Telus 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154 . TELUS 2010 annual report

(d) Impairment testing of intangible assets with indefinite lives and goodwill

As referred to in Note 1(b) and Note 1(f), the carrying value of intangible assets with indefinite lives, and goodwill, is periodically tested for impairment

and this test represents a significant estimate for the Company.

The carrying amounts of intangible assets with indefinite lives and good

will allocated to each reporting unit are as set out in the following table.

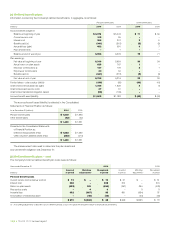

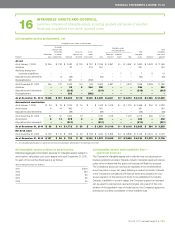

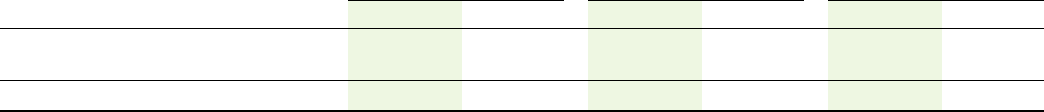

Intangible assets with indefinite lives Goodwill To ta l

As at December 31 (millions) 2010 2009 2010 2009 2010 2009

Wireless $ß3,856 $ß3,856 $ß2,606 $ß2,606 $ß6,462 $ß6,462

Wireline – – 966 966 966 966

$ß3,856 $ß3,856 $ß3,572 $ß3,572 $ß7,428 $ß7,428

There is a material degree of uncertainty with respect to the estimates

of the reporting units’ fair values given the necessity of making key

economic assumptions about the future. The fair value calculation uses

discounted cash flow projections which employ the following key assump-

tions: future cash flows and growth projections, including economic

risk assumptions and estimates of achieving key operating metrics and

drivers; the future weighted average cost of capital; and earnings mul-

tiples. The Company considers a range of reasonably possible amounts

to use for key assumptions and decides upon amounts that represent

management’s best estimate. In the normal course, changes are made

to key assumptions to reflect current (at time of test) economic conditions,

updating of historical information used to develop the key assumptions

and changes in the Company’s debt ratings.

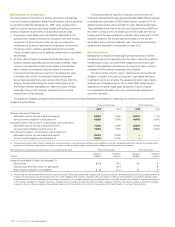

The cash flow projection key assumptions are based upon the

Company’s approved financial forecasts which span a period of three

years and are discounted at a consolidated rate of 8.25% (2009 – 7.61%).

For impairment testing valuation purposes, the cash flows subsequent

to the three-year projection period are extrapolated using perpetual

growth rates of 1.75% (2009 – 1.75%) for the wireless reporting unit and

zero (2009 – zero) for the wireline reporting unit; these growth rates do

not exceed the observed long-term average growth rates for the markets

in which the Company operates.

The Company validates its fair value results through the use of

the market-comparable approach and analytical review of industry and

Company-specific facts. The market-comparable approach uses cur-

rent (at the time of test) market consensus estimates and equity trading

prices for U.S. and Canadian firms in the same industry. In addition, the

Company ensures that the combination of the valuations of the reporting

units is reasonable based on current market values of the Company.

The Company believes that any reasonably possible change in the

key assumptions on which its reporting units’ fair values are based would

not cause the reporting units’ carrying amounts to exceed their fair

value amounts. If the future was to adversely differ from management’s

best estimate of key assumptions and associated cash flows were to

be materially adversely affected, the Company could potentially experi-

ence future material impairment charges in respect of its intangible

assets with indefinite lives and goodwill.

Sensitivity testing was conducted as a part of the December 2010

annual test. A component of the sensitivity testing was a break-even

analysis. Stress testing included moderate declines in annual cash flows

with all other assumptions being held constant; this too resulted in the

Company continuing to be able to recover the carrying value of its intan-

gible assets with indefinite lives and goodwill for the foreseeable future.

(e) Business acquisitions; other

Transactel Barbados, Inc.: On December 22, 2008, the Company

acquired a direct 29.99% economic interest in Transactel Barbados, Inc.,

a business process outsourcing and call centre company with facilities

in three Central American countries, for $19 million cash. Additional con-

tingent consideration could become payable depending upon Transactel

Barbados, Inc. earnings for the year ending December 31, 2011.

Concurrent with acquiring the initial interest in Transactel Barbados, Inc.,

the Company provided two written put options to the vendor. The first

written put option became exercisable on December 31, 2009, expiring

June 30, 2011, and allows the vendor to put up to a further

21.01% eco-

nomic interest to the Company (the Company’s effective

economic

interest in Transactel Barbados, Inc. would become 51% assuming the

written put option was exercised in full). The second written put option

became exercisable on December 31, 2010, with no expiry, and allows

the vendor to put whatever interest is not put under the first written put

option plus up to an incremental 44% economic interest to the Company.

The written put options set out the share pricing methodology, which

is dependent upon Transactel Barbados, Inc. future earnings.

The vendor provided the Company with two purchased call options

which substantially mirror the written put options except that they

are only exercisable upon achieving certain business growth targets.

The Company initially accounted for its investment in Transactel

Barbados, Inc. using the equity method.

The investment was made with a view to enhancing the Company’s

business process outsourcing capacity, particularly regarding Spanish-

language capabilities.

On January 7, 2011, the Company exercised its purchased call option

to acquire a further 21.01% economic interest in Transactel Barbados, Inc.

from the vendor for $20 million cash. The Company continues to account

for its resulting direct 51% economic interest in Transactel Barbados, Inc.

using the equity method. The control of Transactel Barbados, Inc. resides

with the “super-majority” of its board of directors, who have the con-

tinuing power to determine the strategic operating, investing and financing

policies of Transactel Barbados, Inc. Although the Company has the right

to elect the simple majority of the board of directors at the direct 51%

economic interest level, it does not have the right to elect the super-

majority of the board of directors at that level. As a result, the vendor’s

remaining direct 49% economic interest effectively has a veto right over

the strategic operating, investing and financing policies of Transactel

Barbados, Inc. and thus the Company does not have the control neces-

sary to apply consolidation accounting.