Telus 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 43

MANAGEMENT’S DISCUSSION & ANALYSIS: 1

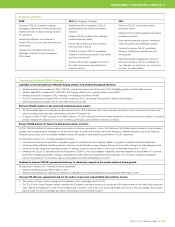

The following key assumptions were made at the time the 2010 targets were announced in December 2009.

Assumptions for 2010 original targets Result or expectation for 2010

Ongoing wireline and wireless competition in both business and

consumer markets

Confirmed by frequent promotional offers by the primary cable-TV

competitor in Western Canada (Shaw Communications), a new

brand launch (Chatr) by an incumbent wireless competitor (Rogers

Communications), and a brand re-launch (Solo) by an incumbent

wireless competitor (Bell Canada).

Canadian wireless industry market penetration gain of approximately

four percentage points for the year (approximately 3.6 percentage

points in 2009)

The Company’s estimate is a gain of approximately 4.4 percentage

points in industry market penetration for 2010, with an increasing

proportion from postpaid subscribers associated with growing data

usage and smartphone adoption.

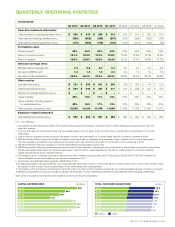

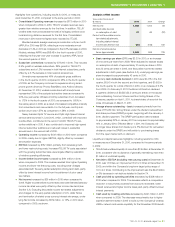

Increased wireless subscriber loading in smartphones Smartphones represented 46% of postpaid gross additions in the

fourth quarter of 2010, compared to 25% in the fourth quarter of 2009.

Smartphones represent 33% of the postpaid subscriber base at the

end of 2010 compared to 20% at the end of 2009.

Reduced downward pressure on wireless ARPU Confirmed by the 1.9% year-over-year increase in wireless ARPU in the

fourth quarter of 2010 and 1.4% decrease for the full year of 2010, as

compared to decreases of 7.7% and 6.8%, respectively, in the fourth

quarter and full year of 2009.

New competitive wireless entry in early 2010 following one competitive

launch in December 2009

After its initial launch in Calgary and Toronto in December 2009, Globalive

(Wind brand) launched in Edmonton and Ottawa in the first quarter of

2010, and Vancouver in the second quarter, and announced that it expects

to launch in Victoria in 2011.

Other new entrants began launching services in the second quarter

of 2010. Mobilicity launched services in the Toronto area in the second

quarter, in Edmonton, Vancouver and Ottawa in the fourth quarter, and

in Calgary in early 2011. Public Mobile turned up services in the Toronto

and Montreal areas. Quebecor (Videotron brand) launched its services

in September 2010, initially in Montreal and Quebec City. Videotron

previously offered wireless services in Quebec as a mobile virtual network

operator. Shaw Communications stated it expects to begin launching

wireless services in early 2012.

In addition, during the third quarter of 2010, one incumbent national

competitor launched a new brand and the other incumbent national

competitor re-launched one of its brands.

In wireline, stable residential network access line losses and

continued competitive pressure in small and medium business

market from cable-TV and voice over IP (VoIP) companies

Residential access line losses moderated in the second half of 2010

when compared to the same period in 2009, due to improved bundle

and retention offers. Residential access lines decreased by 8.0% in

2010, resulting from promotional activity by the primary Western cable-TV

competitor Shaw for voice and Internet services, particularly in the first

half of 2010. Business line losses were 2.9% in 2010 due to increased

competition in the small and medium business market and conversion

of voice lines to more efficient IP services. See Section 5.4.

Continued wireline broadband expansion See Section 2: Core business and strategy.

Significant increase in cost of acquisition and retention expenses

for smartphones and TELUS TV loading

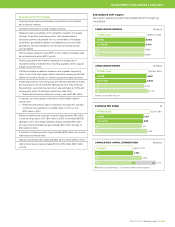

Wireless cost of acquisition (COA) per gross subscriber addition was

$350 in 2010, an increase of 3.9% from 2009. Retention spending as

a percentage of growing network revenue was 11.6% in 2010, up from

10.9% in 2009.

TELUS TV loading was 144,000 in 2010, an increase of 57% from

2009. TELUS TV programming and other costs have increased, as well,

due to the 85% increase in total TV subscribers compared to 2009.

EBITDA savings of approximately $135 million from efficiency initiatives Savings of approximately $134 million were realized in 2010.

Approximately $75 million of restructuring expenses ($190 million

in 2009)

Restructuring charges were $74 million.