Telus 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 . TELUS 2010 annual report

exposure draft. The exposure draft also proposes certain recognition,

measurement, presentation and disclosure changes. Amendments to

the existing standards are currently expected to be finalized in mid-2011

with an unknown effective date for the Company.

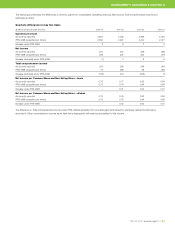

In June 2010, the IASB issued an exposure draft pertaining to

revenue recognition as part of the joint revenue project with the U.S.

Financial Accounting Standards Board (FASB). In August 2010, the

IASB issued an exposure draft pertaining to leases as part of the joint

leasing project with FASB. The leasing exposure draft proposes the

elimination of the distinction between operating leases and finance leases

and would introduce a new model for lessees and lessors.

The Company continues to evaluate the possible effects of new

standards and exposure drafts, and will monitor the near-term projects

that the IASB initiates for income taxes. The ultimate impacts cannot

be determined at this time.

International Financial Reporting Standards that are mandatory at

the changeover date have been finalized, however, the IASB’s work

plan currently has projects underway that are expected to result in

new pronouncements that continue to evolve IFRS. The IASB is review-

ing the requirements of IAS 37 Provisions, Contingent Liabilities and

Contingent Assets, with the intention of replacing it with a new standard

in 2011. The IASB is also expected to review the IAS 12 standard for

income taxes and develop proposals for changes. The existing IAS 12

standard is applicable to TELUS’ transition.

In April 2010, the IASB issued an exposure draft pertaining to

employee benefits, specifically the recognition of actuarial gains or losses

for defined benefit plans. The exposure draft proposes to eliminate the

corridor method for recognition of actuarial gains or losses. The Company’s

elected accounting policy choice of recognizing ongoing actuarial

gains or losses in Other comprehensive income is consistent with this

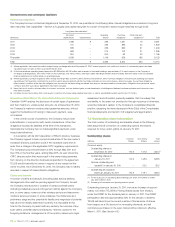

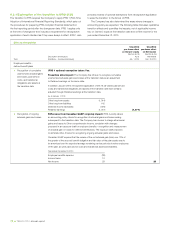

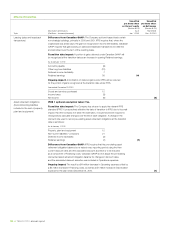

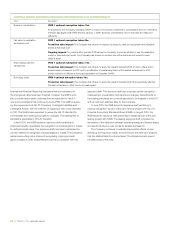

Additional optional exemptions and policies with insignificant or no quantified impact

Topic Description

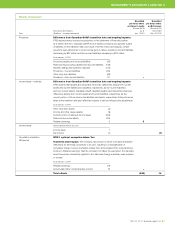

Business combinations IFRS 1 optional exemption taken: Yes.

As adopted by the Company, Canadian GAAP in respect of business combinations, consolidation and non-controlling

interests was aligned with IFRS effective January 1, 2009. Business combinations prior to that date are measured

differently.

Fair value or revaluation

as deemed cost

IFRS 1 optional exemption taken: No.

Transition date impact: The Company has chosen to measure its property, plant and equipment and intangible

assets at historical cost.

Ongoing impact: For post-transition periods, IFRS allows the Company to choose whether to use the revaluation

model or historical cost model. The Company has chosen to continue use of the historical cost model for each

class of asset.

Share-based payment

transactions

IFRS 1 optional exemption taken: Yes.

Transition date impact: The Company has chosen to apply the relevant standard (IFRS 2) only to share option

awards made subsequent to 2001 and to modification of outstanding share option awards subsequent to 2001

(which results in no difference from past application of Canadian GAAP).

Borrowing costs IFRS 1 optional exemption taken: Yes.

Transition date impact: The Company has chosen to apply the relevant standard (IAS 23) prospectively effective

the date of transition to IFRS due to its small impact.