Telus 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 81

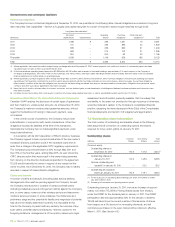

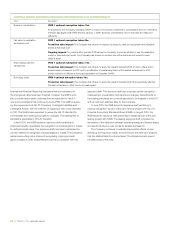

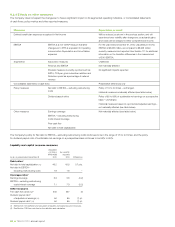

Effects of transition

Topic

Unaudited Unaudited

pro forma effect pro forma effect

on Owners’ equity on Net income

(Section 8.2.2) (Section 8.2.3)

Description and impacts As at Year ended

($ millions – increase (decrease)) Jan. 1, 2010 Dec. 31, 2010

Provisions Difference from Canadian GAAP; transition date and ongoing impacts:

IFRS requires that provisions be presented on the statement of financial position

as a distinct line item. Canadian GAAP did not identify provisions as a specific subset

of liabilities. At the transition date, as a result of further review and analysis, certain

provisions were deter mined to be more long-term in nature, resulting in Current liabilities

decreasing by $22 million and Non-current liabilities increasing by $22 million.

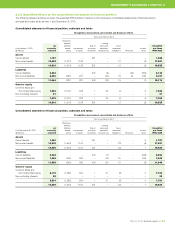

As at January 1, 2010

Accounts payable and accrued liabilities (42)

Restructuring accounts payable and accrued liabilities (135)

Advance billings and customer deposits (144)

Provisions – Current liabilities 299

Other long-term liabilities (69)

Provisions – Non-current liabilities 91 –

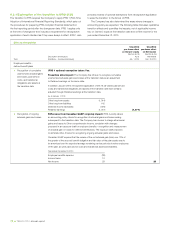

Income taxes – deferred Difference from Canadian GAAP; transition date and ongoing impacts:

IFRS requires that taxable and deductible temporary differences arising from current

assets and current liabilities be classified, respectively, as non-current liabilities

and non-current assets. Canadian GAAP classified taxable and deductible temporary

differences arising from current assets and current liabilities, respectively, as the

current portion of future income tax liabilities and assets, respectively. Deferred income

taxes at the transition date also reflect tax impacts of various retrospective adjustments.

As at January 1, 2010

Other long-term assets (2)

Income and other taxes payable (9)

Current portion of deferred income taxes (294)

Deferred income tax liability 296

Retained earnings 5 5

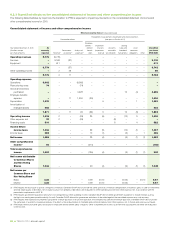

Income taxes Year ended December 31, 2010

Income taxes 1

Net income (1) (1)

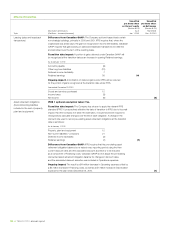

Cumulative translation

differences

IFRS 1 optional exemption taken: Yes.

Transition date impact: The Company has chosen to deem cumulative translation

differences for all foreign operations to be zero, resulting in a reclassification of

cumulative foreign currency translation losses from Accumulated other comprehensive

income to Retained earnings. Had the Company not taken the exemption, the standard

would have been retroactively applied to the date each foreign subsidiary was acquired

or formed.

As at January 1, 2010

Retained earnings (19)

Accumulated other comprehensive income 19 –

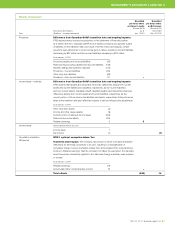

Total effects (220) 14

MANAGEMENT’S DISCUSSION & ANALYSIS: 8