Telus 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 55

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

Deloitte & Touche LLP, the Company’s auditor, has audited

internal controls over financial reporting of TELUS Corporation as

at December 31, 2010.

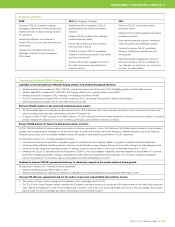

Changes in internal control over financial reporting

There were no changes in internal control over financial reporting that

have materially affected, or are reasonably likely to materially affect,

the Company’s internal control over financial reporting.

Framework, issued by the Committee of Sponsoring Organizations

of the Treadway Commission (COSO). Based on this assessment,

TELUS’ CEO and CFO have determined that the Company’s internal

control over financial reporting is effective as at December 31, 2010,

and expect to certify TELUS’ annual filings with the U.S. Securities

and Exchange Commission on Form 40-F, as required by the

United States Sarbanes-Oxley Act, and with Canadian securities

regulatory authorities.

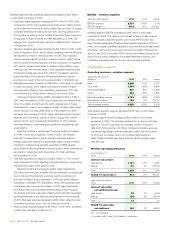

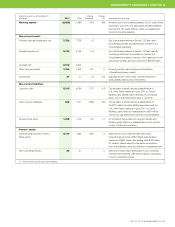

As at December 31

($ millions) 2010 2009 2008

Total assets 19,599 19,219 19,021

Current portion of long-term debt 743 82 4

Current portion of derivative liabilities 419 62 75

Non-current financial liabilities

Long-term debt 5,313 6,090 6,348

Derivative and other non-current

financial liabilities 397 1,108 1,103

5,710 7,198 7,451

Future income taxes 1,498 1,319 1,213

Owners’ equity

Common equity 8,179 7,554 7,085

Non-controlling interests 22 21 23

Differences among the three

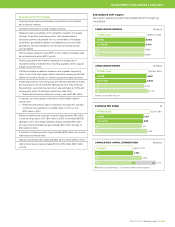

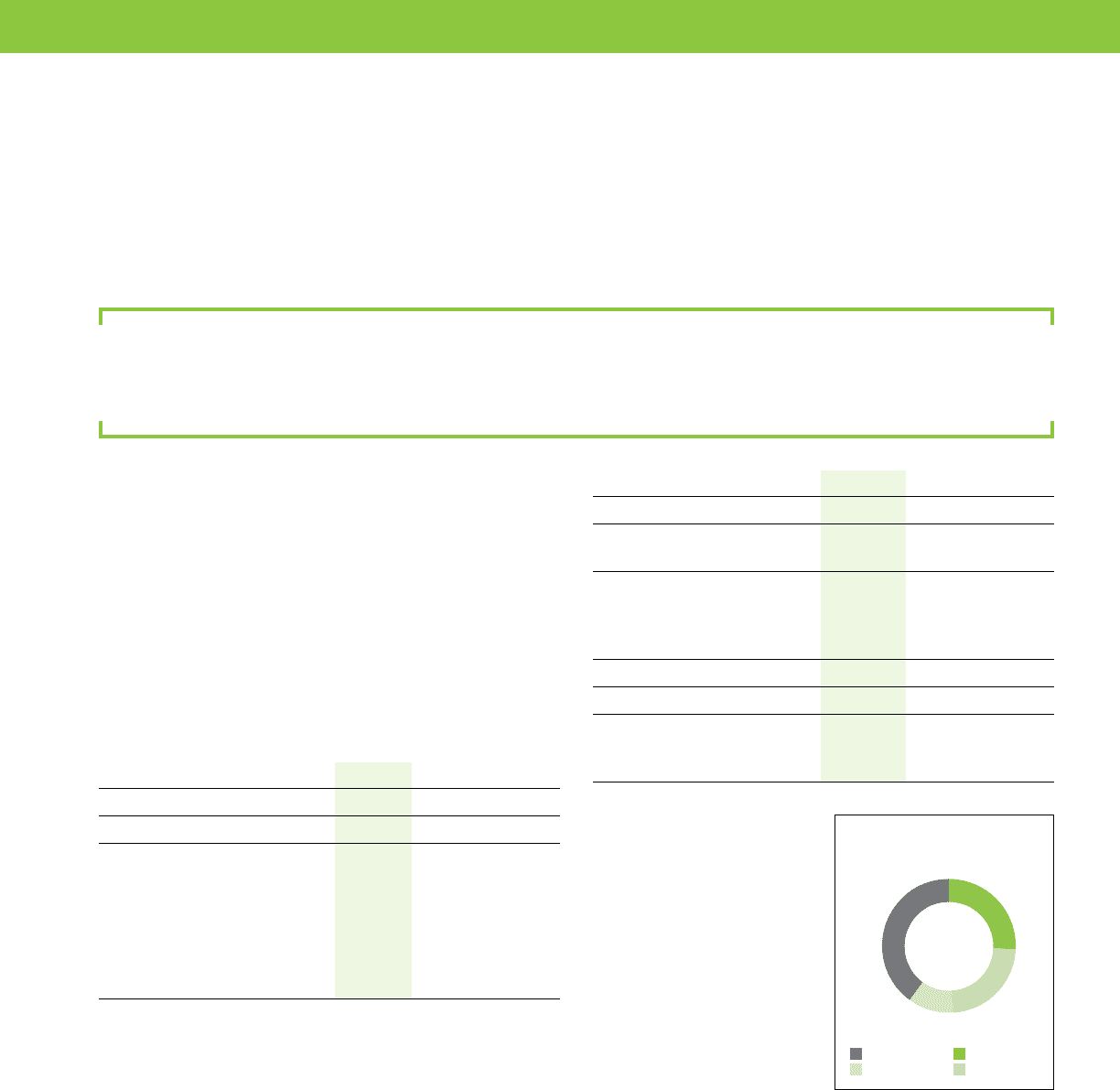

2010 REVENUE MIX –

74% WIRELESS AND DATA

wireless voice

wireless data

wireline voice

wireline data

40%

11%

26%

23%

years presented:

.Revenues increased by 1.8% in

2010 after decreasing by 0.5%

in 2009 and growing by 6% in

2008. Wireless revenue and

wireline data revenue combined

represent approximately 74% of

consolidated revenues in 2010,

as compared to 71% in 2009

and 69% in 2008. Legacy wire-

line voice revenues continue to

be eroded by competition and

technological substitution.

.Net income includes income tax-related adjustments resulting from

legislated income tax changes, settlements and tax reassessments

for prior years, including any related interest. These adjustments

positively affected Net income by approximately $30 million (nine cents

per share) in 2010, $165 million (52 cents per share) in 2009 and

$41 million (13 cents per share) in 2008.

.The decrease in Non-current financial liabilities at December 31, 2010,

is principally due to the remaining U.S. dollar Notes maturing June 1,

2011, and associated derivative liability becoming current liabilities,

as well as debt reduction during 2010. (See Section 6.)

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

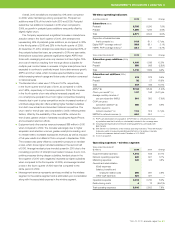

5.1 Selected annual information

The selected three-year consolidated financial information presented

as currently reported according to Canadian GAAP has been derived

from, and should be read in conjunction with, the Consolidated financial

statements of TELUS for the year ended December 31, 2010, and its

annual Consolidated financial statements for previous years. For infor-

mation on the Company’s changeover to IFRS on January 1, 2011,

and the transition effects on 2010, see Section 8.2.

Selected annual information

Years ended December 31

($ in millions, except per share amounts)

2010 2009 2008

Operating revenues 9,779 9,606 9,653

Net income 1,038 1,002 1,131

Income per Common Share

and Non-Voting Share

– basic 3.23 3.14 3.52

– diluted 3.22 3.14 3.51

Cash dividends declared

per Common Share

and Non-Voting Share 2.00 1.90 1.825

5DISCUSSION OF OPERATIONS

A detailed discussion of operating performance for 2010