Telus 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 . TELUS 2010 annual report

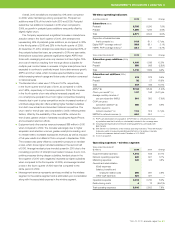

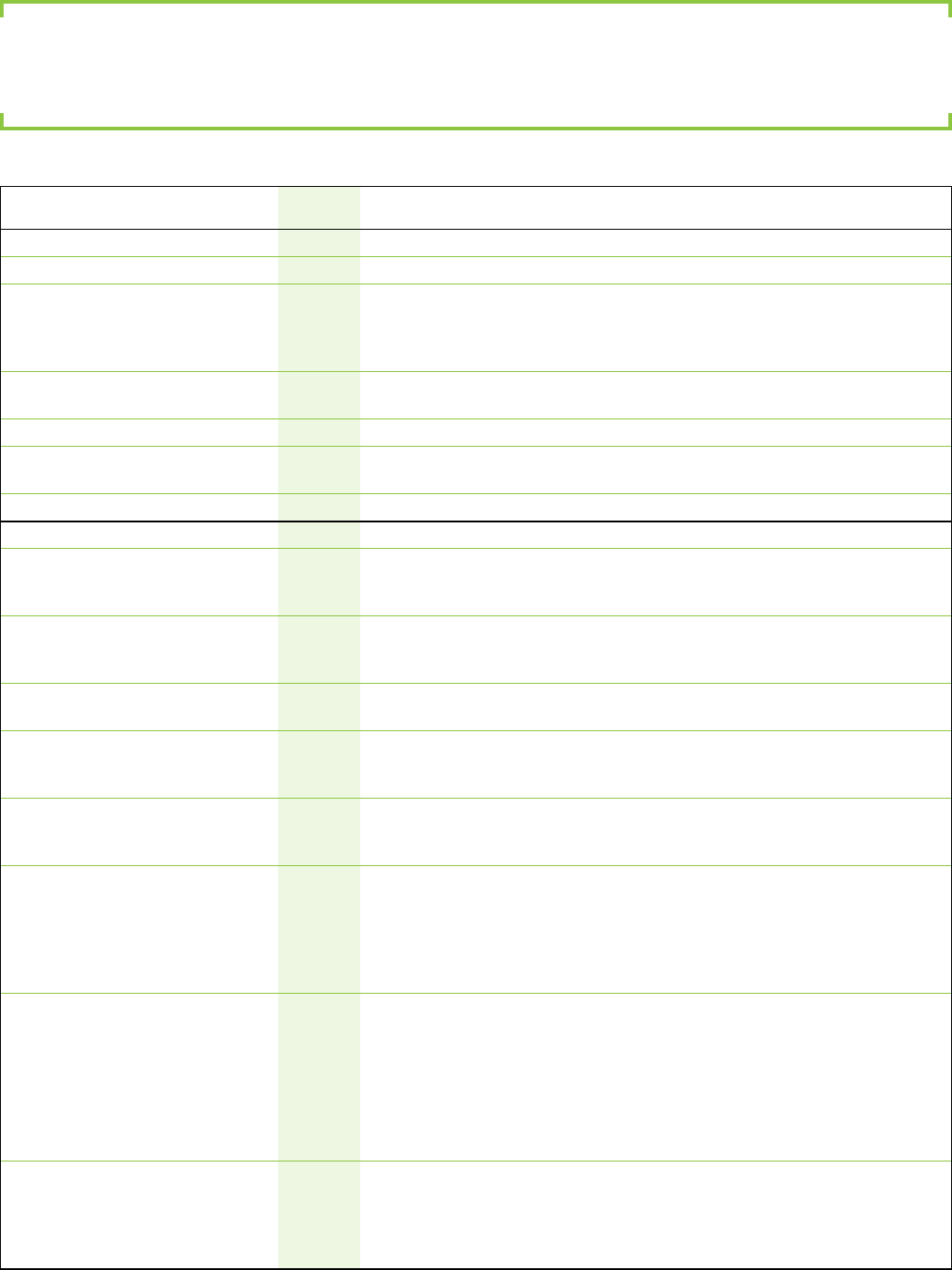

Changes in the Consolidated statements of financial position for the year ended December 31, 2010, are as follows:

6CHANGES IN FINANCIAL POSITION

A discussion of changes in the Consolidated statements of financial position

for the year ended December 31, 2010

Financial position as at December 31 Change Change

($ millions) 2010 2009 ($ millions) (%) Explanation of the change

Current assets

Cash and temporary investments, net 17 41 (24) (59) See Section 7: Liquidity and capital resources

Accounts receivable 917 694 223 32 The increase includes a $100 million reduction in proceeds

from securitized accounts receivable (see Section 7.6), as

well as increased receivables due to the growing wireless

postpaid subscriber base and increase in postpaid ARPU

Income and other taxes receivable 56 16 40 n/m Reflects an increase in accrued recoveries for income

and other taxes receivable, net of refunds received

Inventories 283 270 13 5 Mainly an increase in wireless dealer inventories

Prepaid expenses 113 105 8 8 Mainly an increase in prepaid maintenance contracts net

of amortization

Derivative assets 4 1 3 n/m –

Current liabilities

Accounts payable and accrued liabilities 1,495 1,385 110 8 Reflects an increase in fourth quarter capital and operating

expenditures payable, and increased semi-annual interest

payable

Income and other taxes payable 6 182 (176) (97) Primarily reflects final income tax payments in the first

quarter of 2010 for the 2009 tax year and 2010 instalments

substantially paid during the year

Restructuring accounts payable 111 135 (24) (18) Payments exceeded new obligations from

and accrued liabilities restructuring initiatives

Dividends payable 169 150 19 13 Primarily reflects the 10.5% increase in the dividend rate

for the fourth quarter 2010 dividend, as compared to the

fourth quarter of 2009

Advance billings and customer deposits 658 674 (16) (2) Includes reclassification of $81 million of the price cap

deferral account to Non-current liabilities, net of increased

billings due to subscriber growth

Current maturities of long-term debt 743 82 661 n/m The balance at December 31, 2010, includes $736 million

for 8% U.S. dollar Notes maturing in June 2011 after partial

redemption of the Notes outstanding on September 2.

Two smaller issues totalling $80 million that were current

at December 31, 2009, matured and were repaid in 2010.

See Section 7.3. The residual amounts are capital leases

Derivative liabilities 419 62 357 n/m The December 31, 2010, balance and net change from

December 31, 2009, includes $404 million for derivative

liabilities associated with the June 2011 maturity of U.S.

dollar Notes after fair value adjustments and termination

of the portion associated with the partial redemption of

Notes on September 2. This was partly offset by fair value

adjustments for share option and restricted share unit

hedges, and unwinding option hedges

Current portion of future income taxes 348 294 54 18 Primarily due to changes in the accounting classification

of related liabilities between current and long-term,

reduction in reserves for income tax purposes and

changes in partnership income that will be allocated

over the next 12 months