Telus 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 167

The Company must make significant estimates in respect of the

composition of its deferred income tax asset and deferred income tax

liability. The operations of the Company are complex, and related tax

interpretations, regulations and legislation are continually changing.

As a result, there are usually some tax matters in question. Temporary

differences comprising the deferred income tax liability are estimated

as follows:

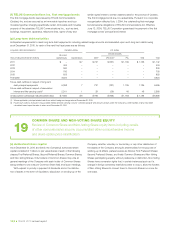

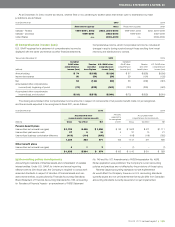

As at December 31 (millions) 2010 2009

Property, plant and equipment and

intangible assets subject to amortization $ (639) $ (583)

Intangible assets with indefinite lives (835) (789)

Partnership income unallocated

for income tax purposes (398) (437)

Net pension and share-based

compensation amounts 22 43

Reserves not currently deductible 70 124

Losses available to be carried forward 35 40

Other (27) (15)

$ß(1,772) $ß(1,617)

Deferred income tax liability

Current $ (348) $ (294)

Non-current (1,424) (1,323)

Deferred income tax asset (liability) $ß(1,772) $ß(1,617)

Effective January 1, 2007, the Company adopted the method of

accounting for uncertain income tax positions prescribed by Financial

Accounting Standards Board Accounting Standards Codification

topic 740, Income Taxes. This topic is intended to standardize accounting

practice for the recognition, derecognition and measurement of tax

benefits to enable consistency and comparability among reporting entities

for the reporting of income tax assets and liabilities. No consequential

adjustments were required in the Company’s financial statements

as a result of that adoption.

The total amount of unrecognized tax benefits, excluding net

capital losses, that, if recognized, would affect the effective tax rate at

December 31, 2010, is $230 million (2009 – $258 million). Unrecognized

tax benefits related to net capital losses, if recognized, amount to $NIL

(2009 – $156 million), none of which would have affected the effective tax

rate for the years ended December 31, 2010 or 2009.

The gross amount of unrecognized tax benefits is calculated as

the undiscounted cumulative impact of such positions on taxable income

before timing-related reversals that have yet to be realized and before

the application of losses carried forward, including taxable income for

partnerships that will be allocated in the next twelve months, multiplied

by the applicable tax rate for the estimated period when such benefit

will be realized.

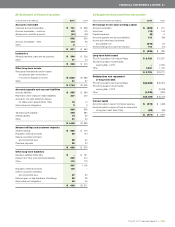

Estimated aggregate amortization expense for intangible assets

subject to amortization, calculated upon such assets held as at

December 31, 2010, for each of the next five fiscal years is as follows:

Years ending December 31 (millions)

2 011 $ß424

2012 304

2013 139

2014 89

2015 76

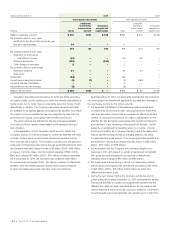

(d) Goodwill

Merger of BC TELECOM and TELUS: Under the purchase method

of accounting, TELUS’ assets and liabilities at acquisition (see (a)) have

been recorded at their fair values with the excess purchase price being

allocated to goodwill in the amount of $403 million. Commencing

January 1, 2002, rather than being systematically amortized, the carrying

value of goodwill is periodically tested for impairment.

Additional goodwill on Clearnet purchase: Under U.S. GAAP, shares

issued by the acquirer to effect an acquisition are measured at the date

the acquisition was announced; however, under Canadian GAAP, at the

time the transaction took place, shares issued to effect an acquisition

were measured at the transaction date. This results in the purchase price

under U.S. GAAP being $131 million higher than under Canadian GAAP.

The resulting difference is assigned to goodwill. Commencing January 1,

2002, rather than being systematically amortized, the carrying value of

goodwill is periodically tested for impairment.

(e) Income taxes

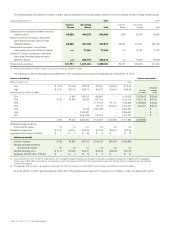

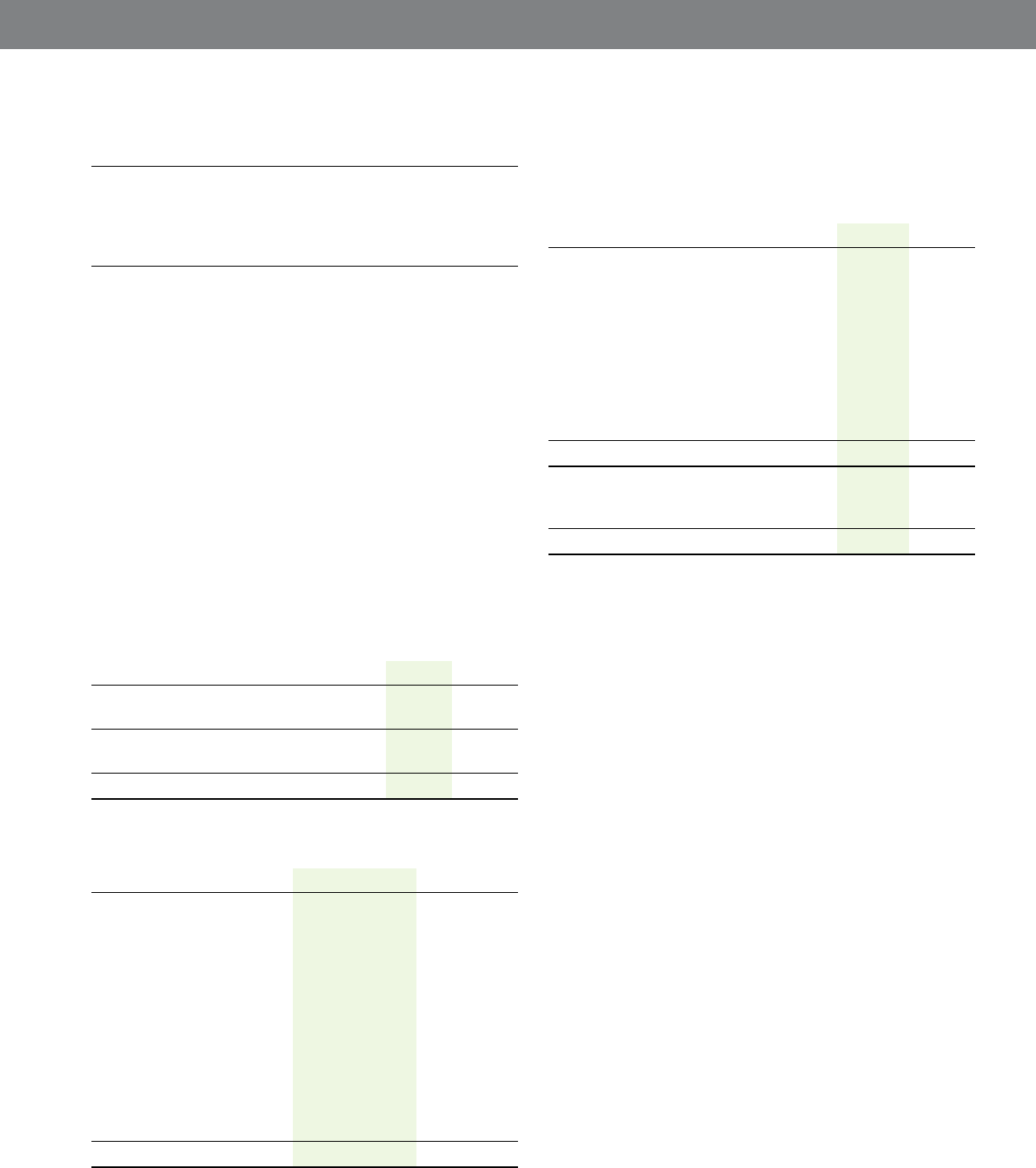

Years ended December 31 (millions) 2010 2009

Current $ß115 $ß286

Deferred 187 (112)

302 174

Investment Tax Credits (5) (15)

$ß297 $ß159

The Company’s income tax expense, for U.S. GAAP purposes, differs

from that calculated by applying statutory rates for the following reasons:

Years ended December 31 ($ in millions) 2010 2009

Basic blended federal and

provincial tax at statutory

income tax rates $ß366 29.0% $ß331 30.3%

Revaluation of deferred income

tax liability to reflect future

statutory income tax rates (40) (97)

Tax rate differential on, and

consequential adjustments

from, reassessment of

prior year tax issues (36) (68)

Share option award compensation 10 4

Investment Tax Credits, net of tax (4) (10)

Other 1 (1)

U.S. GAAP income tax expense $ß297 23.6% $ß159 14.7%

FINANCIAL STATEMENTS & NOTES: 23