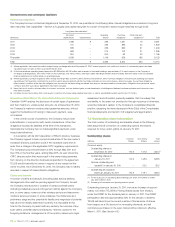

Telus 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 . TELUS 2010 annual report

The discussion in this section is qualified by the Caution regarding

forward-looking statements at the beginning of the MD&A.

The Company’s capital structure financial policies, financing plan

and results are described in Section 4.3. In the normal course, the

Company has generated annual cash flow from operations exceeding

annual capital investment needed to support business growth and

re-invest in technology. In both 2010 and 2009, cash provided by

operating activities exceeded cash used by investing activities, long-

term debt was reduced and the average term to maturity of debt

was extended through financing activities.

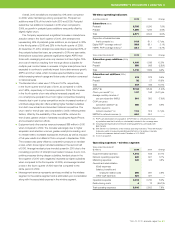

Summary of Consolidated statements of cash flows

Years ended December 31

($ millions) 2010 2009 Change

Cash provided by operating activities 2,546 2,904 (12.3)%

Cash (used) by investing activities (1,707) (2,128) 19.8%

Cash (used) by financing activities (863) (739) (16.8)%

Increase (decrease) in cash and

temporary investments, net (24) 37 –

Cash and temporary investments,

net, beginning of period 41 4 –

Cash and temporary investments,

net, end of period 17 41 (58.5)%

7.1 Cash provided by operating activities

Cash provided by operating activities decreased by $358 million in 2010

when compared to 2009. Year-over-year comparative changes in cash

flow included:

.Changes in proceeds from securitized accounts receivable

(included in Net change in non-cash working capital on the consoli-

dated statements of cash flow) are a use of cash when proceeds

are reduced and a source of cash when proceeds are increased.

Proceeds were reduced by $100 million in 2010, as compared to an

increase of $200 million in 2009, for a comparative decrease in cash

flow of $300 million. (See Section 7.6 Accounts receivable sale.)

.EBITDA – excluding restructuring costs increased by $36 million

in 2010 when compared to 2009.

.Employer contributions to defined benefit plans in excess of the

defined benefit expense decreased by $51 million in 2010 when

compared to 2009. The Company made a voluntary one-time pension

contribution of $200 million in January 2011. (See Section 1.5.)

.Interest paid decreased by $96 million in 2010 when compared to

2009. The decrease resulted from lower losses on early redemption

of U.S. dollar Notes ($52 million in September 2010 as compared

to $99 million in December 2009), as well as lower interest rates

on the $2 billion of Series CG and CH notes issued to fund the two

partial early redemptions of the U.S. dollar Notes, and the change

in timing of semi-annual interest payments on the Series CH Notes

to January and July as compared to June and December on the

redeemed Notes. (See Section 7.3.)

.Interest received decreased by $51 million in 2010 when compared

to 2009, mainly due to higher receipts of interest on the settlement

of tax-related matters in 2009.

.Income tax payments net of recoveries were $311 million in 2010

or higher net payments of $45 million, primarily due to the receipt of

higher income tax recoveries in 2009 together with a slight increase

in instalments in 2010.

.Other changes in non-cash working capital.

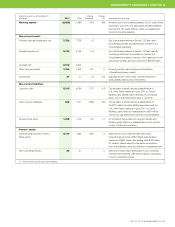

10

09

08

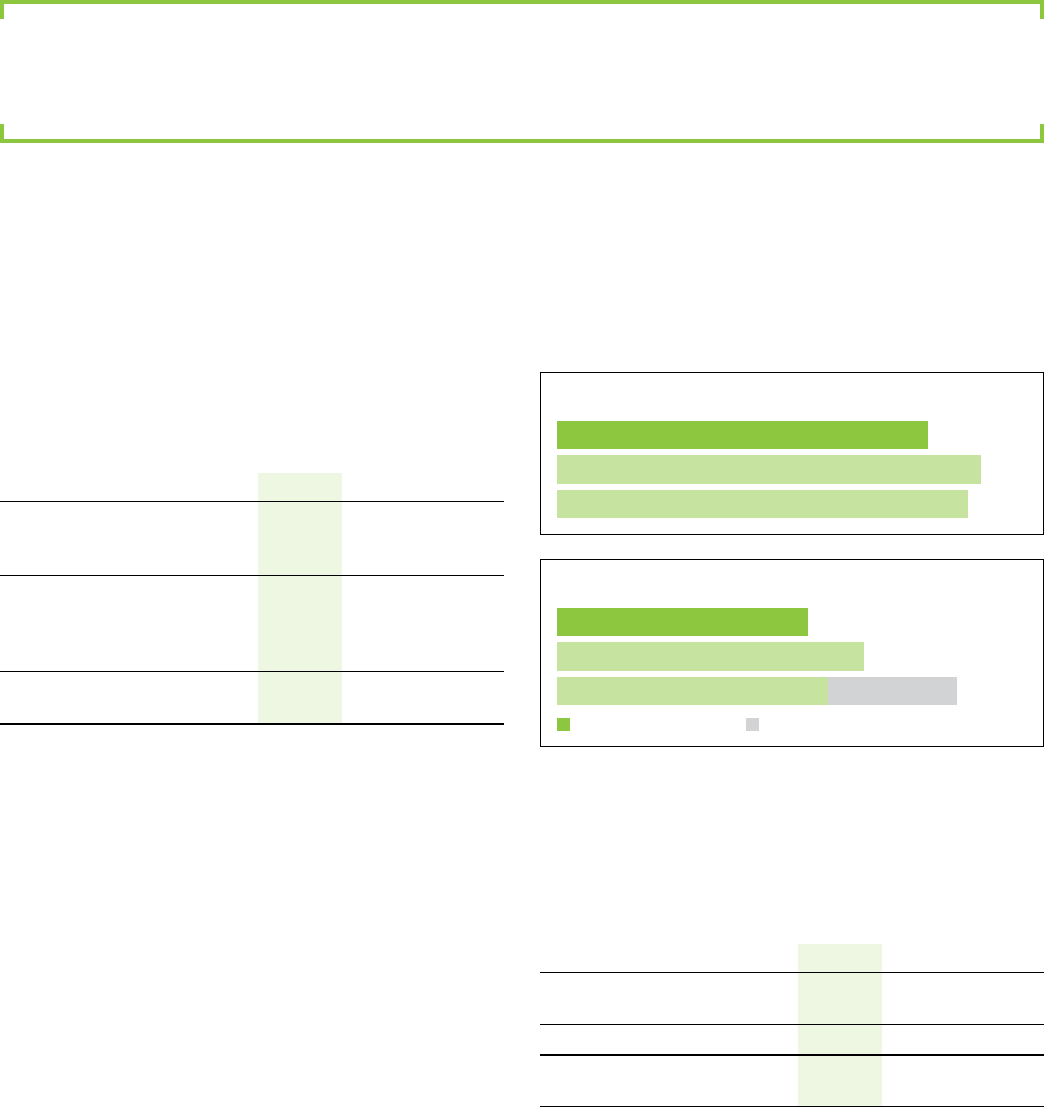

CASH PROVIDED BY OPERAT ING ACTIVITIES ($ millions)

10 2,546

2,904

2,819

09

08

10

09

08

CAPITA L EXPENDITURES ($ millions)

10 1,721

2,10 3

2,741

8821,859

09

08

08

General capital expenditures AWS spectrum licences

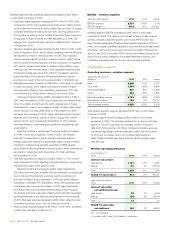

7.2 Cash used by investing activities

Cash used by investing activities decreased by $421 million in 2010

when compared to 2009, principally due to lower capital expenditures

and an acquisition in 2009.

Capital expenditures

Years ended December 31

($ millions, except capital intensity) 2010 2009 Change

Wireless segment 463 770 (39.9)%

Wireline segment 1,258 1,333 (5.6)%

Total capital expenditures 1,721 2,103 (18.2)%

EBITDA less capital expenditures(1) 1,922 1,388 38.5%

Capital intensity(2) (%) 18 22 (4) pts.

(1) See Section 11.1 EBITDA for the calculation and description.

(2) Capital intensity is calculated as capital expenditures divided by operating revenues.

This measure provides a basis for comparing the level of capital expenditures to

other companies of varying size within the same industry.

Total capital expenditures decreased by $382 million in 2010 when

compared to 2009. EBITDA less capital expenditures increased by

$534 million in 2010 when compared to 2009.

7LIQUIDITY AND CAPITAL RESOURCES

A discussion of cash flow, liquidity, credit facilities and other disclosures