Telus 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 169

FINANCIAL STATEMENTS & NOTES: 23

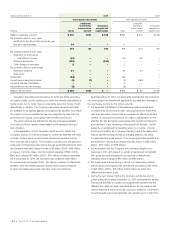

As at December 31, 2010, income tax returns, whether filed or not, pertaining to taxation years that remain open to examination by major

jurisdictions are as follows:

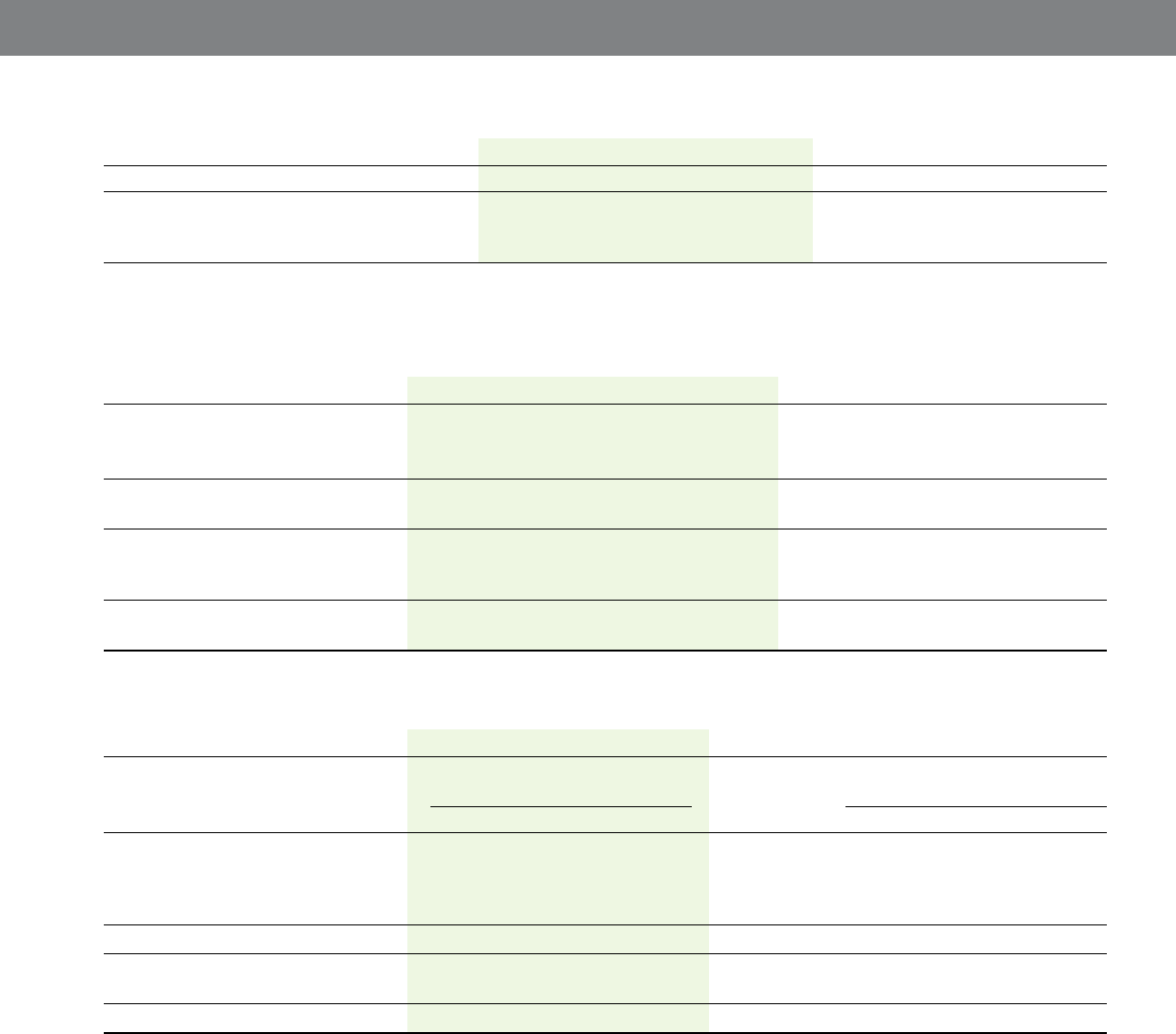

As at December 31 2010 2009

Restricted to appeals Other Restricted to appeals Other

Canada – Federal 1999–2001, 2003 2002, 2004–2010 1999–2001, 2003 2002, 2004–2009

Canada – provincial 1999–2001 2002–2010 1999–2001 2002–2009

United States n.a. 2006–2010 n.a. 2006–2009

Comprehensive income, which incorporates net income, includes all

changes in equity during a period except those resulting from invest-

ments by and distributions to owners.

(f) Comprehensive income (loss)

U.S. GAAP requires that a statement of comprehensive income be

displayed with the same prominence as other financial statements.

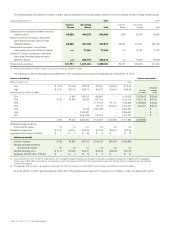

Years ended December 31 2010 2009

Canadian Canadian

GAAP other Pension U.S. GAAP other GAAP other Pension U.S. GAAP other

comprehensive and other comprehensive comprehensive and other comprehensive

(millions) income (loss) benefit plans income (loss) income (loss) benefit plans income (loss)

Amount arising $ 74 $ß(198) $ß(124) $ 87 $ß(593) $ß(506)

Income tax expense 20 (54) (34) 29 (154) (125)

Net 54 (144) (90) 58 (439) (381)

Accumulated other comprehensive

income (loss), beginning of period (72) (829) (901) (130) (390) (520)

Accumulated other comprehensive

income (loss), end of period $ß(18) $ß(973) $ß(991) $ß(72) $ß(829) $ß(901)

The closing accumulated other comprehensive income amounts in respect of components of net periodic benefit costs not yet recognized,

and the amounts expected to be recognized in fiscal 2011, are as follows:

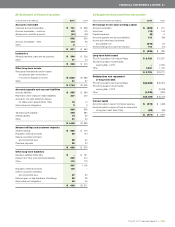

As at December 31 2010

Amounts

2009

Accumulated other expected to Accumulated other

comprehensive income amounts be recognized comprehensive income amounts

(millions) Gross Tax effect Net in 2011 Gross Tax effect Net

Pension benefit plans

Unamortized net actuarial loss (gain) $ß1,726 $ß468 $ß1,258 $ß 99 $ß1,528 $ß417 $ß1,111

Unamortized past service costs 27 9 18 4 31 10 21

Unamortized business combination difference (419) (114) (305) – (418) (116) (302)

1,334 363 971 103 1,141 311 830

Other benefit plans

Unamortized net actuarial loss (gain) 4 1 3 – (1) – (1)

$ß1,338 $ß364 $ 974 $ß103 $ß1,140 $ß311 $ 829

No. 140 and No. 167, Amendments to FASB Interpretation No. 46(R).

Earlier application was prohibited. The Company’s current accounting

policies and practices are not affected by the provisions of these topics.

Recently issued accounting standards not yet implemented:

As would affect the Company, there are no U.S. accounting standards

currently issued and not yet implemented that would differ from Canadian

accounting standards currently issued and not yet implemented.

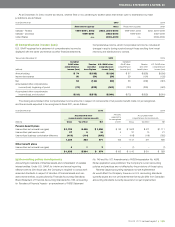

(g) Accounting policy developments

Accounting for transfers of financial assets and consolidation of variable

interest entities: Under U.S. GAAP, for interim and annual reporting

effective with its 2010 fiscal year, the Company is required to comply with

amended standards in respect of transfers of financial assets and vari-

able interest entities, as prescribed by Financial Accounting Standards

Board Statement of Financial Accounting Standards No. 166, Accounting

for Transfers of Financial Assets – an amendment of FASB Statement