Telus 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 . TELUS 2010 annual report

While the Company is exposed to credit losses due to the non-

performance of its counterparties, the Company considers the risk

of this remote. The Company’s derivative liabilities do not have

credit-risk-related contingent features.

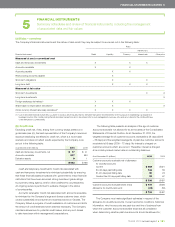

(c) Liquidity risk

As a component of the Company’s capital structure financial

policies, discussed further in Note 3, the Company manages liquidity

risk by maintaining a daily cash pooling process which enables the

Company to manage its liquidity surplus and liquidity requirements

according to the actual needs of the Company and its subsidiaries, by

maintaining bilateral bank facilities and syndicated credit facilities, by

maintaining a commercial paper program, by the sales of trade receiv-

ables to an arm’s-length securitization trust, by continuously monitoring

forecast and actual cash flows and by managing maturity profiles

of financial assets and financial liabilities. As disclosed in Note 18(g),

the Company has significant debt maturities in future years. As at

December 31, 2010, the Company has access to a shelf prospectus,

in effect until October 2011, pursuant to which it can offer $2 billion

(2009 – $3 billion) of debt or equity securities. The Company believes

that its investment grade credit ratings provide reasonable access

to capital markets.

The Company closely matches the derivative financial liability con-

tractual maturities with those of the risk exposures that they are being

used to manage.

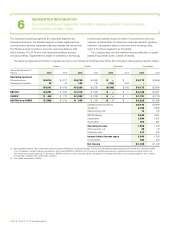

The Company’s undiscounted financial liability expected maturities

do not differ significantly from the contractual maturities. The Company’s

undiscounted financial liability contractual maturities, including interest

thereon (where applicable), are as set out in the following tables:

the same factors are considered when determining whether to write

off amounts charged to the allowance account against the customer

account receivable. The provision for doubtful accounts is calculated

on a specific-identification basis for customer accounts receivable

over a specific balance threshold and on a statistically derived allowance

basis for the remainder. No customer accounts receivable are written

off directly to the provision for doubtful accounts.

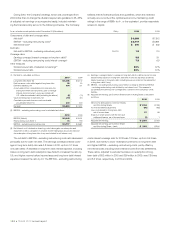

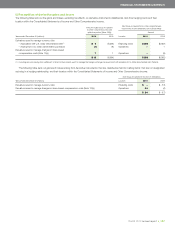

The following table presents a summary of the activity related to the

Company’s allowance for doubtful accounts.

Years ended December 31 (millions) 2010 2009

Balance, beginning of period $ß59 $ß77

Additions (provision for doubtful accounts) 49 80

Net use (67) (98)

Balance, end of period $ß41 $ß59

Aside from the normal customer accounts receivable credit risk

associated with its retained interest, the Company has no continuing

exposure to credit risk associated with its trade receivables which

are sold to an arm’s-length securitization trust, as discussed further

in Note 14.

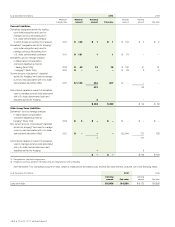

Derivative assets (and derivative liabilities): Counterparties to the

Company’s cross currency interest rate swap agreements, share-based

compensation cash-settled equity forward agreements and foreign

exchange derivatives are major financial institutions that have all been

accorded investment grade ratings by a primary rating agency. The

dollar amount of credit exposure under contracts with any one financial

institution is limited and counterparties’ credit ratings are monitored.

The Company does not give or receive collateral on swap agreements

and hedging items due to its credit rating and those of its counterparties.

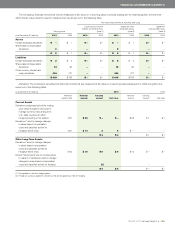

Non-derivative Derivative

Non-interest

Long-term debt (see Note 18) Other financial liabilities

As at bearing All except Currency swaps amounts Currency swaps amounts

December 31, 2010 financial capital Capital to be exchanged(2) to be exchanged

(millions) liabilities leases(1)(2) leases (Receive) Pay Other (Receive) Pay Total

2 011

First quarter $ß1,173 $ 58 $ß3 $ – $ – $ß13 $ß(116) $ß118 $ß 1,249

Balance of year 229 1,013 5 (766) 1,183 – (190) 191 1,665

2012 1 701 – – – – – – 702

2013 – 583 – – – – – – 583

2014 – 958 – – – – – – 958

2015 – 851 – – – – – – 851

Thereafter 1 4,266 – – – – – – 4,267

To t a l $ß1,404 $ß8,430 $ß8 $ß(766) $ß1,183 $ß13 $ß(306) $ß309 $ß10,275

Total (see Note 18(g)) $ß8,855

(1) Interest payment cash outflows in respect of commercial paper and amounts drawn under the Company’s credit facilities (if any) have been calculated based upon the rates in effect

as at December 31, 2010.

(2) The amounts included in the undiscounted non-derivative long-term debt in respect of the U.S. dollar denominated long-term debt, and the corresponding amounts included in the

long-term debt currency swaps receive column, have been determined based upon the rates in effect as at December 31, 2010. The U.S. dollar denominated long-term debt contractual

maturity amounts, in effect, are reflected in the long-term debt currency swaps pay column as gross cash flows are exchanged pursuant to the cross currency interest rate swap

agreements (see Note 18(b)).