Telus 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.126 . TELUS 2010 annual report

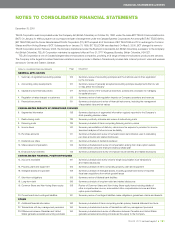

(p) Property, plant and equipment; intangible assets

General: Property, plant and equipment and intangible assets are

recorded at historical cost and, with respect to self-constructed property,

plant and equipment, include materials, direct labour and applicable

overhead costs. With respect to internally developed, internal-use soft-

ware, recorded historical costs include materials, direct labour and

direct labour-related costs. Where property, plant and equipment and

intangible asset construction projects exceed $50 million and are of a

sufficiently long duration (generally, longer than twelve months), an

amount is capitalized for the cost of funds used to finance construction.

The rate for calculating the capitalized financing costs is based on the

Company’s one-year cost of borrowing.

When property, plant, equipment and/or intangible assets are sold

by the Company, the historical cost less accumulated depreciation is

netted against the sale proceeds and the difference is included in the

Consolidated Statements of Income and Other Comprehensive Income

as Other expense, net.

Asset retirement obligations: Liabilities are recognized for statutory,

contractual or legal obligations, normally when incurred, associated

with the retirement of property, plant and equipment (primarily certain

items of outside plant and wireless site equipment) when those obliga-

tions result from the acquisition, construction, development and/or

normal operation of the assets. The obligations are measured initially at

fair value, determined using present value methodology, and the resulting

costs are capitalized into the carrying amount of the related asset. In

subsequent periods, the liability is adjusted for the accretion of discount

and any changes in the amount or timing of the underlying future cash

flows. The capitalized asset retirement cost is depreciated on the same

basis as the related asset and the discount accretion is included in

determining the results of operations.

(q) Leases

Leases are classified as capital or operating depending upon the terms

and conditions of the contracts.

Where the Company is the lessee, asset values recorded under

capital leases are amortized on a straight-line basis over the period of

expected use. Obligations recorded under capital leases are reduced

by lease payments net of imputed interest.

For the year ended December 31, 2010, real estate and vehicle

operating lease expenses, which are net of the amortization of the

deferred gain on the sale-leaseback of buildings, were $254 million

(2009 – $237 million). The unamortized balances of the deferred gains

on the sale-leaseback of buildings are set out in Note 21(b).

(r) Investments

The Company accounts for its investments in companies over which

it has significant influence using the equity basis of accounting whereby

the investments are initially recorded at cost and subsequently adjusted

to recognize the Company’s share of earnings or losses of the investee

companies and reduced by dividends received. The excess of the cost

of equity investments over the underlying book value at the date of

acquisition, except for goodwill, is amortized over the estimated useful

lives of the underlying assets to which it is attributed.

salary escalation and retirement ages of employees. For the purpose

of calculating the expected return on plan assets, those assets are valued

at fair value. The excess of the net actuarial gain (loss) over 10% of the

greater of the accrued benefit obligation and the fair value of the plan

assets is amortized over the expected average remaining service period

of active employees of the plan, as are past service costs and transitional

assets and liabilities.

The Company uses defined contribution accounting for the Telecom-

munication Workers Pension Plan and the British Columbia Public Service

Pension Plan that cover certain of the Company’s employees.

(m) Cash and temporary investments, net

Cash and temporary investments, which may include investments

in money market instruments that are purchased three months or less

from maturity, are presented net of outstanding items including cheques

written but not cleared by the bank as at the statement of financial

position date. Cash and temporary investments, net, are classified as

a liability on the statement of financial position when the amount of

the cheques written but not cleared by the bank exceeds the amount

of the cash and temporary investments. When cash and temporary

investments, net, are classified as a liability, they may also include over-

draft amounts drawn on the Company’s bilateral bank facilities, which

revolve daily and are discussed further in Note 17.

(n) Sales of receivables

Transfers of receivables in securitization transactions are recognized

as sales when the Company is deemed to have surrendered control

over the transferred receivables and consideration, other than for

its beneficial interests in the transferred receivables, has been received.

When the Company sells its receivables, it retains reserve accounts,

which are retained interests in the securitized receivables, and servicing

rights. When a transfer is considered a sale, the Company derecog-

nizes all receivables sold, recognizes at fair value the assets received

and the liabilities incurred and records the gain or loss on sale in the

Consolidated Statements of Income and Other Comprehensive Income

as Other expense, net. The amount of gain or loss recognized on the

sale of receivables depends in part on the previous carrying amount of

the receivables involved in the transfer, allocated between the receivables

sold and the retained interests based upon their relative fair market

value at the sale date. The Company estimates the fair value for its

retained interests based on the present value of future expected cash

flows using management’s best estimates of the key assumptions

(credit losses, the weighted average life of the receivables sold and

discount rates commensurate with the risks involved).

(o) Inventories

The Company’s inventory consists primarily of wireless handsets,

parts and accessories and communications equipment held for resale.

Inventories are valued at the lower of cost and net realizable value,

with cost being determined on an average cost basis. Previous write-

downs to net realizable value are reversed if there is a subsequent

increase in the value of the related inventories. See Note 21(b).