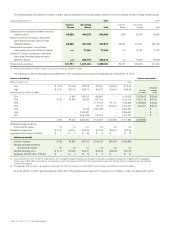

The following is an analysis of major statement of financial position

categories reflecting the application of U.S. GAAP:

As at December 31 (millions) 2010 2009

Current Assets $ß 1,390 $ß 1,127

Non-Current Assets

Property, plant and equipment 7,722 7,729

Intangible assets 6,541 6,605

Goodwill 3,974 3,974

Other assets 310 362

18,547 18,670

$ß19,937 $ß19,797

Current Liabilities $ß 3,950 $ß 2,964

Non-Current Liabilities

Long-term debt 5,340 6,120

Other long-term liabilities 838 1,413

Deferred income taxes 1,424 1,323

7,602 8,856

Total Liabilities 11,552 11,820

Owners’ Equity

Common Share and Non-Voting

Share equity 8,363 7,956

Non-controlling interests 22 21

8,385 7,977

$ß19,937 $ß19,797

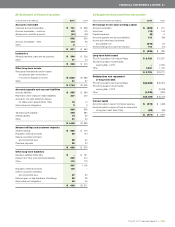

Significant differences between Canadian GAAP and U.S. GAAP

would have the following effect on reported net income of the Company:

Years ended December 31

(millions except per share amounts) 2010 2009

Net income in accordance

with Canadian GAAP $ß1,038 $ß1,002

Adjustments:

Operating expenses

Operations (b) (57) (65)

Amortization of intangible assets (c) (50) (50)

Taxes on the above adjustments

and tax rate changes (e) 31 44

Net income in accordance with U.S. GAAP 962 931

Other comprehensive income (loss),

net of taxes (f)

In accordance with Canadian GAAP 54 58

Change in pension related other

comprehensive income accounts (144) (439)

In accordance with U.S. GAAP (90) (381)

Comprehensive income in

accordance with U.S. GAAP $ 872 $ 550

Net income in accordance with U.S. GAAP

attributable to:

Common Shares and Non-Voting Shares $ 958 $ 927

Non-controlling interests 4 4

$ 962 $ 931

Comprehensive income in accordance

with U.S. GAAP attributable to:

Common Shares and Non-Voting Shares $ 868 $ 546

Non-controlling interests 4 4

$ 872 $ 550

Net income in accordance with U.S. GAAP

per Common Share and Non-Voting Share

Basic $ß 2.99 $ß 2.92

Diluted $ß 2.98 $ß 2.91

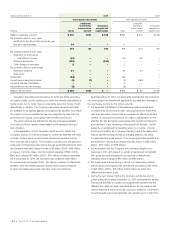

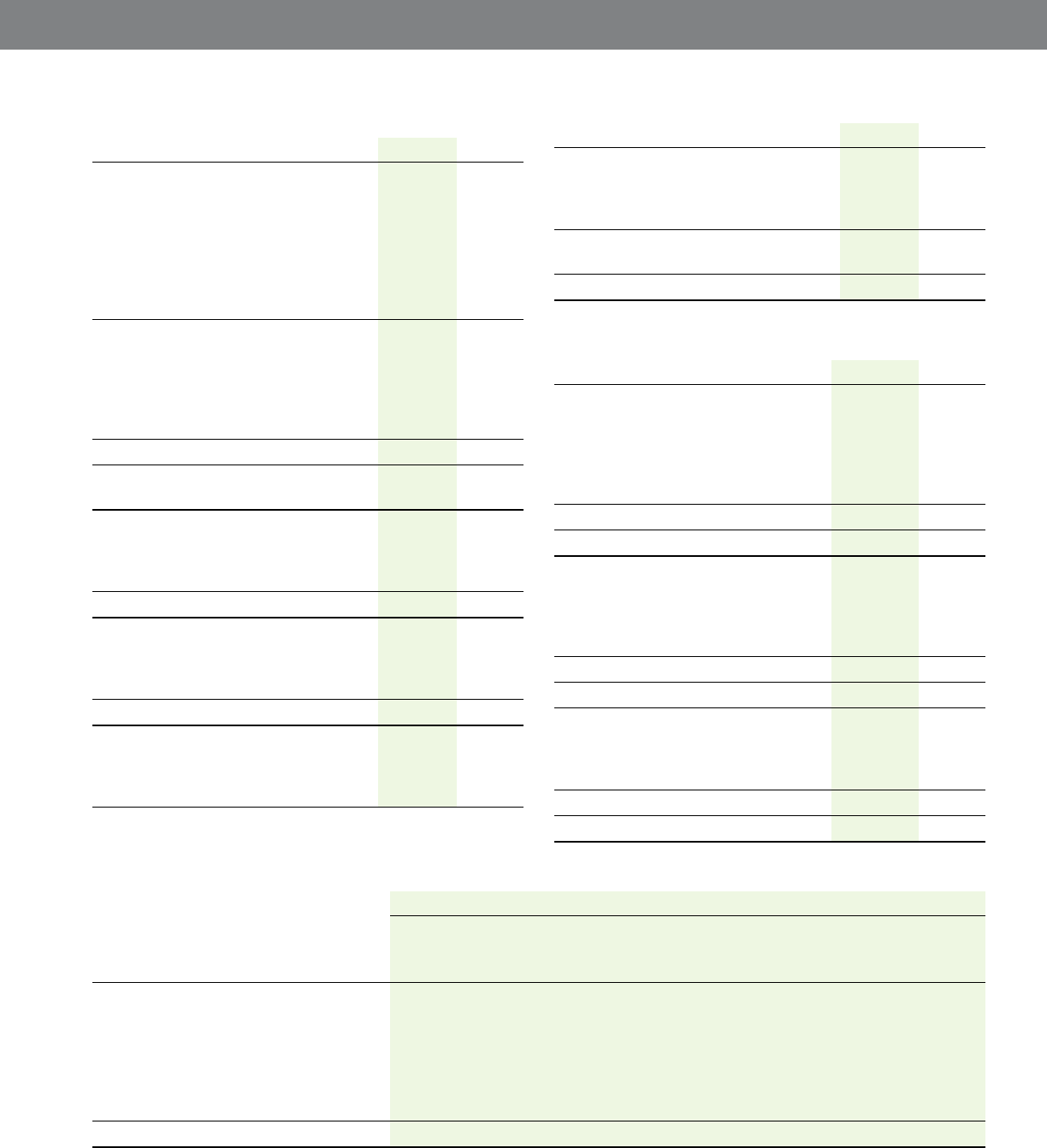

The following is a reconciliation of Common Share and Non-Voting Share equity incorporating the significant differences between Canadian

and U.S. GAAP:

Common Share and Non-Voting Share equity

Accumulated

other

Common Non-Voting Contributed Retained comprehensive

As at December 31, 2010 (millions) Shares Shares surplus earnings income (loss) Total

Under Canadian GAAP $ß2,219 $ß3,237 $ß190 $ß2,551 $ß (18) $ß8,179

Adjustments:

Merger of BC TELECOM and TELUS (a), (c), (d) 1,733 883 – (1,582) (973) 61

Share-based compensation (b) 10 60 26 (96) – –

Acquisition of Clearnet Communications Inc.

Goodwill (d) – 131 – (8) – 123

Convertible debentures – (3) (1) 4 – –

Under U.S. GAAP $ß3,962 $ß4,308 $ß215 $ 869 $ß(991) $ß8,363