Telus 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 113

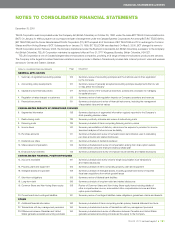

FINANCIAL STATEMENTS & NOTES: X

Consolidated financial statements contained in this report were being

prepared. In addition, the Chief Executive Officer and the Chief Financial

Officer have also evaluated the design and operating effectiveness of

the Company’s internal control over financial reporting as explained in the

following report entitled Report of Management on Internal Control over

Financial Reporting.

The Board of Directors has reviewed and approved these

Consolidated financial statements. To assist the Board in meeting its

oversight responsibilities, it has appointed an Audit Committee, which

is comprised entirely of independent directors. All the members of

the committee are financially literate and the Chair of the committee has

financial expertise and meets the applicable securities law requirements

as a financial expert. The committee oversees the Company’s accounting

and financial reporting, internal controls and disclosure controls, legal

and regulatory compliance, ethics policy and timeliness of filings with

regulatory authorities, independence and performance of the Company’s

external and internal auditors, management of the Company’s risks, its

creditworthiness, treasury plans and financial policy, and whistleblower

and accounting and ethics complaint procedures. The committee meets

no less than quarterly and, as a standard feature of regularly scheduled

meetings, holds an in-camera session with the external auditors and

separately has the opportunity to meet with the internal auditor without

other management, including management directors, present. It over-

sees the work of the external auditors and approves the annual audit plan.

It also receives reports on the external auditor’s internal quality control

procedures and independence. Furthermore, the Audit Committee reviews:

the Company’s major accounting policies including alternatives and

potential key management estimates and judgements; the Company’s

financial policies and compliance with such policies; the evaluation by

the internal auditors of management’s internal control systems; and the

evaluation by management of the adequacy and effectiveness of the

design and operation of the Company’s disclosure controls and internal

controls over financial reporting. The Audit Committee also considers

reports on the Company’s business continuity and disaster recovery

plan; reports on financial risk management including derivatives exposure

and policies; tax planning, environmental, health and safety risk man-

agement, corporate social responsibility and management’s approach for

safeguarding corporate assets; an annual review of the Chair of Board

of Directors, Chief Executive Officer and Executive Leadership Team

expenses and their use of corporate assets; and regularly reviews mate-

rial

capital expenditure initiatives. The committee pre-approves all audit,

audit-related and non-audit services provided to the Company by the

external auditor (and its affiliates). The committee’s terms of reference

are available, on request, to shareholders and at telus.com/governance.

Robert G. McFarlane Darren Entwistle

Executive Vice-President President

and Chief Financial Officer and Chief Executive Officer

February 24, 2011 February 24, 2011

Management is responsible to the Board of Directors for the preparation

of the Consolidated financial statements of the Company and its sub-

sidiaries. These financial statements have been prepared in accordance

with Canadian generally accepted accounting principles and necessarily

include some amounts based on estimates and judgements.

The Company maintains a system of internal controls that provides

management with reasonable assurance that assets are safeguarded

and that reliable financial records are maintained. This system includes

written policies and procedures, an organizational structure that seg-

regates duties and a comprehensive program of periodic audits by the

internal auditors. The Company has also instituted policies and guide-

lines that require TELUS team members (including Board members and

Company employees) to maintain the highest ethical standards, and has

established mechanisms for the reporting to the Audit Committee of

accounting and ethics policy complaints. In addition, the Chief Compliance

Officer works to ensure the Company has appropriate policies, controls

and measurements in place to facilitate compliance with all legal and

regulatory requirements. Annually, the Company performs an extensive

risk assessment process (updated quarterly), which includes interviews

with senior management, a web-enabled risk and control assessment

survey distributed to a large sample of employees, a survey of the

TELUS

Board and input from the Company’s strategic planning activities.

Included in this process are the identification and prioritization of key

enterprise risks, the assessment of risk appetite and tolerance by risk

category, and the assessment of the perceptions of the strength of

the internal control environment. Results of this process influence the

development of the internal audit program, which is reviewed with

and approved by the Audit Committee. Key enterprise-wide risks are

assigned to executive owners for risk mitigation responsibility.

As required by Canadian securities regulations and the United

States Sarbanes-Oxley Act, the Company has an effective and efficient

Sarbanes-Oxley certification enablement process. In addition to assess-

ing disclosure controls and procedures and internal control over financial

reporting, this process cascades informative certifications from the

key stakeholders, which are reviewed by the Chief Executive Officer

and the Chief Financial Officer as part of their due diligence process.

The Company performs an annual fraud risk assessment that further

informs their assessment of the internal control environment.

The Company has a formal policy on Corporate Disclosure and

Confidentiality of Information, which sets out policies and practices

including the mandate of the Disclosure Committee.

The Chief Executive Officer and the Chief Financial Officer have

evaluated the effectiveness of the Company’s disclosure controls and

procedures related to the preparation of the Management’s discus-

sion and analysis and the Consolidated financial statements, as well

as other information contained in this report. They have concluded

that the Company’s disclosure controls and procedures were effective,

at a reasonable assurance level, to ensure that material information

relating to the Company and its consolidated subsidiaries would be

made known to them by others within those entities, particularly during

the period in which the Management’s discussion and analysis and the

FINANCIAL STATEMENTS & NOTES

MANAGEMENT’S REPORT