Telus 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 77

This section discusses the Company’s expectations regarding the

changeover to IFRS-IASB. The term IFRS used in this MD&A is an

abbreviation of IFRS-IASB.

There can be no guarantee that the International Accounting

Standards Board will not make further pronouncements, and that the

Canadian Accounting Standards Board will also not adopt further

pronouncements, before the Consolidated financial statements as at

December 31, 2011, are prepared. Consequently, there can be no

guarantee that the standards used to prepare information in this Section

will not differ from those used to prepare the Consolidated financial

statements for the year ended December 31, 2011, and that the effects

described and quantified below will not change.

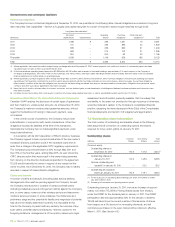

Key dates

.January 1, 2010 (transition date): An opening statement of financial

position according to IFRS was prepared, as at this date, to facilitate

the changeover to IFRS reporting in 2011. TELUS reported its fiscal

2010 and comparative 2009 results according to Canadian GAAP.

.January 1, 2011 (changeover date): The date after which TELUS

will prepare and report interim and annual 2011 financial statements

with 2010 comparatives according to IFRS.

As activities consistent with Canadian GAAP being converged

with IFRS-IASB, the Company previously adopted new recommendations

for Goodwill and intangible assets (CICA Handbook Section 3064),

Business combinations (CICA Handbook Section 1582), Consolidations

(CICA Handbook Section 1601), Non-controlling interests (CICA

Handbook Section 1602), financial instrument disclosure and presen-

tation (CICA Handbook Sections 3862 and 3863), and Inventories

(CICA Handbook Section 3031).

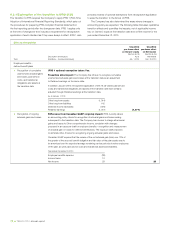

The remainder of this section is comprised of:

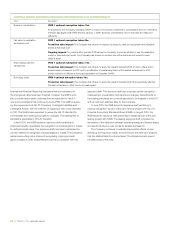

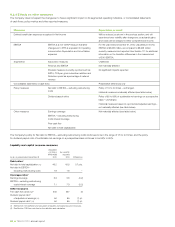

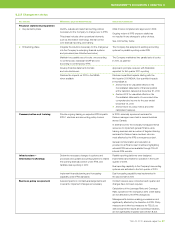

.Section 8.2.1 – Explanation of transition to IFRS-IASB

.Section 8.2.2 – Quantified effects on consolidated statements

of financial position

.Section 8.2.3 – Quantified effects on consolidated statement

of income and other comprehensive income

.Section 8.2.4 – Effects on other measures

.Section 8.2.5 – Changeover status.

MANAGEMENT’S DISCUSSION & ANALYSIS: 8

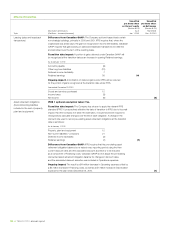

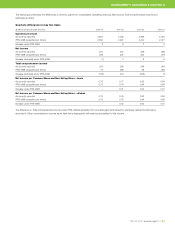

The discount rate, which is used to determine the accrued benefit

obligation, is based upon the yield on long-term, high-quality fixed

term investments, and is set annually at the end of each calendar

year, based upon yields on long-term corporate bond indices in

consultation with actuaries. The expected long-term rate of return

is based upon forecasted returns of the major asset categories

and weighted by plans’ target asset allocations. Future increases

in compensation are based upon the current benefits policies

and economic forecasts.

.Assumptions used in determining defined benefit pension costs,

accrued pension benefit obligations and pension plan assets include:

discount rates, long-term rates of return for plan assets, market esti-

mates and rates of future compensation increases. Material changes

in overall financial performance and financial statement line items

would arise from reasonably likely changes, because of revised

assumptions to reflect updated historical information and updated

economic conditions, in the material assumptions underlying this

estimate. See Note 13 of the Consolidated financial statements for

further analysis.

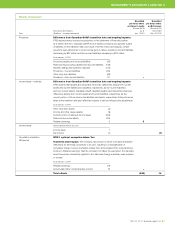

.This accounting estimate is in respect of a component of the

Operating expenses line item on the Company’s Consolidated

statements of income and other comprehensive income. If the

future were to adversely differ from management’s best estimate

of assumptions used in determining defined benefit pension

costs, accrued benefit obligations and pension plan assets,

the Company could experience future increased (or decreased)

defined benefit pension expense. In any given reporting period,

actual returns on plan assets are likely to vary from the expected

long-term rate of return, resulting in fluctuations in Other compre-

hensive income – Item never subsequently reclassified to income.

8.2 Accounting policy developments

In 2006, Canada’s Accounting Standards Board ratified a strategic

plan that results in Canadian GAAP, as used by publicly accountable

enterprises, being fully converged with International Financial Reporting

Standards as issued by the International Accounting Standards

Board (IFRS-IASB), over a transitional period to be complete by 2011.