Telus 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 . TELUS 2010 annual report

Net debt to EBITDA – excluding restructuring costs is defined

as Net debt as at the end of the period divided by the 12-month trailing

EBITDA – excluding restructuring costs. TELUS’ long-term guideline range

for Net debt to EBITDA is from 1.5 to 2.0 times. Historically, Net debt

to EBITDA – excluding restructuring costs is substantially the same as

the Leverage Ratio covenant in TELUS’ credit facilities.

Net debt to total capitalization provides a measure of the

proportion of debt used in the Company’s capital structure.

Net interest cost is defined as Financing costs before gains on

redemption and repayment of debt, calculated on a 12-month trailing

basis. No gains on redemption and repayment of debt were recorded

in the respective periods. Losses recorded on the redemption of long-

term debt are included in net interest cost. Net interest costs for the

years ended December 31, 2010 and 2009 are equivalent to Financing

costs reported for those periods, as currently reported and for

unaudited pro forma IFRS-IASB results.

Total capitalization – book value is calculated as Net debt plus

Owners’ equity, excluding accumulated other comprehensive income or

loss. The transition to IFRS results in differences in Owners’ equity from

the amounts currently reported.

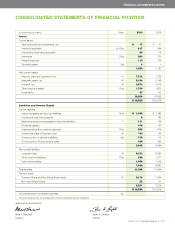

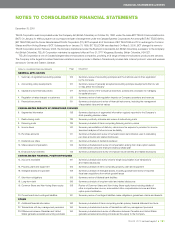

Calculation of total capitalization

Unaudited pro forma

IFRS-IASB As currently reported

Dec. 31, Jan. 1, Dec. 31, Dec. 31,

As at ($ millions) 2010 2010 2010 2009

Net debt 6,869 7,312 6,869 7,312

Owners’ equity

Common Share and Non-

Voting Share equity 7,759 7,334 8,179 7,554

Add back

Accumulated other

comprehensive loss 213 53 18 72

Non-controlling interests 22 21 22 21

Total capitalization

– book value 14,863 14,720 15,088 14,959

Calculation of Net debt

Unaudited pro forma

IFRS-IASB As currently reported

Dec. 31, Jan. 1, Dec. 31, Dec. 31,

As at ($ millions) 2010 2010 2010 2009

Long-term debt including

current portion 6,056 6,172 6,056 6,172

Debt issuance costs netted

against long-term debt 28 30 28 30

Derivative liability 404 721 404 721

Accumulated other compre-

hensive income amounts

arising from financial

instruments used to

manage interest rate and

currency risks associated

with U.S. dollar denomi-

nated debt (excluding

tax effects) (2) (70) (2) (70)

Cash and temporary

investments (17) (41) (17) (41)

Proceeds from securitized

accounts receivable

derecognized in

accounts receivable n.a. n.a. 400 500

Short-term borrowings

(proceeds from securitized

accounts receivable) 400 500 n.a. n.a.

Net debt 6,869 7,312 6,869 7,312

The derivative liability in the table above relates to cross currency

interest rate swaps that effectively convert principal repayments and

interest obligations to Canadian dollar obligations, and is in respect of the

U.S.$741 million debenture as at December 31, 2010 (U.S.$1,348 million

at December 31, 2009) that matures June 1, 2011. Management believes

that Net debt is a useful measure because it incorporates the exchange

rate impact of cross currency swaps put into place that fix the value

of U.S. dollar debt and because it represents the amount of long-term

debt obligations that are not covered by available cash and temporary

investments.