Telus 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 53

MANAGEMENT’S DISCUSSION & ANALYSIS: 4

Operational resources Operational risks and risk management

Technology, systems and properties

TELUS is a highly complex technology-dependent company with a multitude

of interconnected wireline and wireless telecommunications networks, IT

systems and processes.

Network facilities are constructed under or along streets and highways, pur-

suant to rights-of-way granted by the owners of land such as municipalities

and the Crown, or on freehold land owned by TELUS.

Intangible assets include wireless spectrum licensed from Industry Canada,

essential to providing wireless services.

Real properties (owned or leased) include: administrative office space, work

centres and space for telecommunications equipment. A small number of

buildings are constructed on leasehold land and the majority of radio towers

are situated on lands held under leases or licences for varying terms.

TELUS International provides contact centre and business process and IT

outsourcing by utilizing sophisticated on-site facilities including call centre

solutions, and by utilizing international data networks and reliable data centres

with rigorous privacy and security standards. Global rerouting and diversity

is provided through facilities in North America, Latin America and Asia-Pacific.

Technology risks – See Section 10.2.

Process risks – See Section 10.5.

Health, safety and environment – See Section 10.8

.Increasing adoption of wireless services and expanding

wireless competition have resulted in more public scrutiny of,

and opposition to, new radio towers. Public concerns include

perceived health risks

.Increasing stakeholder interest in environmental issues.

Risks associated with legal and regulatory compliance, defects

in software and failures in data and transaction processing,

and intellectual property and proprietary rights – See Section 10.9

Litigation and legal matters.

Human-caused and natural threats to TELUS infrastructure

and operations – See Section 10.10.

Common Shares and Non-Voting Shares, issue new shares from treasury,

purchase shares for cancellation pursuant to permitted normal course

issuer bids, issue new debt, issue new debt to replace existing debt

with different characteristics and/or increase or decrease the amount of

sales of trade accounts receivable to an arm’s-length securitization trust.

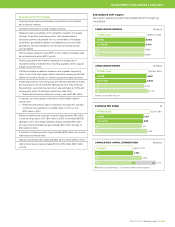

The Company monitors capital utilizing a number of measures,

including net debt to EBITDA – excluding restructuring costs and divi-

dend payout ratios. On May 4, 2010, the Board of Directors approved

a revised dividend payout ratio guideline of 55 to 65% of sustainable

net earnings on a prospective basis. See Section 7.4 Liquidity and capital

resource measures.

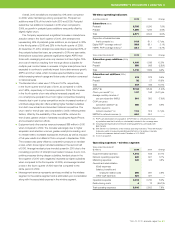

Financing and capital structure management plans

Progress against the 2010 plan is described below, followed by plans

for 2011.

4.3 Liquidity and capital resources

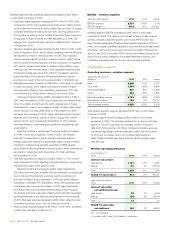

Capital structure financial policies

The Company’s objectives when managing capital are: (i) to maintain

a flexible capital structure that optimizes the cost and availability of

capital at acceptable risk; and (ii) to manage capital in a manner that

considers the interests of equity and debt holders.

In the management and definition of capital, the Company includes

Common Share and Non-Voting Share equity (excluding accumulated

other comprehensive income), long-term debt (including any associated

hedging assets or liabilities, net of amounts recognized in accumulated

other comprehensive income), cash and temporary investments and

securitized accounts receivable.

The Company manages the capital structure and makes adjustments

to it in light of changes in economic conditions and the risk characteristics

of the underlying assets. In order to maintain or adjust the capital structure,

the Company may adjust the amount of dividends paid to holders of

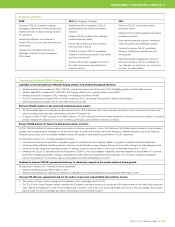

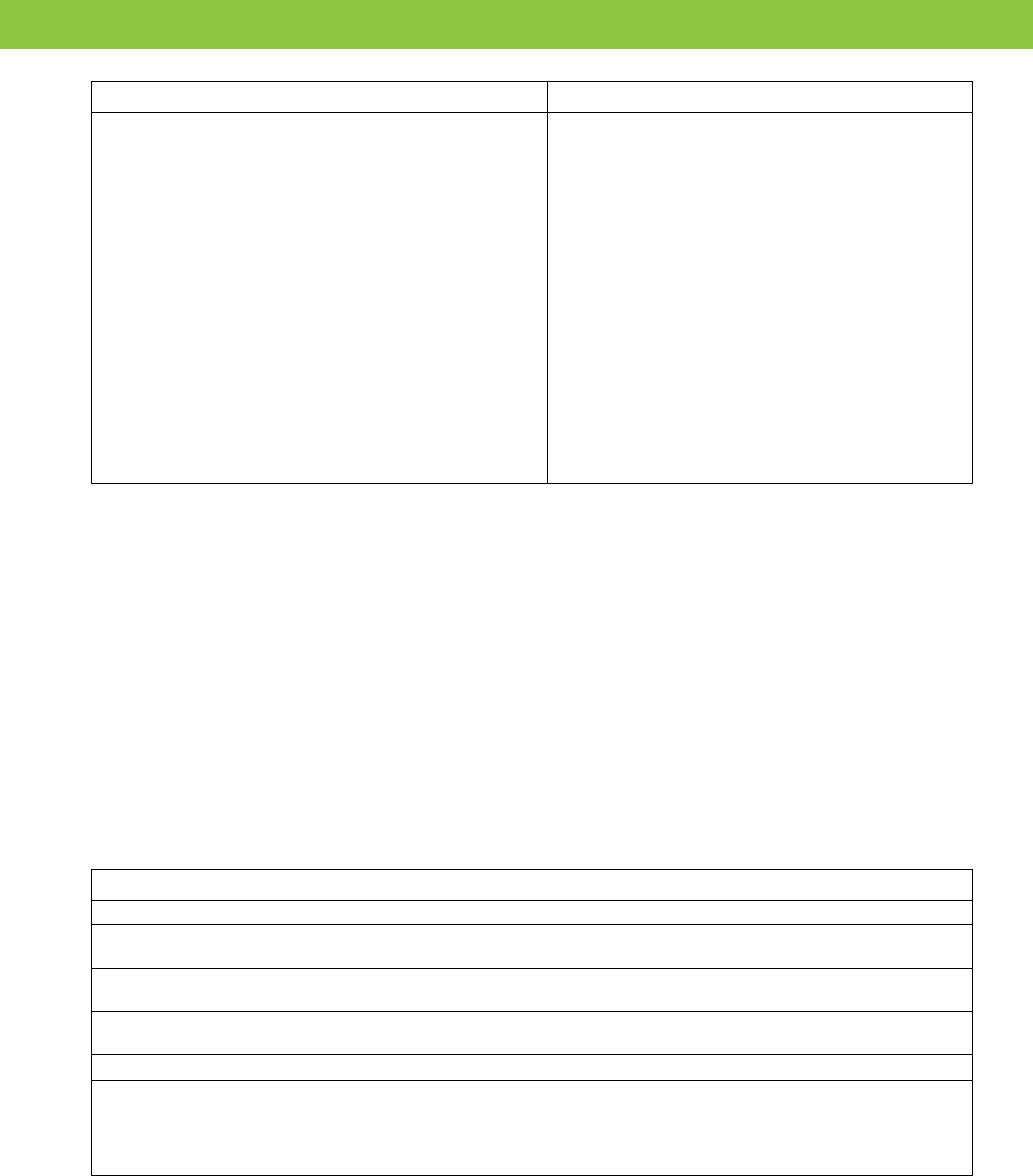

Reporting back on TELUS’ 2010 financing and capital structure management plan

Pay dividends to the holders of TELUS Common Shares and Non-Voting Shares

The quarterly dividend paid on January 4, 2011, was 52.5 cents per share, a 10.5% increase from the 47.5 cents per share dividend paid on January 4, 2010.

The Company announced two 2.5-cent increases during 2010.

Use proceeds from securitized receivables, bank facilities, commercial paper and dividend reinvestment, as needed, to supplement

free cash flow and meet other cash requirements

Stronger free cash flow, as well as reduced cash outflow for dividends reinvested in TELUS Non-Voting Shares issued from treasury, facilitated a $443 million

reduction in net debt during 2010.

Maintain compliance with financial objectives, policies and guidelines

Generally maintain a minimum $1 billion in unutilized liquidity – The Company had unutilized liquidity of more than $1.9 billion at December 31, 2010,

including more than $1.8 billion of unutilized credit facilities and $100 million availability under the accounts receivable securitization program.

Net debt to EBITDA excluding restructuring costs ratio of 1.5 to 2.0 times – Actual result of 1.8 times at December 31, 2010.

Dividend payout ratio guideline of 55 to 65% of sustainable net earnings on a prospective basis – See Section 7.4.