Telus 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 65

MANAGEMENT’S DISCUSSION & ANALYSIS: 6

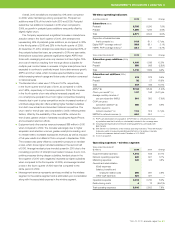

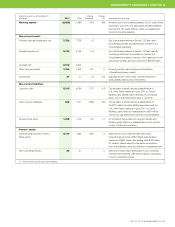

Financial position as at December 31 Change Change

($ millions) 2010 2009 ($ millions) (%) Explanation of the change

Working capital(1) (2,559) (1,837) (722) (39) Primarily due to the remaining balance of U.S. dollar Notes

maturing in June 2011 and associated derivative liabilities

(see Section 7.3), partly offset by higher receivables and

lower income taxes payable

Non-current assets

Property, plant and equipment, net 7,722 7,729 (7) – See Capital expenditures in Section 7.2 Cash used

by investing activities and Depreciation in Section 5.3

Consolidated operations

Intangible assets, net 5,134 5,148 (14) – See Capital expenditures in Section 7.2 Cash used by

investing activities and Amortization in Section 5.3

Consolidated operations. Included in the balances for both

periods are wireless spectrum licences of $3,849 million

Goodwill, net 3,572 3,572 – – –

Other long-term assets 1,744 1,602 142 9 Primarily pension plan funding and amortization

of transitional pension assets

Investments 37 41 (4) (10) Dispositions and write-downs of small investments

were partially offset by new investments

Non-current liabilities

Long-term debt 5,313 6,090 (777) (13) The decrease primarily reflects reclassification of

U.S. dollar Notes maturing in June 2011 to Current

liabilities, and a $363 million decrease in commercial

paper, net of a $1 billion Note issue in July 2010

Other long-term liabilities 638 1,271 (633) (50) The decrease primarily reflects reclassification of

the $721 million derivative liability associated with the

U.S. dollar Notes maturing in June 2011 to Current

liabilities, partly offset by reclassification of $81 million

of the price cap deferral account from Current liabilities

Future income taxes 1,498 1,319 179 14 An increase in future taxes on long-term assets and

liabilities partly offset by a reclassification to the Current

portion of future income taxes

Owners’ equity

Common Share and Non-Voting 8,179 7,554 625 8 Mainly Net income of $1,034 million and Other

Share equity compre hensive income of $54 million, less declared

dividends of $642 million, and adding back $150 million

for treasury shares issued for dividends reinvested in

Non-Voting Shares under the dividend re-investment plan

Non-controlling interests 22 21 1 5 Net income of $4 million attributable to non-controlling

interests less dividends of $3 million paid by a subsidiary

to a non-controlling interest

(1) Current assets subtracting Current liabilities.