Telus 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 125

FINANCIAL STATEMENTS & NOTES: 1

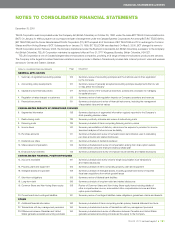

The operations of the Company are complex and the related tax

interpretations, regulations and legislation are continually changing.

As a result, there are usually some tax matters in question that result

in uncertain tax positions. The Company only recognizes the income

tax benefit of an uncertain tax position when it is more likely than

not that the ultimate determination of the tax treatment of the position

will result in that benefit being realized. The Company accrues for

interest charges on current tax liabilities that have not been funded,

which would include interest and penalties arising from uncertain tax

positions. The Company includes such charges as a component

of Financing costs.

The Company’s research and development activities may be

eligible to earn Investment Tax Credits; the determination of eligibility

is a complex matter. The Company only recognizes the Investment

Tax Credits when there is reasonable assurance that the ultimate deter-

mination of the eligibility of the Company’s research and development

activities will result in the Investment Tax Credits being received. When

there is reasonable assurance that the Investment Tax Credits will

be received, they are accounted for using the cost reduction method

whereby such credits are deducted from the expenditures or assets

to which they relate, as set out in Note 9.

(k) Share-based compensation

For share option awards granted after 2001, a fair value is determined

for share option awards at the date of grant and that fair value is recog-

nized in the financial statements. Proceeds arising from the exercise of

share option awards are credited to share capital, as are the recognized

grant-date fair values of the exercised share option awards.

Share option awards which have a net-equity settlement feature,

as set out in Note 19(c), and which do not also have a net cash settle-

ment feature, are accounted for as equity instruments. The Company

has selected the equity instrument fair value method of accounting

for the net-equity settlement feature so as to align with the accounting

treatment afforded to the associated share option awards.

Share option awards which have a net-cash settlement feature,

as set out in Note 12(b), are accounted for as liability instruments.

If share option awards which have the net-cash settlement feature and

which were granted subsequent to 2001 are settled using other than

the net-cash settlement feature, they would revert to being accounted

for as equity instruments.

In respect of restricted stock units, as set out in Note 12(c), the

Company accrues a liability equal to the product of the vesting restricted

stock units multiplied by the fair market value of the corresponding shares

at the end of the reporting period (unless hedge accounting is applied,

as set out in Note 1(i)). The expense for restricted stock units that do not

ultimately vest is reversed against the expense that had been previously

recorded in their respect.

When share-based compensation vests in one amount at a future

point in time (cliff vesting), the expense is recognized by the Company on

a straight-line basis over the vesting period. When share-based compen-

sation vests in tranches (graded vesting), the expense is recognized by

the Company using the accelerated expense attribution method.

(l) Employee future benefit plans

The Company accrues for its obligations under employee defined benefit

plans, and the related costs, net of plan assets. The cost of pensions

and other retirement benefits earned by employees is actuarially deter-

mined using the projected benefit method pro-rated on service and

management’s best estimate of expected plan investment performance,

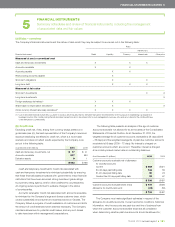

Hedge accounting: The purpose of hedge accounting, in respect

of the Company’s designated hedging relationships, is to ensure that

counterbalancing gains and losses are recognized in the same periods.

The Company chose to apply hedge accounting, as it believes this

is more representative of the economic substance of the underlying

transactions.

In order to apply hedge accounting, a high correlation (which indicates

effectiveness) is required in the offsetting changes in the values of the

financial instruments (the hedging items) used to establish the designated

hedging relationships and all, or a part, of the asset, liability or transac-

tion having an identified risk exposure that the Company has taken steps

to modify (the hedged items). The Company assesses the anticipated

effectiveness of designated hedging relationships at inception and for

each reporting period thereafter. A designated hedging relationship is

considered effective by the Company if the following critical terms match

between the hedging item and the hedged item: the notional amount

of the hedging item and the principal of the hedged item; maturity dates;

payment dates; and interest rate index (if, and as, applicable). As set

out in Note 5(i), any ineffectiveness, such as from a difference between

the notional amount of the hedging item and the principal of the hedged

item, or if a previously effective designated hedging relationship becomes

ineffective, is reflected in the Consolidated Statements of Income and

Other Comprehensive Income as Financing costs if in respect of long-term

debt and as Operations expense if in respect of U.S. dollar denominated

future purchase commitments or share-based compensation.

Hedging assets and liabilities: In the application of hedge accounting,

an amount (the hedge value) is recorded on the Consolidated Statements

of Financial Position in respect of the fair value of the hedging items.

The net difference, if any, between the amounts recognized in the deter-

mination of net income and the amount necessary to reflect the fair

value of the designated cash flow hedging items on the Consolidated

Statements of Financial Position is effectively recognized as a component

of other comprehensive income, as set out in Note 19(b).

In the application of hedge accounting to U.S. dollar denominated

long-term debt future cash outflows, the amount recognized in the deter-

mination of net income is the amount that counterbalances the difference

between the Canadian dollar equivalent of the value of the hedged

items at the rate of exchange at the statement of financial position date

and the Canadian dollar equivalent of the value of the hedged items

at the rate of exchange in the hedging items.

In the application of hedge accounting to the compensation cost

arising from share-based compensation, the amount recognized in the

determination of net income is the amount that counterbalances the

difference between the quoted market price of the Company’s Non-Voting

Shares at the statement of financial position date and the price of the

Company’s Non-Voting Shares in the hedging items.

(j) Income taxes

The Company follows the liability method of accounting for income

taxes. Under this method, current income taxes are recognized for the

estimated income taxes payable for the current year. Future income

tax assets and liabilities are recognized for temporary differences between

the tax and accounting bases of assets and liabilities as well as for the

benefit of losses available to be carried forward to future years for tax

purposes that are more likely than not to be realized. The amounts recog-

nized in respect of future income tax assets and liabilities are based upon

the expected timing of the reversal of temporary differences or usage

of tax losses and application of the substantively enacted tax rates at the

time of reversal or usage.