Telus 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 . TELUS 2010 annual report

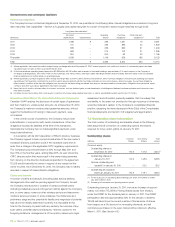

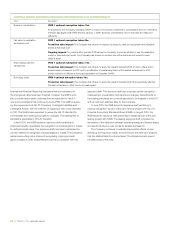

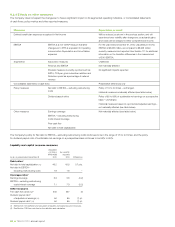

Effects of transition

Topic

Unaudited Unaudited

pro forma effect pro forma effect

on Owners’ equity on Net income

(Section 8.2.2) (Section 8.2.3)

Description and impacts As at Year ended

($ millions – increase (decrease)) Jan. 1, 2010 Dec. 31, 2010

Employee benefits –

defined benefit plans

.Recognition of cumulative

unamortized actuarial gains

and losses, past service

costs, and transitional

obligations and assets at

the transition date

IFRS 1 optional exemption taken: Yes.

Transition date impact: The Company has chosen to recognize cumulative

unamortized actuarial gains and losses at the transition date as an adjustment

to Retained earnings on the same date.

In addition, as part of the retrospective application of IAS 19, all vested past service

costs and transitional obligations and assets at the transition date were similarly

adjusted through Retained earnings at the transition date.

As at January 1, 2010

Other long-term assets (1,314)

Other long-term liabilities 142

Deferred income tax liability (379)

Retained earnings (1,077) (1,077)

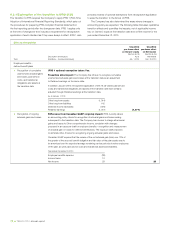

.Recognition of ongoing

actuarial gains and losses

Difference from Canadian GAAP; ongoing impact: IFRS currently allows

an accounting policy choice for recognition of actuarial gains and losses arising

subsequent to the transition date. The Company has chosen to charge all actuarial

gains and losses to Other comprehensive income, consistent with changes

proposed in an exposure draft for employee benefits – recognition and measurement

of actuarial gain or losses for defined benefit plans. The exposure draft proposes

to eliminate other choices for recognizing ongoing actuarial gains and losses.

Canadian GAAP required that the excess of the net actuarial gain (loss) over 10% of

the greater of the accrued benefit obligation and fair value of the plan assets was to

be amortized over the expected average remaining service periods of active employees

of the plan, as were past service costs and transitional assets and liabilities.

Year ended December 31, 2010

Employee benefits expense (39)

Income taxes 10

Net income 29 29

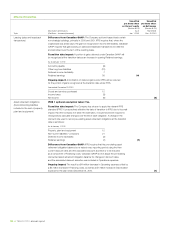

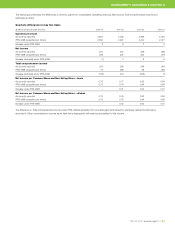

provides a series of optional exemptions from retrospective application

to ease the transition to the full set of IFRS.

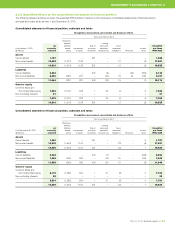

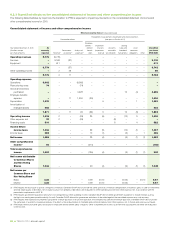

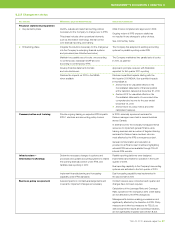

The Company has also determined the areas where changes in

accounting policy are expected. The following table discusses qualitative

transition effects and quantifies the impacts, net of applicable income

tax, on Owners’ equity at the transition date and on Net income for the

year ended December 31, 2010.

8.2.1 Explanation of the transition to IFRS-IASB

The transition to IFRS requires the Company to apply IFRS 1 (First-Time

Adoption of International Financial Reporting Standards), which sets out

the procedures for preparing IFRS-compliant financial statements in

the first reporting period after the changeover date. IFRS 1 applies only

at the time of changeover and includes a requirement for retrospective

application of each standard as if they were always in effect. IFRS 1 also