Telus 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 93

MANAGEMENT’S DISCUSSION & ANALYSIS: 10

extend the Company’s footprint in healthcare, benefit from the investments

being made by governments in eHealth, bring to market services targeted

at consumers such as personal health records and tools to manage

their health, pursue the transformation of the Canadian pharmacy benefit

management sector and cross-sell more traditional telecom products

and services to the healthcare sector. TELUS is also focused on imple-

menting large enterprise deals that leverage the Company’s capital

investments and capabilities.

Wireline voice and data – Consumer

In the consumer wireline market, cable-TV companies and other

competitors encounter minimal regulation and continue to combine a

mix of residential local VoIP, long distance, HSIA and, in some cases,

wireless services into one bundled and/or discounted monthly rate,

along with their traditional broadcast or satellite-based TV services.

In addition, cable-TV companies continue to increase the speed of their

HSIA offerings. To a lesser extent, other non-facilities-based competi-

tors offer local and long distance VoIP services over the Internet and

resell HSIA solutions. Erosion of TELUS’ residential network access lines

(NALs) is expected to continue from this competition, as well as ongoing

technological and wireless substitution. Competitors are anticipated

to capture a majority of the share in growth marketplace opportunities;

therefore, access line associated revenues, including long distance,

can be expected to continue to decline. Although the HSIA market is

maturing, subscriber growth is expected to continue over the next several

years. With a more mature HSIA market, and the potential for higher-

speed Internet offerings from competitors, TELUS may be constrained

in its ability to maintain market share in its incumbent territories,

because of the amount and timing of capital expenditures associated

with maintaining competitive network access speeds.

Risk mitigation in the consumer wireline market: TELUS continues

to expand the coverage and increase the speed of its high-speed

Internet service and increase the coverage and capability of its IP-based

Optik TV service in its incumbent territories (see Broadcasting below

and Section 2.2 Strategic imperatives). The provision of Optik TV service

helps the Company attract pull-through Internet subscriptions and

generally counter cable-TV competition in its incumbent markets, and to

retain and grow revenues with a bundled offering of local and long dis-

tance telephony, HSIA and TV entertainment services. TELUS Satellite TV

service in Alberta and B.C. complements IP TV service, enabling the

Company to more effectively serve those households that are not currently

on the TELUS IP TV network footprint and leverage TELUS’ strong

distribution and marketing presence. TELUS Satellite TV service is made

possible by an agreement with Bell Canada.

Broadcasting

As noted above, the Company offers TELUS TV in B.C., Alberta and

Eastern Quebec, and continues targeted roll-outs of Optik TV to new

areas. While TELUS TV provides numerous interactivity and custom-

ization advantages, there can be no assurance that TELUS TV will be

successful in achieving its plans of obtaining a sizable share of the

TV services market or that implementation costs or projected revenues

for TELUS’ television service will be as planned.

Risk mitigation: Fully digital TELUS TV is offered as both an IP-based

service (in urban markets of B.C., Alberta and Eastern Quebec) and

as a satellite-based service (in B.C. and Alberta). TELUS broadened the

addressable market for its HD TV services through the deployment of

ADSL2+ technology and the Company continues to upgrade to VDSL2

technology. In February 2010, TELUS launched an upgrade of its IP TV

middleware to next generation Microsoft Mediaroom. These developments

and services, and enhance services with integrated bundle offers.

TELUS continues to expand into and generate growth in non-incumbent

markets in Central Canada with business services and mobility offerings.

TELUS also continues to actively pursue a competitive cost structure.

Customer experience

There is a risk that TELUS will not maintain or increase levels of client

loyalty if the products, services and service experience offered by the

Company do not meet or exceed customer expectations. If TELUS does

not provide a better customer experience than its competitors, the TELUS

brand image could suffer, and business clients and consumers may

change service providers. The Company’s profitability could be negatively

impacted should the costs to acquire and retain customers increase.

Risk mitigation: Enhancing customer experience and earning the

loyalty of clients is a prioritized Company-wide commitment, which was

accelerated in a major organization-wide initiative that commenced in

2010 and continues into 2011. Delivering on TELUS’ future friendly brand

promise to clients continues as one of the Company’s key corporate

priorities in 2011. (See Section 3.)

Wireline voice and data

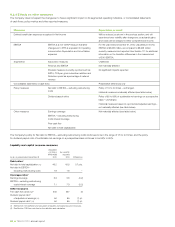

Competition is expected to remain intense from traditional telephony, data,

IP and IT service providers, as well as from voice over Internet protocol

(VoIP) focused entrants in both business and consumer markets.

The industry transition from legacy voice infrastructure to IP telephony,

and from legacy data platforms to Ethernet, IP virtual private networks

(VPN), multi-protocol label switching (MPLS) IP platforms and IP-based

service delivery models, continues at a robust pace. Legacy data revenues

and margins continue to decline. This decline has been only partially

offset by increased demand and/or migration of customers to IP-based

platforms. IP-based solutions are also subject to downward pricing

pressure, lower margins and technological evolution. Capital investments

in wireline infrastructure are required to facilitate this ongoing transition

process for all traditional incumbent local exchange carrier (ILEC) entities

including TELUS.

Wireline voice and data – Business

In the business market, price-discounted bundling of local access,

wireless and advanced data and IP services has evolved to include

web-based and e-commerce services, as well as other IT services and

support. Non-traditional competitors such as Microsoft have entered

the telecom space through new products like Unified Communications,

which provides the ability to redirect and deliver, in real time, email,

voice and text messages from a variety of telecom and IT systems to

the device nearest to the intended recipient. With this broader bundling

of traditional telecom services with IT services, TELUS increasingly

faces competition from pure Internet and information technology hardware,

software and business process/consulting related companies. Cable-TV

companies target the SMB market with their VoIP services. The result

is that traditional and non-traditional competitors are now focused on

providing a broad range of telecommunications services to the business

market, particularly in the major urban areas.

Risk mitigation in the business wireline market: TELUS continues

to increase its capabilities through a combination of strategic acquisitions

and partnerships, a focus on priority vertical markets (public sector,

healthcare, financial services, energy, and telecom wholesale), expansion

of strategic solution sets in the enterprise market, and a mass modular

approach in the SMB market (including services such as TELUS Business

One). Since the launch of TELUS Health Solutions in 2008, TELUS now

leverages systems, its proprietary solutions and its reach and brand to